Track Group Inc. (TRCK)

August Was Volatile—But ETFs Stayed On Track for a Record Year of Inflows

Investors continued to pour money into U.S. funds last month despite it being the market's most volatile month in years.

XP Q2 Earnings: On Track To Meet Its 2026 Financial Targets

Q2 results demonstrated a solid performance in both growth and profitability. The company remains on track to meet its 2026 financial targets in terms of revenue and margins. I remain confident in XP's business despite competitive threats and an uncertain macro environment.

As Research into Pain Accelerates, a Newly Recognized Type of Pain Comes to the Forefront - Tonix Targets it with FDA-Fast Track-Designated TNX-102 SL

CHATHAM, NJ / ACCESSWIRE / September 4, 2024 / This post was written and published as a collaboration between the in-house editorial team at Benzinga and Tonix Pharmaceuticals Holding Corp. with financial support from Tonix. The two organizations work to ensure that any and all information contained within is true and accurate as of the date hereof to the best of their knowledge and research.

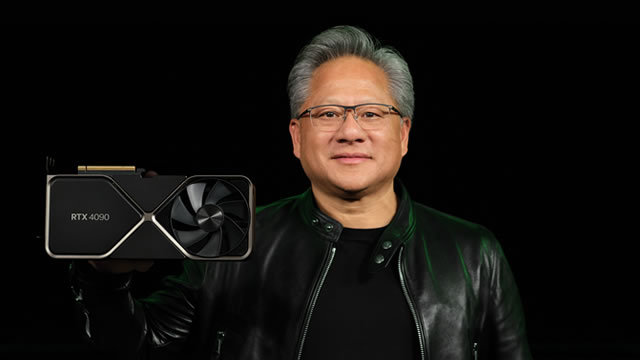

Wall Street On Track For Relief Rally With Nvidia Earnings In Rearview Mirror: Strategist Says Near-Term Market Trajectory May Not Hinge On Presidential Election But This

After dilly-dallying in recent sessions amid anticipation ahead of Nvidia Corp.'s NVDA earnings, market mood is settling in. The index futures were higher in early trading.

Teleperformance: Majorel Integration And AI Are Well On Track; Buy Confirmed

Teleperformance continues to show strong fundamentals in H1. The company's AI initiatives and Majorel acquisition are future earnings growth. Majorel integration might yield significant cost synergies ahead. Teleperformance organic growth was beat for the 2nd consecutive quarter. The company confirmed its 2024 guidance, and we reiterate our buy rating.

Arthur J. Gallagher: Strong Growth Expectations And Track Record

Arthur J. Gallagher shows strong revenue and profit growth, with a CAGR of 8.5% in revenue and 24.4% in EPS over the past 4 years. The company benefits from a consistent revenue stream, primarily from its insurance brokerage segment, and has a solid track record of organic growth and acquisitions. Despite a lower dividend yield, Arthur J. Gallagher reinvests profits for growth, making it less attractive for income investors compared to Marsh & McLennan.

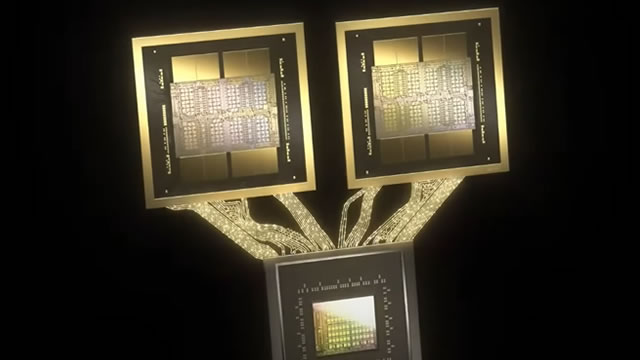

Nvidia Beats Q2 Estimates, But Stock Slips—Is AI-Driven Growth Still on Track?

Despite beating Q2 earnings estimates, Nvidia's stock drops 2%. Investors eye ambitious Q3 forecasts, signaling potential for sustained AI-driven growth.

Wall Street On Track For Weak Start As Anticipation For Nvidia Earnings Drives Traders To Sidelines: Strategist Flags Shift From Volatile Tech Stocks To Good Dividend-Paying Bets

U.S. stocks are on track for a jittery start as traders brace for a few market-moving catalysts that will pan out over the next few sessions. The index futures were narrowly mixed in early trading.

Roivant Sciences: Inherently Risky Business Model, But Track Record Impresses

Roivant Sciences stock has risen significantly since my initial coverage in 2022, with a positive market response to fiscal year 2025 Q1 earnings. Roivant operates by creating "nimble subsidiaries to develop and commercialize medicines", with a focus on unearthing strong drug candidates for lucrative exits. Key drugs in Roivant's pipeline include VTAMA, Batoclimab, and Breproctinib, each facing competition and uncertainties in their respective markets.

Stella-Jones: Tying Up A Solid Q2 And On Track For A Good Year

Stella-Jones is a profitable company in the Materials sector manufacturing railway ties and utilities poles, with consistent sales growth and strong EBITDA margins. The company's core segments of railway ties and utility poles are performing well, with increased sales and profitability. Despite solid performance, valuation concerns, and potential headwinds in the railway, tie segment may impact future growth, making shares a 'hold' for now.

Retail Sales, Jobless Claims Ease Recession Fears, Fed Rate Cut On Track; S&P 500 Jumps

Retail sales and other economic data eased recession fears while keeping a Fed rate cut on track. The S&P 500 jumped.

3 Long-Term Stocks on Track to Double (or More) by 2032

Investing in the stock market for the long term is always the most sound way to avoid losing money. However, identifying long-term stocks with robust business models and little risk can be somewhat tricky.