PayPal Holdings Inc. (PYPL)

PayPal Holdings, Inc. (PYPL) Is a Trending Stock: Facts to Know Before Betting on It

Paypal (PYPL) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

PayPal: Operating Profit Growth, High Margins, Low P/E

PayPal beat Q2 sales and profit expectations, showing strong operating and transaction margin growth and raising its 2025 profit guidance by 50%. The company's account base continues to expand, with 438 million users, reflecting renewed growth and improved customer quality. PayPal trades at a steep discount to fintech peers, with a forward P/E of 11.6x, despite robust profitability and margin expansion.

Wall Street Still Doesn't Get PayPal And That's A Big Opportunity

PayPal remains deeply undervalued, trading at low valuation multiples despite solid growth and strong fundamentals, making it a compelling long-term investment opportunity. Recent Q2 results beat estimates and guidance was raised, but the market overreacted to short-term metrics like declining free cash flow and slower account growth. Buybacks are accelerating, reducing share count and boosting EPS, while initiatives like Buy Now, Pay Later and PayPal World offer significant future growth potential.

PayPal: One Of My Largest Contrarian Ideas; Needs To Become A Dividend Machine

PayPal remains highly profitable and is growing revenue, defying the market's negative narrative and recent share price declines. The company is deeply undervalued, trading at a significant discount to peers, despite strong free cash flow and double-digit EPS growth projections. Buybacks have failed to create shareholder value; I strongly advocate for a substantial dividend program to attract new investors and income-focused ETFs.

PayPal: Strong Fundamentals, Aggressive Buybacks, Highly Undervalued - A Long-Term Buy

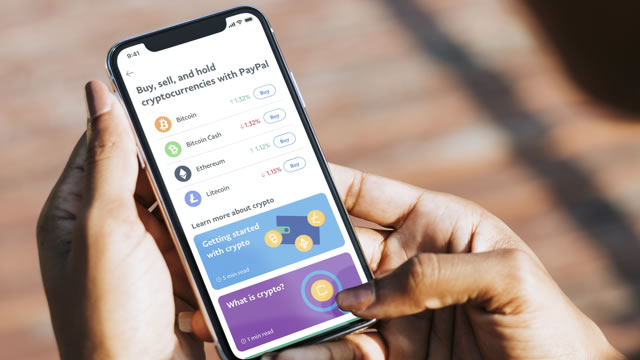

PayPal (NASDAQ:PYPL) has posted a solid Q2 2025 with revenue and EPS better than expected. Full-year guidance reaffirmed. Temporary weakness in free cash flow is explained by working capital timing. Continued aggressive share repurchases, Venmo and Braintree growth, and the pursuit of crypto initiatives suggest a strong long-term outlook for the company.

PayPal: Cash-Flow Correction Overly Done, Upward Momentum Likely Lumpy

PYPL's ongoing turnaround has been met with much skepticism, as observed in the steep sell-off after the lumpy FQ2'25 cash flow performance, despite the reiterated FY2025 guidance. This is especially since the new management has already delivered double-beat FQ2'25 performance while raising the FY2025 top/ bottom-line guidance. PYPL has also reported richer Transaction and adj operating margins, while driving new active account growths for six consecutive quarters.

PYPL Stock Falls 10% Post Q2 Earnings: Should You Buy, Hold or Fold?

PayPal stock plunges 10% despite strong Q2 results and raised guidance, highlighting tension between progress and expectations.

PayPal: Why Buy The Post-Earnings Dip?

PayPal Holdings, Inc.'s post-earnings 9% selloff is an overreaction, in my opinion, offering a compelling entry point. Strong Q2 results with raised guidance, robust value-added services growth, and continued share buybacks support my bullish outlook despite modest top-line growth. AI-driven agentic shopping is a key long-term catalyst, positioning PayPal ahead of peers in enabling frictionless, automated transactions across platforms.

PayPal: The Sell-Off Makes No Sense

PayPal delivered strong Q2 results, beating estimates and achieving its fourth consecutive quarter of customer base growth, addressing a key prior weakness. The Fintech remained free cash flow profitable in Q2, confirmed its FY 2025 free cash flow guidance and raised its EPS outlook. Slowing growth in PayPal's branded checkout, driven by tariff uncertainty, have led to an exaggerated 9% drop in the Fintech's share price on Tuesday.

PayPal Falls Despite Q2 Earnings Beating Estimates: ETFs in Focus

PayPal topped Q2 earnings and revenue estimates but slid 8% as slowing transaction margins weighed on investor sentiment. ETFs like IPAY and FINX should be monitored closely.

PayPal Can't Catch A Break As Even A Triple Beat Leaves Investors Asking For More

PayPal Holdings Inc. just reported a triple beat for their Q2 FY 2025 earnings and the stock is down -9%. Revenue growth from Braintree is reaccelerating, active accounts are growing again, they're improving their profitability. At the same times, valuations remain incredibly depressed, not pricing in any type of success from all the projects PayPal has been announcing lately.

2 Fintech Stocks in Focus After Earnings

Fintech giants PayPal Holdings Inc (NASDAQ:PYPL) and SoFi Technologies Inc (NASDAQ:SOFI) are fresh off the earnings confessional.