Star Group L.P. (SGU)

East Star signs joint venture deal with Xinhai for Verkhuba copper project development

East Star Resources PLC shares shone 17.5% brighter at 3.47p after it entered a binding heads of agreement to establish a joint venture for the development of the Verkhuba copper deposit in Kazakhstan. The deal is with Hong Kong-based Xinhai Mining Services, an engineering and construction firm, which will fund the entire development of the project in stages, with an estimated total investment of US$65 million.

SGU Posts Narrower Y/Y Q4 Loss as Acquisitions & Margins Improve

Star Group's Q4 results improve on stronger volumes, margins and acquisitions, even as customer gains slow down and expenses rise y/y.

Star Group, L.P. Common Units (SGU) Q4 2025 Earnings Call Transcript

Star Group, L.P. Common Units (SGU) Q4 2025 Earnings Call Transcript

On Holding: This Growth Star Is Now Trading On The Clearance Rack

On Holding stands out as a top pick among small- and mid-cap growth stocks for 2026, despite a 25% share price correction. ONON continues to deliver >30% revenue growth, expanding market share in Asia and apparel, with gross margins soaring to 65.7% and strong EBITDA gains. The stock now trades at a compelling 13.8x EV/FY26 adjusted EBITDA, positioning the company as a 'growth at a reasonable price' opportunity.

Star Bulk: Dividends Could Triple Next Quarter, But Share Repurchases Are The Real Value Driver

Star Bulk (SBLK) offers a compelling investment case with a diversified fleet and strong financial position, trading at a significant discount to NAV. SBLK's Q4 guidance suggests a fleet-wide rate could be above $20,000/day, potentially tripling the dividend and more than doubling Q3 earnings. Management prioritizes share buybacks from asset sales, but a more aggressive approach using retained FCF could better close the NAV discount.

Liberty Star Minerals outlines strategic realignment of mining assets

Liberty Star Minerals (OTCQB:LBSR) has announced a strategic realignment of its mining claims and mineral assets, including the Hay Mountain Project and Red Rock Canyon Gold Project, located in Arizona. According to the company, the move aims to enhance operational clarity, facilitate asset differentiation, and expand potential for strategic partnerships within its diverse mineral portfolio.

Why 'Big Short' investor Michael Burry is posting 'Star Wars' memes and betting big against Nvidia and Palantir

Michael Burry is back to posting on X, warning about market mania, and betting against AI giants. The investor of "The Big Short" fame compared the AI spending boom to the dot-com bubble.

Clover Health: Clinical Excellence To Fuel SaaS Growth Beyond The Star Downgrade

Clover's latest star rating downgrade was mainly driven by low member experience scores, which is an aspect it fully controls in its business. Despite low member experience scores, members' ratings for CLOV's health plan increased YoY, and fewer members are expected to leave its plan, which could offset new members' higher medical costs. The company's SaaS inflection point could be nearing through a potential partnership with Humana, which appears to be deploying Counterpart Assistant into its digital infrastructure.

Some Star Energy Stocks Are Found in This ETF

With higher growth sectors and glitzier commodities soaring, the energy sector isn't getting much attention this year beyond the standard focus on oil market gyrations. That's not to say energy stocks have been “bad” per se, but as highlighted by the S&P Energy Select Sector Index, the group is trailing the broader market.

Some Star Energy Stocks Are Found in This ETF

With higher growth sectors and glitzier commodities soaring, the energy sector isn't getting much attention this year beyond the standard focus on oil market gyrations. That's not to say energy stocks have been “bad” per se, but as highlighted by the S&P Energy Select Sector Index, the group is trailing the broader market.

AI Killed The Internet Star But Wiley Offers A Pure Data Hoard

John Wiley & Sons owns a vast library of high-quality, human-generated academic content, making it valuable in an AI-dominated internet. WLY's strategy to license its content for AI training and niche applications could drive new revenue streams and improve margins. Despite recent revenue declines and moderate risks, WLY's AI potential and solid dividend yield support a cautious buy rating.

