Timken Co. (TKR)

Summary

Why Is Timken (TKR) Up 3.4% Since Last Earnings Report?

Timken (TKR) reported earnings 30 days ago. What's next for the stock?

The Timken Company (TKR) Presents at Baird 55th Annual Global Industrial Conference Transcript

The Timken Company ( TKR ) Baird 55th Annual Global Industrial Conference November 11, 2025 5:05 PM EST Company Participants Lucian Boldea - CEO, President & Director Michael Discenza - Vice President & Chief Financial Officer Presentation Unknown Analyst [Audio Gap] second session. With me today Lucian Boldea, President and CEO; and Mike Discenza, who's the CFO.

The Timken Company: Transformed Business With A Strong Moat And Visible Growth

The Timken Company earns a buy rating due to its transformation into a diversified, higher-margin industrial business with reduced cyclical risk. TKR's pivot from automotive OEMs to the Industrial Motion segment and aftermarket sales has stabilized earnings and improved profitability. The Industrial Motion segment, driven by automation and on-shoring trends, offers significant growth potential and cross-selling opportunities for TKR.

Timken Co. (TKR) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Timken Co. ever had a stock split?

Timken Co. Profile

| Life Sciences Tools & Services Industry | Healthcare Sector | Lucian Boldea CEO | NYSE Exchange | 887389104 CUSIP |

| US Country | 19,000 Employees | 25 Nov 2025 Last Dividend | 1 Jul 2014 Last Split | 1 Jul 1985 IPO Date |

Overview

The Timken Company, with a rich history dating back to 1899, has established itself as a global leader in engineering, manufacturing, and selling of engineered bearings and industrial motion products, alongside a wide range of related services. This pioneering company boasts a diverse product lineup that caters to a multitude of industries, from wind energy and agriculture to aerospace and automotive, among others. With its headquarters in North Canton, Ohio, Timken operates not just within the United States but extends its market reach internationally. The company is well-regarded for its commitment to innovation, quality, and reliability, providing solutions under esteemed brands like Timken, GGB, and Fafnir in its Engineered Bearings segment, and a suite of other recognized brands in its Industrial Motion segment.

Products and Services

The Timken Company’s offerings are divided into two major segments: Engineered Bearings and Industrial Motion. Each segment encompasses a broad spectrum of products and services designed to meet the demands of various industries.

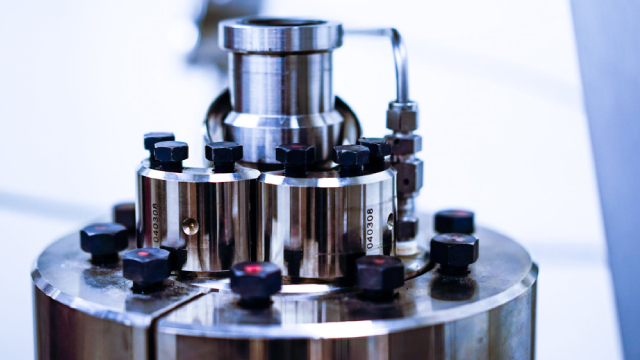

- Engineered Bearings

This segment delivers an extensive range of bearing products such as tapered, cylindrical, and spherical roller bearings; plain and metal-polymer bearings; rod end, radial, angular, and precision ball bearings; thrust and specialty ball bearings; journal bearings; as well as housed or mounted bearings. Catering to sectors like wind energy, agriculture, construction, food and beverage, metals and mining, automotive and truck, aerospace, and rail, these products are available under the Timken, GGB, and Fafnir brands.

- Industrial Motion

The Industrial Motion segment provides a comprehensive portfolio of engineered products that includes industrial drives, automatic lubrication systems, linear motion products and systems, chains, belts, seals, couplings, filtration systems, and industrial clutches and brakes. Additionally, this segment offers services such as industrial drivetrain and bearing repair. These solutions cater to a wide array of industries including solar energy, automation, construction, agriculture and turf, passenger rail, marine, aerospace, packaging and logistics, medical, among others. Products in this segment are marketed under various brands including Philadelphia Gear, Cone Drive, Rollon, Nadella, Groeneveld, BEKA, Diamond, Drives, Timken Belts, Spinea, Des-Case, Lagersmit, Lovejoy, and PT Tech.