Charles Schwab Corporation (SCHW)

Economy to remain K-shaped in 2026, says Charles Schwab's Sonders

CNBC's "The Exchange" team discusses what may be next for markets and the U.S. economy in 2026 with Liz Ann Sonders, chief investment strategist at Charles Schwab.

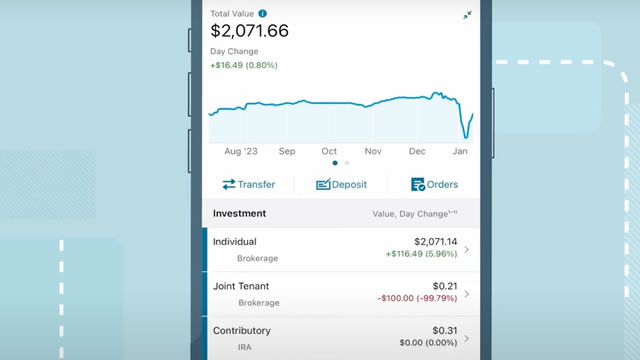

SCHW Enhances Trading Platform: Can It Accelerate Client Asset Growth?

Schwab rolls out major upgrades across Schwab.com, Mobile and thinkorswim as retail trading surges and client assets keep climbing.

Schwab Total Client Assets Rise Y/Y in November on Higher NNAs

SCHW reports November client assets of $11.83T, up nearly 15% year over year, driven by strong investor engagement and higher net new assets.

Here's Why The Charles Schwab Corporation (SCHW) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Charles Schwab (SCHW) Upgraded to Buy: Here's What You Should Know

Charles Schwab (SCHW) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Why The Charles Schwab Corporation (SCHW) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

SCHW or MKTX: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Financial - Investment Bank sector might want to consider either The Charles Schwab Corporation (SCHW) or MarketAxess (MKTX). But which of these two companies is the best option for those looking for undervalued stocks?

Is Charles Schwab (SCHW) Outperforming Other Finance Stocks This Year?

Here is how The Charles Schwab Corporation (SCHW) and Popular (BPOP) have performed compared to their sector so far this year.

SCHW to Feel the Heat as Vanguard Greenlights Crypto-Product Trading?

Vanguard's crypto shift trims Schwab's edge, but rising ETF activity may still play to SCHW's platform strengths.

The Charles Schwab Corporation: Rate Cuts Are Not A Problem (Upgrade)

The Charles Schwab Corporation is upgraded to a 'buy' rating, reflecting strong asset gathering and resilience amid Fed rate cuts. SCHW's acquisition of Forge Global strategically expands its private investment offerings, enhancing its competitive edge without materially impacting near-term earnings. Net new assets surged 80% year-over-year, margins remain best-in-class, and net interest margin is poised to surpass 3% by mid-2026.

Why The Charles Schwab Corporation (SCHW) is a Top Value Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

The Charles Schwab Corporation (SCHW) is a Top-Ranked Growth Stock: Should You Buy?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.