LendingTree Inc. (TREE)

LendingTree, Inc. (TREE) Q4 2024 Earnings Call Transcript

LendingTree, Inc. (NASDAQ:TREE ) Q4 2024 Earnings Conference Call March 5, 2025 5:00 PM ET Company Participants Andrew Wessel - SVP, IR &Corporate Development Doug Lebda - Chairman & CEO Scott Peyree - COO & President of Marketplace Businesses Jason Bengel - CFO Conference Call Participants Ryan Tomasello - KBW Jed Kelly - Oppenheimer & Company Youssef Squali - Truist Securities Oscar Nieves - Stephens Mike Grondahl - Northland Melissa Wedel - JPMorgan Operator Good day and thank you for standing by. Welcome to the LendingTree, Inc. Fourth Quarter 2024 Earnings Conference Call.

Tree.com (TREE) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates

While the top- and bottom-line numbers for Tree.com (TREE) give a sense of how the business performed in the quarter ended December 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Tree.com (TREE) Q4 Earnings and Revenues Top Estimates

Tree.com (TREE) came out with quarterly earnings of $1.16 per share, beating the Zacks Consensus Estimate of $0.37 per share. This compares to earnings of $0.28 per share a year ago.

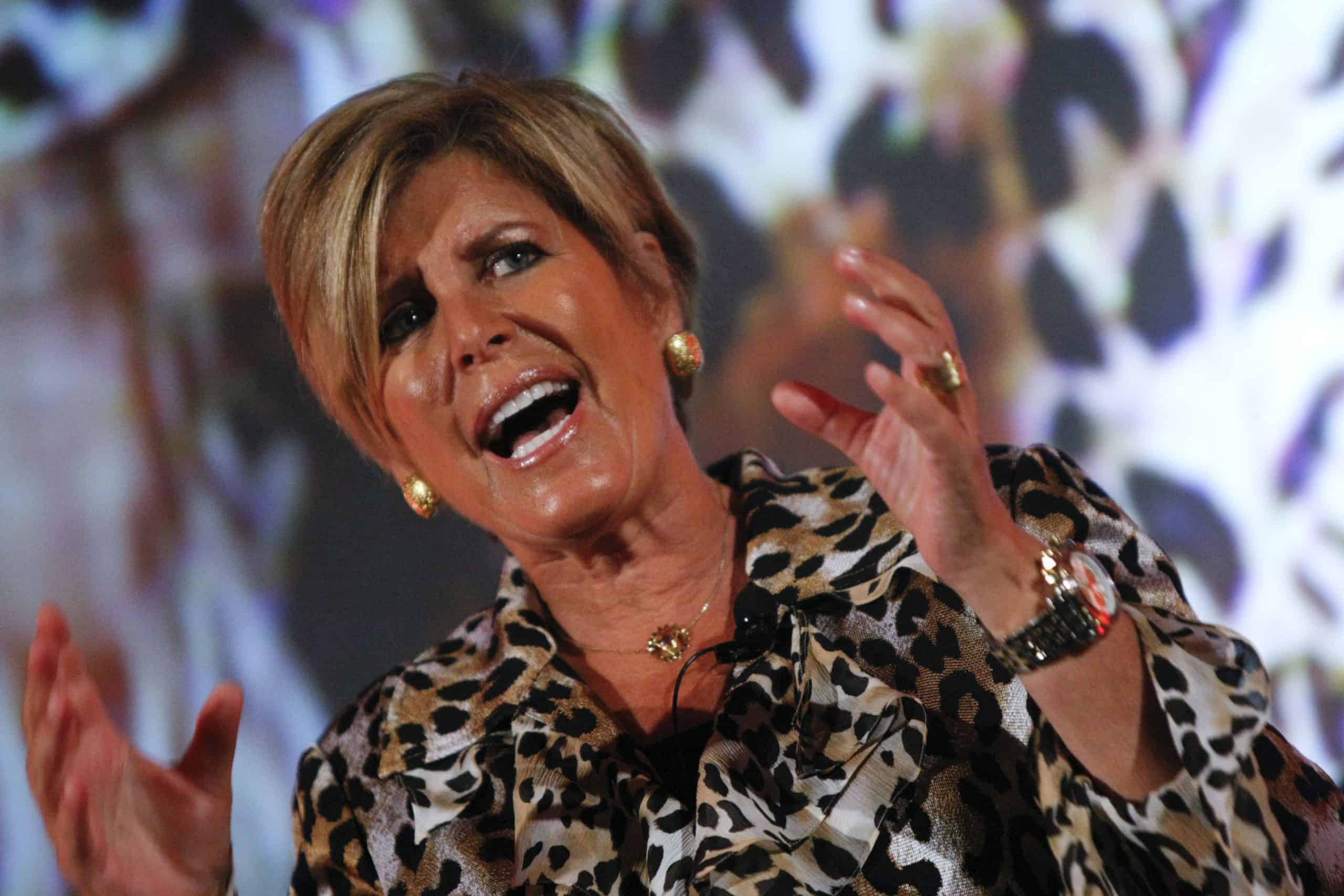

Suze Orman’s Five Top Money Tips You May Want to Follow

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. At some point, we all want to retire comfortably. But to do so, you need to plan ahead, as noted by finance expert Suze Orman. In fact, she notes there are key things you should pay close attention to if you’re nearing retirement. Key Points About This Article According to Suze Orman, “Every family should have an emergency savings account that can cover at least eight months of living expenses,” she said on Oprah.com. Unless you can pay off your entire credit card bill every month, avoid using credit cards. Instead, rely on cash or debit cards. The average lifespan may be 77.5. But many more of us are living to be far older. In that case, you may want to set aside extra money for extra financial padding. 4 million Americans are set to retire this year. If you want to join them, click here now tosee if you’re behind, or ahead. It only takes a minute. (Sponsor) Have an Emergency Fund According to Suze Orman, “Every family should have an emergency savings account that can cover at least eight months of living expenses,” she said on Oprah.com. For many of us, saving eight months of expenses is easier said than done. If you can’t swing that, start small with an emergency savings goal of at least $1,000. Sure, it’s small but it’s a safety net, and it’s a start. If you can put away about $85 a month, you’ll reach that goal and have some wiggle room. However, be sure to store this in a separate “don’t touch” account, automatically depositing money every time you’re paid. Plus, if you ever receive another source of income, such as a bonus or a gift, put it directly into that “don’t touch” account instead of spending it immediately. Use Debit Cards Instead of Credit Cards Unless you can pay off your entire credit card bill every month, avoid using credit cards. Instead, rely on cash or debit cards. “There is no more expensive form of bondage than spending more than you have and paying interest of 15% or more on your credit card,” Orman said, as quoted by GoBankingRates.com. Get Out of Credit Card Debt Many of us think it’s easier to just charge everything until they get the bill, plus interest. According to LendingTree.com, Americans have about $1.166 trillion in debt, which is up from $1.142 trillion in the second quarter. Also, according to Experian, “the average credit card balance in the United States in 2024 is $6,699, a 5.3% increase from June 2023. The average monthly payment for credit card debt in 2024 is $1,212, which is a 5.9% increase from June 2023.” It’s better to get rid of credit cards if you can, and just use cash. Set Up Automatic Deposits One of the best ways to set aside money for savings is by setting