Leverage Shares 2x Long Super Micro Computer Inc. (SMCI)

Summary

SMCI Chart

Super Micro Computer (NASDAQ: SMCI) Stock Price Prediction and Forecast (Dec 2025)

Super Micro Computer Inc. (NASDAQ: SMCI) stock has its bullish supporters, some of whom feel it can withstand global trade issues and that it may be one of the best artificial intelligence (AI) stocks going forward.

Super Micro Computer, Inc. (SMCI) Presents at Barclays 23rd Annual Global Technology Conference Transcript

Super Micro Computer, Inc. (SMCI) Presents at Barclays 23rd Annual Global Technology Conference Transcript

SMCI Declines 9% in a Year: Should You Hold or Fold the Stock?

Super Micro Computer's shares slide as expansion strains margins and cash flow, even as AI server demand and new platforms fuel long-term growth ambitions.

Leverage Shares 2x Long Super Micro Computer Inc. (SMCI) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Leverage Shares 2x Long Super Micro Computer Inc. ever had a stock split?

Leverage Shares 2x Long Super Micro Computer Inc. Profile

| LSE Exchange | US Country |

Overview

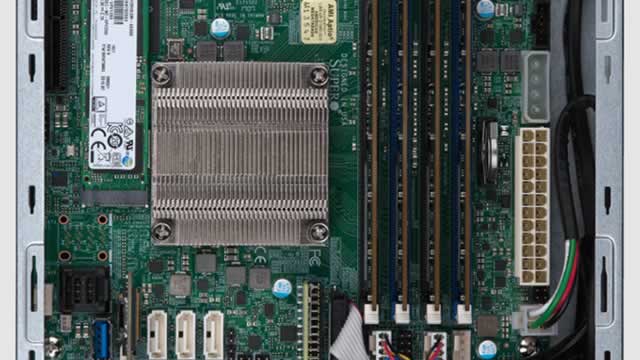

Super Micro Computer, Inc., a stalwart in the high-performance server and storage solutions industry, orchestrates and manufactures cutting-edge products characterized by their modular and open architecture. With a global footprint extending across the United States, Europe, Asia, and other international markets, the company stands as a pillar of innovation and efficiency in the computing world. Super Micro Computer, Inc. is dedicated to providing versatile solutions that meet the expanding needs of enterprise data centers, cloud computing environments, artificial intelligence technologies, and the emerging realms of 5G and edge computing. Its inception in 1993 and subsequent establishment of its headquarters in San Jose, California, mark the beginning of a journey aimed at revolutionizing server and storage capabilities worldwide, leveraging both direct and indirect sales channels, including distributors, value-added resellers, system integrators, and original equipment manufacturers, to reach its vast and varied clientele.

Products and Services

- Complete Server and Storage Systems - Tailor-made solutions including rackmount and blade servers, designed for high performance and efficiency in data-intensive environments.

- Modular Blade Servers and Blades - Flexible and scalable server solutions that can be customized to meet the unique needs of any organization, enhancing computation and storage capabilities.

- Workstations and Full Racks - High-quality workstations for professional applications, alongside full rack solutions to accommodate extensive server and storage requirements.

- Networking Devices - Sophisticated networking solutions that ensure reliable and fast communication between various hardware components within data centers.

- Server Sub-systems and Security Software - Core components such as server boards, chassis, power supplies, alongside robust security software to safeguard critical data.

- Server Software Management Solutions - A comprehensive suite including Supermicro Server Manager, Power Management software, Update Manager, SuperCloud Composer, and SuperDoctor 5, designed to streamline server management and operational efficiency.

- Technical Documentation and Support Services - Extensive support ranging from initial system integration and software upgrades to ongoing maintenance and technical assistance, ensuring customers maximize the utility and longevity of their Super Micro solutions.