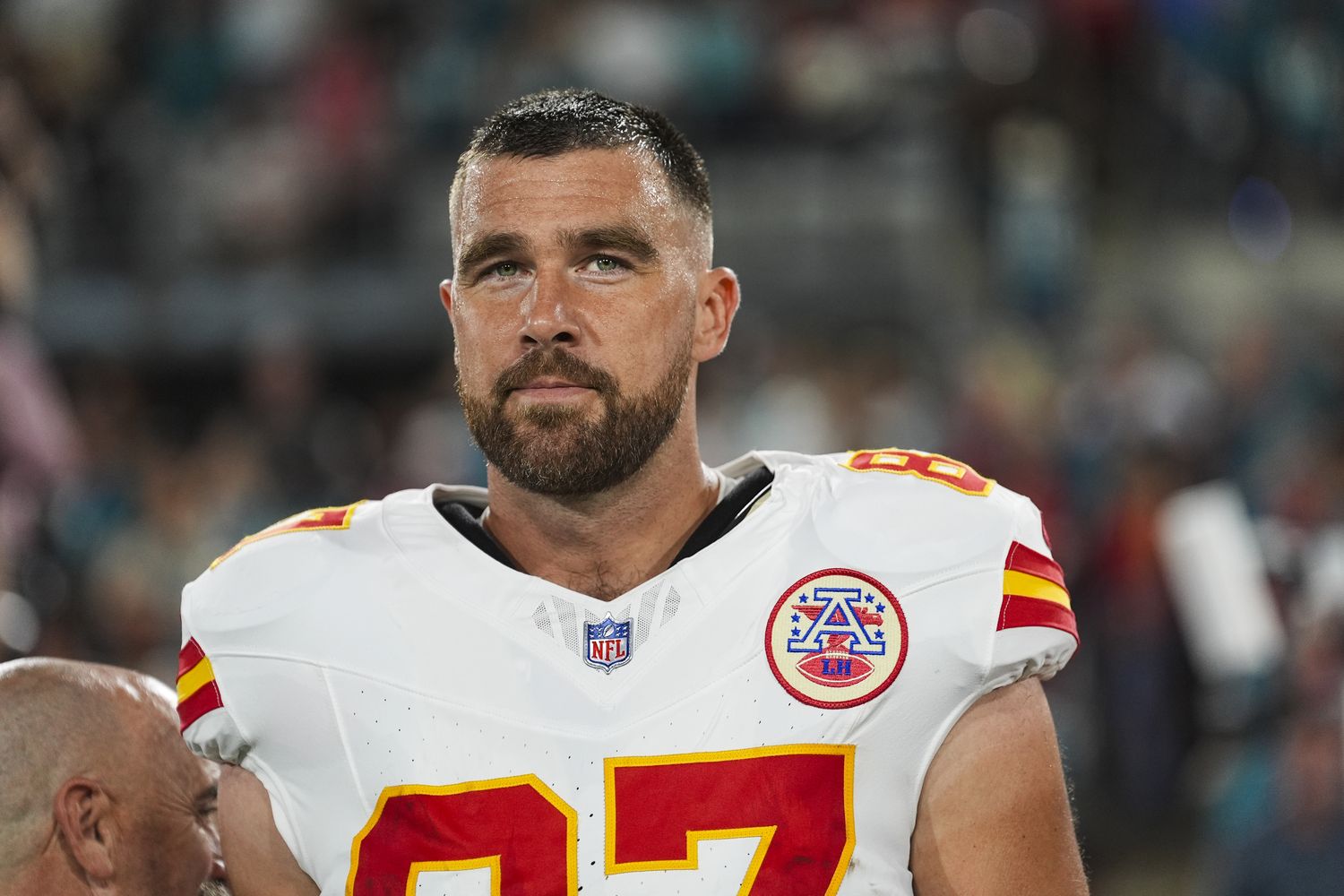

Travis Kelce's Star Power Is Helping Boost Six Flags Stock

Six Flags' stock is getting a bit of help from Travis Kelce.