up automatic deposits. “It can be $10 a month, $200, or $1,000. That’s up to you, and each account can have a different contribution amount,” Orman said, as also quoted by GoBankingRates.com. “All I insist is that you make this automatic. That is a proven way to stay committed to a savings goal. Having money zapped from your checking account into your savings account is free too. The set it and forget it approach is how you will reach your savings goals.” Save for Retirement as Though You’ll Live to 100 The average lifespan may be 77.5. But many more of us are living to be far older. In that case, you may want to set aside extra money for extra financial padding. “You know that I have long recommended that you base your retirement planning on living to at least 90; to be even safer planning to age 95 is even smarter,” Orman added. “Anyone who makes it to age 65 basically has a 50-50 chance of still being alive in his or her mid 80s. And living into your 90s is not nearly as rare as you may think.” In fact, according to Census.gov, “The nation’s 90-and-older population nearly tripled over the past three decades, reaching 1.9 million in 2010, according to a report released today by the U.S. Census Bureau and supported by the National Institute on Aging. Over the next four decades, this population is projected to more than quadruple. Because of increases in life expectancy at older ages, people 90 and older now comprise 4.7 percent of the older population (age 65 and older), as compared with only 2.8 percent in 1980. By 2050, this share is likely to reach 10 percent.” The post Suze Orman’s Five Top Money Tips You May Want to Follow appeared first on 24/7 Wall St..

Unveiling Tree.com (TREE) Q4 Outlook: Wall Street Estimates for Key Metrics

Beyond analysts' top -and-bottom-line estimates for Tree.com (TREE), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended December 2024.

Tree.com (TREE) Soars 19.0%: Is Further Upside Left in the Stock?

Tree.com (TREE) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

Tree.com (TREE) Upgraded to Buy: What Does It Mean for the Stock?

Tree.com (TREE) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

LendingTree: Buy The Dip, If Bullish On A 2025 Housing Recovery

LendingTree, Inc. has surged over the past year, but a recent pullback may have some believing it is time to sell/avoid this stock. However, with TREE stock, the potential for further price appreciation remains strong, even if the housing market doesn't quickly return to boom times. Why? With the strength of this online consumer finance platform's insurance business already driving improved results, only slight improvements to mortgage demand may be needed to sustain further EPS growth.

LendingTree Partners With Coverdash to Launch Insurance Offering

TREE's collaborative partnership with Coverdash broadens its range of financial products for SMBs.

LendingTree Surpasses Q3 Earnings Estimates, Raises 2024 View

TREE's third-quarter 2024 results benefit from year-over-year increases in EBITDA and revenues. Rising costs act as headwinds.

LendingTree, Inc. (TREE) Q3 2024 Earnings Call Transcript

LendingTree, Inc. (NASDAQ:TREE ) Q3 2024 Earnings Conference Call October 31, 2024 4:30 PM ET Company Participants Andrew Wessel - SVP, IR &Corporate Development Doug Lebda - Chairman & CEO Jason Bengel - CFO Scott Peyree - COO & President of Marketplace Businesses Conference Call Participants Jed Kelly - Oppenheimer & Company Ryan Tomasello - KBW John Campbell - Stephens Inc. Jamie Friedman - Susquehanna International Group Robert Zeller - Truist Securities Melissa Wedel - JPMorgan Mike Grondahl - Northland Operator Thank you for standing by, and welcome to LendingTree's Third Quarter 2024 Earnings Conference Call. At this time, all participants are in a listen-only-mode.

Tree.com (TREE) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Tree.com (TREE) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.