Sensata Technologies Holding plc (ST)

Summary

Sensata Technologies: Improvements, Albeit Very Modest

Sensata Technologies shows modest organic growth and gradual deleveraging but remains hampered by flattish sales and highly adjusted earnings. Recent SKU rationalization is hurting top-line sales but could improve margins, though tangible benefits remain to be seen. Leverage is trending down, with net debt reduced to $2.43 billion and a 2.9x EBITDA ratio, yet it remains elevated.

All You Need to Know About Sensata (ST) Rating Upgrade to Buy

Sensata (ST) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Should Value Investors Buy Sensata Technologies Holding (ST) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Sensata Technologies Holding plc (ST) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Sensata Technologies Holding plc ever had a stock split?

Sensata Technologies Holding plc Profile

| Automobile Components Industry | Consumer Discretionary Sector | Stephan Von Schuckmann CEO | NYSE Exchange | G8060N102 CUSIP |

| US Country | 18,000 Employees | 12 Nov 2025 Last Dividend | - Last Split | 11 Mar 2010 IPO Date |

Overview

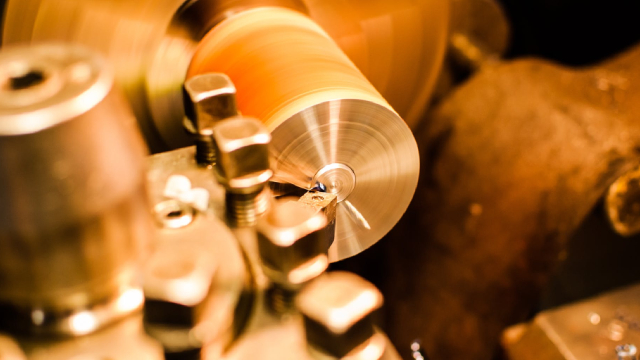

Sensata Technologies Holding plc is a global entity known for the development, manufacture, and sale of a broad spectrum of sensors, electrical protection components, and sensor-rich solutions. These products find their application in mission-critical systems across various industries, including automotive, energy, aerospace, and more. With operations that span the United States and international markets, Sensata operates through two primary segments: Performance Sensing and Sensing Solutions. Founded in 1916, the company has established a significant presence in the market, contributing to the safety, efficiency, and sustainability of complex machines and systems. Headquartered in Attleboro, Massachusetts, Sensata has become synonymous with innovation and reliability in the sectors it serves.

Products and Services

The range of products and services offered by Sensata Technologies is diverse and tailored to meet the demanding requirements of its clientele. The company’s portfolio is broadly categorized into two segments:

- Performance Sensing: This segment focuses on delivering critical sensor technologies, including pressure, temperature, and position sensors. High-voltage solutions and other products also fall under this segment, catering primarily to the automotive industry for applications such as tire pressure monitoring, thermal management, and exhaust management. Furthermore, it addresses the needs of on-road trucks and off-road equipment customers, ensuring the operation of mission-critical systems in vehicles and machinery.

- Sensing Solutions: Dedicated to offering application-specific sensor and electrical protection products, the Sensing Solutions segment encompasses a wide range of products. These include motor and compressor protectors, high-voltage contactors, and solid state relays, among others. Moreover, it provides advanced solutions such as power inverters, charge controllers, battery management systems, operator controls, and power conversion systems. These products serve a myriad of industries including but not limited to automotive, construction, agriculture, medical, energy, and aerospace. The segment is also vital for systems integrators, as well as aerospace and motor and compressor distributors, showcasing Sensata’s commitment to a variety of market needs.