Texas Instruments Inc. (TXN)

Understanding Texas Instruments (TXN) Reliance on International Revenue

Examine the evolution of Texas Instruments' (TXN) overseas revenue trends and their effects on Wall Street's forecasts and the stock's prospects.

Investors Heavily Search Texas Instruments Incorporated (TXN): Here is What You Need to Know

Zacks.com users have recently been watching Texas Instruments (TXN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Is Texas Instruments A Good Buy After The Q3 Results?

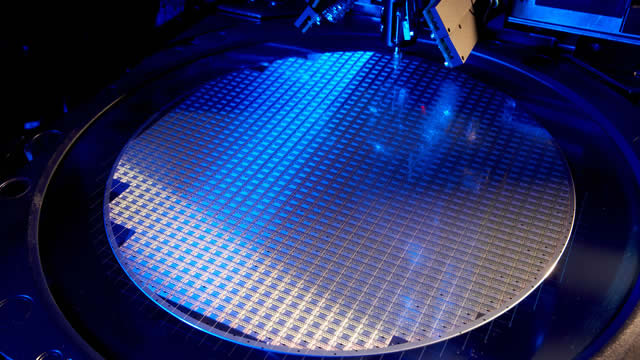

Texas Instruments' revenue performance in Q3 was better than expected, but it is now entering a seasonally soft 6 months; meanwhile consensus estimates for Q4 have already been curtailed. TXN's key end market- Industrials continues to decline, whilst its second-biggest end market- Autos is only posting better trends on account of the Chinese market. Despite receiving favorable ITC to the tune of $220m, TXN's FCF margin is well short of its long-term target as CAPEX commitments towards the 300m wafer capacity remain high.

Texas Instruments Beats Q3 Expectations, But Analysts 'Don't Yet See The Lift-Off In Sales Growth'

Shares of Texas Instruments Inc TXN spiked in early trading on Wednesday, after the company reported its third-quarter results.

Texas Instruments Q3 Earnings Beat: Can Strong Results Lift the Stock?

TXN's third-quarter 2024 results reflect growth across personal electronics, communication equipment, enterprise systems and automotive end markets.

Texas Instruments is staying strong with their strategy despite activist campaigns: Analyst

Dylan Patel from SemiAnalysis explains why it makes sense for Texas Instruments to invest in fab upgrading given the competition in the market.

Texas Instruments Incorporated (TXN) Q3 2024 Earnings Call Transcript

Texas Instruments Incorporated (NASDAQ:TXN ) Q3 2024 Earnings Conference Call October 22, 2024 4:30 PM ET Company Participants Dave Pahl - Head of IR Haviv Ilan - CEO Rafael Lizardi - CFO Conference Call Participants Timothy Arcuri - UBS Vivek Arya - Bank of America Securities C.J. Muse - Cantor Fitzgerald Ross Seymore - Deutsche Bank Stacy Rasgon - Bernstein Research Thomas O'Malley - Barclays Joseph Moore - Morgan Stanley William Stein - Truist Securities Tore Svanberg - Stifel Dave Pahl Welcome to the Texas Instruments Third Quarter 2024 Earnings Conference Call.

Compared to Estimates, Texas Instruments (TXN) Q3 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Texas Instruments (TXN) give a sense of how the business performed in the quarter ended September 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Texas Instruments posts earnings and revenue beat

Barbara Doran, BD8 Capital Partners CEO, and Brooke May, Evans May Wealth managing partner, join 'Closing Bell Overtime' to talk markets and earnings.

Texas Instruments (TXN) Q3 Earnings and Revenues Top Estimates

Texas Instruments (TXN) came out with quarterly earnings of $1.47 per share, beating the Zacks Consensus Estimate of $1.36 per share. This compares to earnings of $1.80 per share a year ago.

Texas Instruments earnings show some improvements, despite weak industrial sales

Texas Instruments grew overall revenue on a sequential basis, though industrial sales still dropped sequentially.

Chipmaker Texas Instruments Tops Q3 Views But Guides Low

Chipmaker Texas Instruments topped estimates for the third quarter but missed views with its guidance for the current period. TXN stock fell.