Charles Schwab Corporation (SCHW)

Will Charles Schwab (SCHW) Beat Estimates Again in Its Next Earnings Report?

Charles Schwab (SCHW) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Charles Schwab Stock Upgraded on Growth Potential

Citigroup this morning upgraded bank stock Charles Schwab Corp (NYSE:SCHW) to "buy" from "neutral," with a price-target hike to $102 from $85.

SCHW vs. MKTX: Which Stock Is the Better Value Option?

Investors interested in stocks from the Financial - Investment Bank sector have probably already heard of The Charles Schwab Corporation (SCHW) and MarketAxess (MKTX). But which of these two companies is the best option for those looking for undervalued stocks?

Here's Why The Charles Schwab Corporation (SCHW) is a Strong Growth Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Investors' biggest concern is growth: Charles Schwab CEO

As ongoing recession fears and the Trump administration's tariffs are stirring volatility in equity markets (^DJI, ^IXIC, ^GSPC), what are some of Wall Street's top executives telling clients amid these sell-offs? Charles Schwab (SCHW) CEO and President Rick Wurster — who took up the mantle of chief executive on January 1 — sits down in person with Madison Mills and Yahoo Finance executive editor Brian Sozzi on Catalysts to expand upon his views on the investing environment, his economic outlook, and even the brokerage operator's participation in the crypto market.

Bullish Signal Has Never Failed This Bank Stock

Charles Schwab Corp (NYSE:SCHW) is tumbling alongside other major bank stocks , as economic uncertainty and persistent selling pressure weigh on the financial sector.

Is Charles Schwab (SCHW) Stock Outpacing Its Finance Peers This Year?

Here is how The Charles Schwab Corporation (SCHW) and BB Seguridade Participacoes SA (BBSEY) have performed compared to their sector so far this year.

SCHW Stock Falls 10% in a Month: Is This a Perfect Buying Opportunity?

As Schwab shares show weakness, let's find out whether this is the right time to add it to your portfolio.

Charles Schwab: Breakout Moment With Strengthening Fundamentals And $5.6B Buybacks

TD Bank's full exit from its 10.1% stake in Schwab removes a significant sentiment overhang, refocusing investor attention on SCHW's strengthening fundamentals. Schwab's January metrics show strong organic growth, with $30 billion in net new assets and 7.3 million daily average trades, exceeding analyst estimates. Analysts project ~30% annual EPS growth for 2025 and 2026, driven by net interest margin expansion, operating margin growth, and substantial share repurchases.

Why The Charles Schwab Corporation (SCHW) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Why Charles Schwab Is A Strong Buy Even With Market Uncertainty

Charles Schwab's current price of $79 presents a compelling long-term investment opportunity, driven by its massive client assets, adaptable business model, and operating efficiency. Market concerns about net interest margin compression and regulatory uncertainty are short-term issues; Schwab's long-term asset growth and Ameritrade integration offer substantial upside. Management's confidence, proactive strategies, and strong expense controls indicate Schwab's resilience, with liquidity concerns being overblown and temporary.

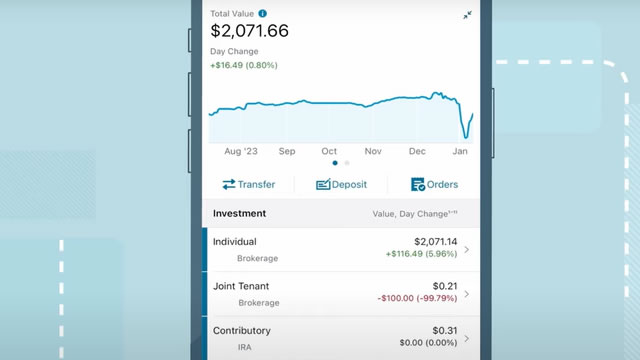

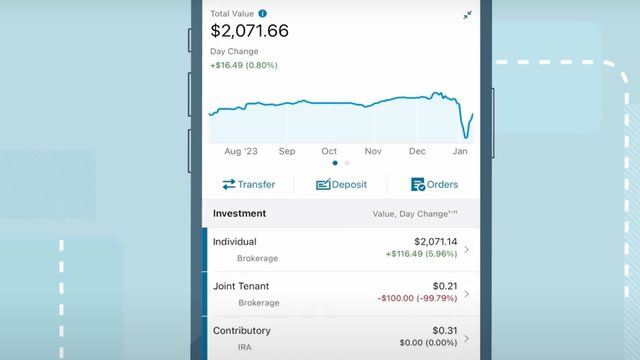

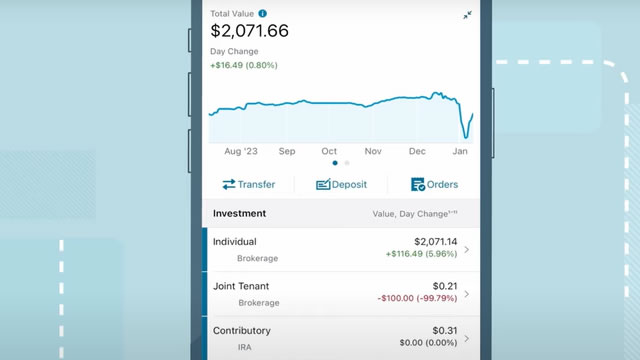

Schwab's January Core Net New Assets Rise Significantly Y/Y

SCHW's January core net new assets increase on the back of a rise in new brokerage accounts and total client assets.