Teledyne Technologies Incorporated (TDY)

Compared to Estimates, Teledyne (TDY) Q3 Earnings: A Look at Key Metrics

The headline numbers for Teledyne (TDY) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Teledyne Technologies' Q3 Earnings Top Estimates, Revenues Rise Y/Y

TDY's total sales in the third quarter of 2024 beat the Zacks Consensus Estimate by 1.3%. The top line also rose 2.9% from the year-ago level.

Teledyne Technologies (TDY) Surpasses Q3 Earnings and Revenue Estimates

Teledyne Technologies (TDY) came out with quarterly earnings of $5.10 per share, beating the Zacks Consensus Estimate of $4.97 per share. This compares to earnings of $5.05 per share a year ago.

Teledyne's third-quarter profit rises on strong defense demand

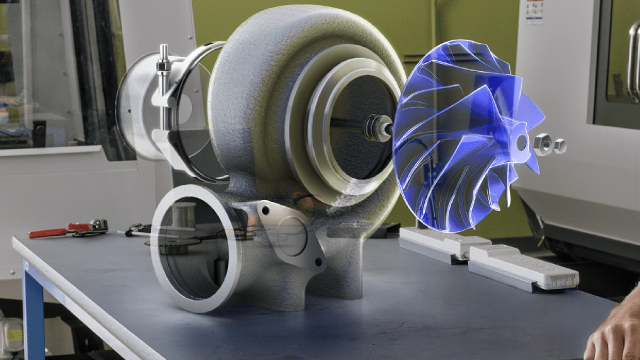

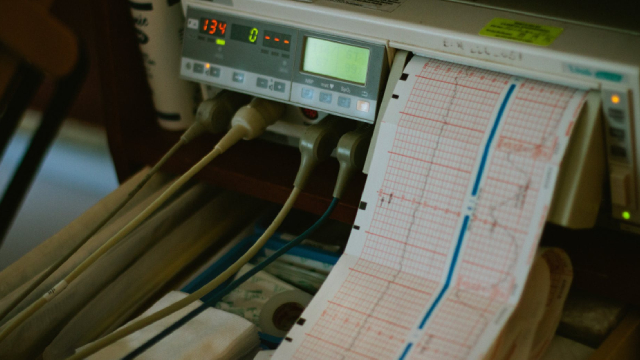

U.S. defense firm Teledyne on Wednesday reported a rise in third-quarter profit, driven by strong demand for marine instrumentation and aerospace electronics.

What Analyst Projections for Key Metrics Reveal About Teledyne (TDY) Q3 Earnings

Besides Wall Street's top -and-bottom-line estimates for Teledyne (TDY), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended September 2024.

Will Supply-Chain Challenges Hurt Teledyne's Q3 Earnings?

TDY's third-quarter results are likely to reflect solid overall sales performance amid the negative impact of supply-chain challenges.

Reasons to Add Teledyne Technologies Stock to Your Portfolio Now

TDY makes a strong case for investment in the aerospace sector, given its long-run growth prospects, low debt and strategic acquisitions.

Teledyne Wins Deal to Supply Multi-Spectral Imaging Systems

TDY wins a $20.8 million multi-spectral imaging system contract from the Japan Maritime Self-Defense Force.

Reasons to Add Teledyne Technologies Stock to Your Portfolio Now

TDY makes a strong case for investment in the aerospace sector, given its long-run growth prospects, low debt and strategic acquisitions.

Teledyne's (TDY) Unit Wins $114M Contract for Missile Defense

Teledyne's (TDY) subsidiary Teledyne Brown Engineering receives a $114-million contract for building target missiles.

Teledyne: Shares Are Attractive Now That Growth Is Returning

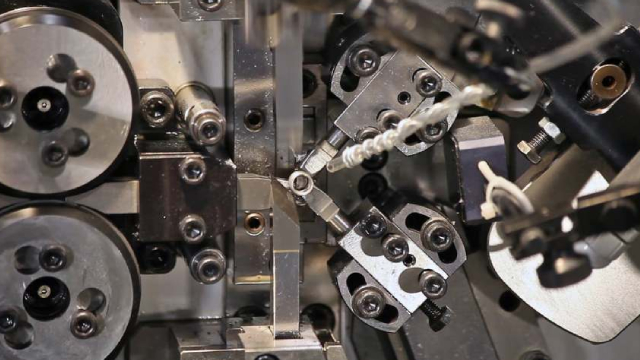

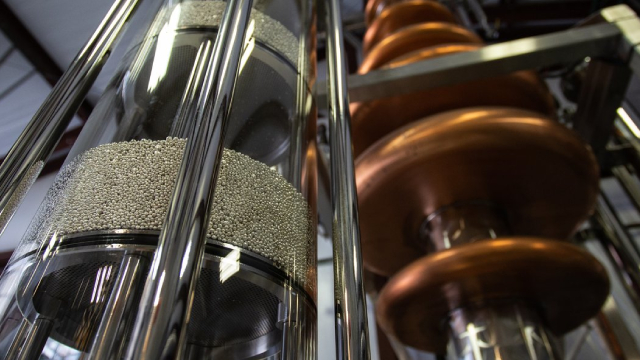

Teledyne, founded by Dr. Henry Singleton, has shown steady growth and strong capital allocation strategies over the past decade. Teledyne's growth is driven by autonomous growth and acquisitions, with a focus on digital imaging equipment for various industries. For full-year 2024, adjusted EPS is expected to be between $19.25 and $19.45, which is up about 5% from last year.

Why Is Teledyne (TDY) Up 0.5% Since Last Earnings Report?

Teledyne (TDY) reported earnings 30 days ago. What's next for the stock?