True Corporation Public Company Limited (TCPFF)

Intuitive Machines Says It Has a "Fortress-Like Balance Sheet." Is It True?

Lunar exploration company Intuitive Machines (LUNR 0.13%) shot up like a rocket after reporting earnings last week (well, it did before an inflation- and tariff-inspired temper tantrum crashed the stock market on Friday). If you own Intuitive stock, you probably know this already.

Alexandria Real Estate: The True Definition Of A Dividend Bargain

ARE has faced significant challenges since COVID-19: higher for longer, work from home, and an unfavorable supply/demand level in the office space. Despite these challenges, ARE boasts a top-tier credit rating, low debt, and strong fundamentals, making it one of the highest quality REITs. ARE's 2024 performance showed solid FFO per share growth and high occupancy rates, indicating strong demand and robust underlying business performance.

True North REIT: Distribution Back With A 6.5% Yield

We had previously recognized that the strong leasing momentum had reduced some risks for True North Commercial REIT. This quarter continued in that fashion and the distribution made a comeback as well. We review the Q4-2024 numbers and tell you why we still don't own the REIT.

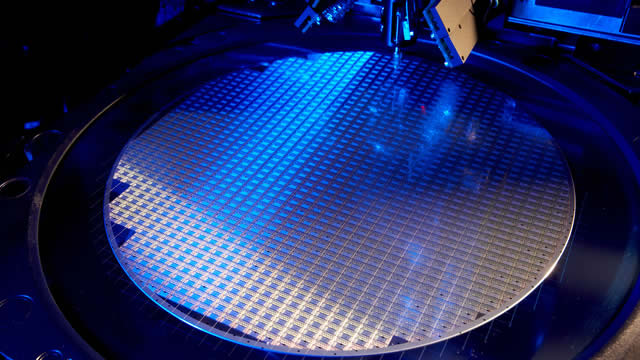

Micron: Mr. Market Is Missing Its True Potential, Buy

Micron Technology is a compelling investment due to its market position in memory/storage and the AI-driven demand expected to sustain growth well beyond 2025. Recent innovations like its 1-gamma DRAM and partnerships with Samsung highlight MU's technological leadership and potential for further industry partnerships. Despite cyclical risks, MU's recovery from the 2023 downturn and strong revenue growth in 2024-2025 signal a promising upcycle driven by AI.

Truist: True Rewards Come With Risks

Truist Financial Corporation shows improved topline growth after repositioning its investment portfolio. TFC maintains good liquidity, asset quality, and impressive capital adequacy, ensuring financial stability and resilience. The stock is trading below its book value per share, presenting a buying opportunity with a target price of $45.25 and the potential for a rebound.

Tenet (THC) Is Considered a Good Investment by Brokers: Is That True?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Unity Stock: Is a True Turnaround Finally Taking Shape?

Unity Software Inc. NYSE: U recently saw its stock price experience a jump, leaving investors wondering if this marks the beginning of a sustained rally or a temporary blip on the radar. After closing at $21.47, shares gapped up to $24.68 at the open on February 20, 2025, following the company's fourth-quarter earnings release.

Mark Zuckerberg Just Made 3 Startling AI Predictions. Should You Buy Meta Stock Before They Come True?

You may think of social media when you think of Meta Platforms (META 0.34%). After all, the company owns some of the most popular apps in the space, from Facebook and Messenger to WhatsApp and Instagram.

Philip Morris International: Market Is Underestimating The Company's True Growth Prospects

Philip Morris International (PMI) offers strong growth, consistent cash flow, and prioritizes shareholder returns through dividends and buybacks, outperforming the S&P 500 over the last five years. PMI's impressive Q3 results, including EPS of $1.97 and $9.91 billion in revenue, highlight robust performance in both core and reduced-risk products. Management's focus on expanding reduced-risk products like IQOS and Zyn, along with strategic investments, positions PMI for sustained growth and market share gains.

GAMCO Natural Resource Gold & Income Trust - A High Yield With Gold Exposure Sounds A Bit Too Good To Be True

GNT is a closed-end fund focused on natural resources and gold, using covered call options and leverage to generate high income and capital appreciation. Despite attractive sector positioning and a call writing strategy suited for volatility, GNT's long-term performance and high expense ratio are concerning. The fund's discount to NAV has stabilized around 10%, but a wider discount of 15% could make it a more attractive trading buy.

Richemont Rises And Signet Falls As Jewelry Market Splinters Between True And Accessible Luxury

Richemont of Cartier and Van Cleef & Arpels fame just delivered spectacular third quarter results, ending December 31 with its luxury jewelry brand revenues up 14%.

Marvell Technology Q3: A True AI Winner

Marvell's custom silicon business now comprises 73% of Q3 revenues, driven by a 5-year agreement with Amazon AWS for AI accelerators and optical interconnect products. The company reported strong Q3 results with adjusted EPS of $0.43 and revenue of $1.52B, significantly benefiting from a 98% YoY increase in data center revenue. Marvell's restructuring efforts and focus on AI have positioned it well for future growth, with strong Q4 guidance and a forecasted 26% revenue growth for fiscal 2025.