Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

Jim Cramer on if TSMC's earnings sparked a broader rally

'Mad Money' host Jim Cramer looks at Taiwan Semiconductor earnings and how they could have impacted the stock market.

TSMC: Demand Outlook Offsets Likely Peak In Gross Margins

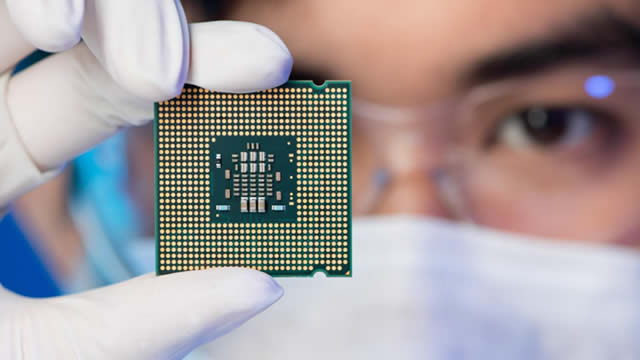

TSMC is set to increase FY25 capex by 34%. This is a very healthy demand signal, driven by aggressive AI-related spending and augmented by the N2 process node's ramp. TSMC may be at peak gross margins as dilution is expected from the ramp-up of additional capacity. But there are structural improvements too, driven by productivity and utilization increases. TSMC's discount vs peers has widened a little bit from what it was a few days before the Q4 FY24 earnings release.

Taiwan Semiconductor Stock Investors: Here's What You Should Know

The company plans to increase capital expenditures by roughly 33% in 2025.

Where Will Taiwan Semiconductor Stock Be in 2025 (and Beyond)

Thanks to better-than-expected sales for artificial intelligence end markets, Taiwan Semiconductor Manufacturing (TSM -1.53%) management is optimistic about its future.

TSMC Just Delivered Incredible News to AMD, Nvidia, and Micron Stock Investors

In today's video, I discuss Taiwan Semiconductor Manufacturing (TSM -1.53%) and recent updates impacting the semiconductor industry . To learn more, check out the short video, consider subscribing, and click the s pecial offer link below.

TSMC says all its sites operating following Taiwan quake

Chipmaker TSMC said on Tuesday that all its sites were operating following an overnight earthquake in southern Taiwan.

Could TSMC lose US funding under Trump 2.0?

US markets are keenly awaiting more color on Trump's stance on the “Chips and Science Act” following his public criticism of the costs associated with that bill. Tariff, he argued during his campaign, could have been a more effective and cost-friendly initiative for onshore chip manufacturing.

TSMC (TSM) Is Up 1.50% in One Week: What You Should Know

Does TSMC (TSM) have what it takes to be a top stock pick for momentum investors? Let's find out.

Investors Heavily Search Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to TSMC (TSM). This makes it worthwhile to examine what the stock has in store.

Taiwan Semiconductor Will Keep Processing Bigger Gains

TSMC's FY24 performance exceeded expectations with revenue up significantly, driven by AI chip demand and successful 3nm chip production. Looking ahead, management projects continued strong growth fueled by AI accelerator demand, though they warn of some margin pressure in 2025 due to overseas expansion costs and higher electricity prices. The company maintains a clear technological edge over competitors, particularly in 2nm chip development. Combined with strong fundamentals and growth potential, we see significant upside despite the stock's recent gains.

Will TSMC's CHIPS Act funding survive Trump's ‘chip theft' accusations?

Taiwan Semiconductor Manufacturing Co. (TSMC) is at the centre of a geopolitical and economic tug-of-war as it navigates US efforts to localise semiconductor manufacturing. While the Biden administration allocated $6.

TSMC: A Strong AI Stock For 2025

Taiwan Semiconductor Manufacturing reported strong Q4 earnings, driven by surging demand for AI-optimized chips, signaling robust AI spending into 2025. TSMC's revenue growth in high-performance computing was 58% in FY 2024, outpacing smartphone-related growth and boosting gross margins to 59% in Q4. Despite market dominance and a 64% global foundry share, TSMC's shares appear to be undervalued relative to other high-performing AI hardware stocks.