Steel Dynamics Inc. (STLD)

Steel Dynamics: Mixed Q2 But Tariffs Should Provide Added Support

Steel Dynamics faces short-term headwinds from supplier issues and muted demand, but tariff support and backlog strength point to improving Q3 results. Tariffs on steel and aluminum are critical tailwinds, supporting domestic pricing and providing a competitive advantage for STLD's new and existing facilities. Despite near-term earnings pressure and higher costs from expansion projects, I view these as transitory and maintain a midcycle earnings estimate of ~$12.25.

Compared to Estimates, Steel Dynamics (STLD) Q2 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Steel Dynamics (STLD) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Steel Dynamics (STLD) Q2 Earnings and Revenues Lag Estimates

Steel Dynamics (STLD) came out with quarterly earnings of $2.01 per share, missing the Zacks Consensus Estimate of $2.05 per share. This compares to earnings of $2.72 per share a year ago.

Steel Dynamics (STLD) Laps the Stock Market: Here's Why

The latest trading day saw Steel Dynamics (STLD) settling at $131.15, representing a +2.89% change from its previous close.

Analysts Estimate Steel Dynamics (STLD) to Report a Decline in Earnings: What to Look Out for

Steel Dynamics (STLD) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Steel Dynamics (STLD) Suffers a Larger Drop Than the General Market: Key Insights

The latest trading day saw Steel Dynamics (STLD) settling at $135.07, representing a -1.67% change from its previous close.

Steel Dynamics (STLD) Beats Stock Market Upswing: What Investors Need to Know

The latest trading day saw Steel Dynamics (STLD) settling at $131.5, representing a +2.35% change from its previous close.

STLD Issues Q2 Guidance, Expects Higher Steel Operations Earnings

Steel Dynamics projects Q2 EPS of $2.00-$2.04, up from Q1 but down from the prior-year quarter, driven by stronger steel pricing.

Steel Dynamics (STLD) Declines More Than Market: Some Information for Investors

Steel Dynamics (STLD) reached $130.11 at the closing of the latest trading day, reflecting a -2.29% change compared to its last close.

Steel Dynamics (STLD) Falls More Steeply Than Broader Market: What Investors Need to Know

In the closing of the recent trading day, Steel Dynamics (STLD) stood at $130.03, denoting a -2.82% move from the preceding trading day.

Why Steel Dynamics (STLD) Outpaced the Stock Market Today

In the most recent trading session, Steel Dynamics (STLD) closed at $136.84, indicating a +0.83% shift from the previous trading day.

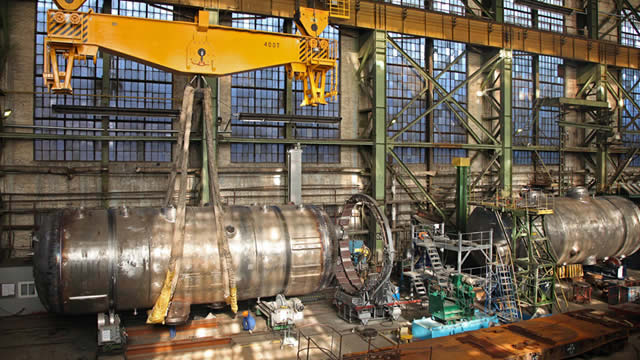

Steel Dynamics Shares Climb After Tariff Announcement

Domestic steel manufacturing stocks billowed higher to start the week as President Trump doubled down on tariffs on imported metals. The new measures increased the tariff level on imported steel and aluminum to 50%, doubling the previous rate of 25%.