Rockwell Automation, Inc. (ROK)

Analysts Estimate Rockwell Automation (ROK) to Report a Decline in Earnings: What to Look Out for

Rockwell Automation (ROK) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

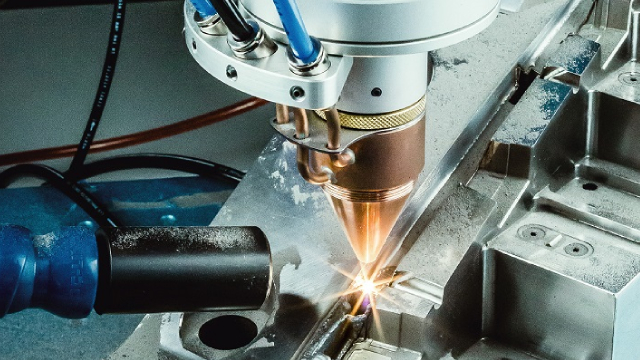

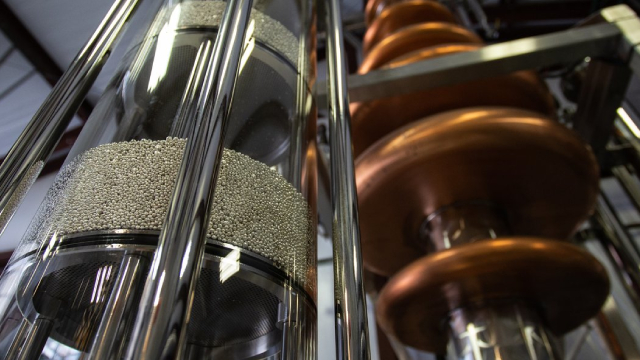

Rockwell Automation: Stands To Benefit From Industrial Automation And Re-Shoring Trends (Rating Upgrade)

Rockwell Automation: Stands To Benefit From Industrial Automation And Re-Shoring Trends (Rating Upgrade)

Reasons to Hold Rockwell Automation Stock in Your Portfolio Now

ROK gains from portfolio optimization and price increase actions amid supply-chain challenges and cost inflation.

Why Rockwell Automation (ROK) International Revenue Trends Deserve Your Attention

Explore Rockwell Automation's (ROK) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

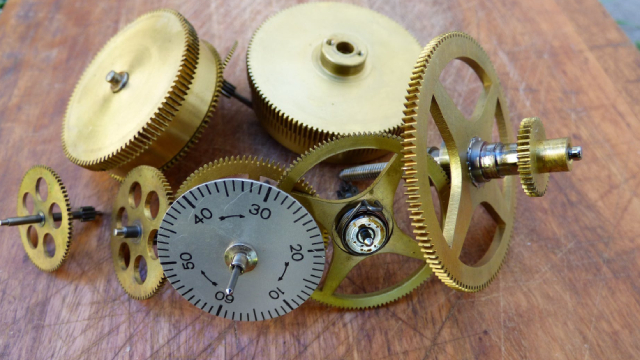

Rockwell Automation Q4 Earnings Beat Estimates, Revenues Dip Y/Y

ROK's Q4 earnings reflect the impacts of lower sales volume and an unfavorable mix, partially negated by gains from cost-reduction actions.

Rockwell Automation, Inc. (ROK) Q4 2024 Earnings Call Transcript

Rockwell Automation, Inc. (NYSE:ROK ) Q4 2024 Earnings Conference Call November 7, 2024 8:30 AM ET Company Participants Aijana Zellner - Head of IR Blake Moret - Chairman and Chief Executive Officer Christian Rothe - Senior Vice President and Chief Financial Officer Conference Call Participants Scott Davis - Melius Research Andy Kaplowitz - Citi Andrew Obin - Bank of America Nigel Coe - Wolfe Research Chris Snyder - Morgan Stanley Julian Mitchell - Barclays Joseph O'Dea - Wells Fargo Noah Kaye - Oppenheimer Operator Thank you for holding, and welcome to Rockwell Automation's Quarterly Conference Call. I need to remind everyone that today's conference call is being recorded.

Compared to Estimates, Rockwell Automation (ROK) Q4 Earnings: A Look at Key Metrics

The headline numbers for Rockwell Automation (ROK) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Rockwell Automation (ROK) Q4 Earnings Surpass Estimates

Rockwell Automation (ROK) came out with quarterly earnings of $2.47 per share, beating the Zacks Consensus Estimate of $2.40 per share. This compares to earnings of $3.64 per share a year ago.

Rockwell Automation forecasts weaker-than-expected FY profit

Rockwell Automation forecast its annual profit below analysts' estimates on Thursday, as the company navigates slower automation demand and headwinds from the uncertainty in the current macroeconomic environment.

Rockwell Automation to Post Q4 Earnings: What Should You Expect?

ROK's fourth-quarter fiscal 2024 results are likely to reflect the impacts of lower order levels and elevated costs.

Exploring Analyst Estimates for Rockwell Automation (ROK) Q4 Earnings, Beyond Revenue and EPS

Besides Wall Street's top -and-bottom-line estimates for Rockwell Automation (ROK), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2024.

Earnings Preview: Rockwell Automation (ROK) Q4 Earnings Expected to Decline

Rockwell Automation (ROK) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.