Texas Instruments Inc. (TXN)

With Analog Market Seeing A Lull, What To Expect From Texas Instruments Q2 Earnings?

Texas Instruments is poised to report its Q2 results next week. We expect the company's revenues for the quarter to decline by about 15% year-over-year to $3.84 billion, slightly ahead of estimates, while earnings are likely to come in at about $1.17 per share, roughly in line with estimates.

Texas Instruments (TXN) Aids Power Designers With New Modules

Texas Instruments (TXN) unveils six new power modules in a bid to boost its power electronics portfolio.

Up, Up, And Away - Why I See Much More Potential In Texas Instruments

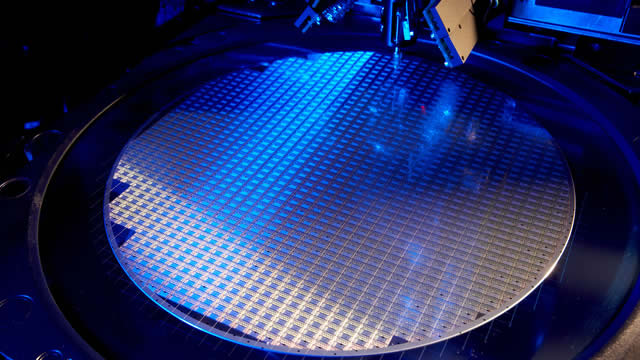

Texas Instruments has outpaced the S&P 500 with a 20% return since April, showcasing its strong capital allocation and robust dividend growth. Despite lagging peers post-pandemic due to AI trade and high CapEx, TXN's strategic investments in automation and electrification are set to pay off. Looking ahead, TXN aims for substantial revenue growth with new facilities like RFAB2 and LFAB1, positioning itself for long-term market leadership and profitability.

Texas Instruments (TXN) Registers a Bigger Fall Than the Market: Important Facts to Note

In the closing of the recent trading day, Texas Instruments (TXN) stood at $199.99, denoting a -1.78% change from the preceding trading day.

Texas Instruments Q2 Preview: Fade The Rally - Too Expensive Here

TXN and ADI have hinted at the recovery of the analog chips market, with the next quarterly earnings call likely to bring about QoQ top-line improvements. However, this also means that TXN has pulled forward most of its upside potential through 2026, with it appearing to be expensive at current levels. While the geopolitically dependable capacity is commendable, the intensified capex has also triggered its deteriorating balance sheet and moderating shareholder returns.

Texas Instruments (TXN) Beats Stock Market Upswing: What Investors Need to Know

Texas Instruments (TXN) closed at $194.47 in the latest trading session, marking a +0.29% move from the prior day.

Is It Finally Time to Buy This Leading Chip Stock Again?

Texas Instruments landed itself in the crosshairs of an activist investor, Elliott Management. The chipmaker has plans to spend aggressively (perhaps too much so) on new manufacturing facilities.

Texas Instruments Incorporated (TXN) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Texas Instruments (TXN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Here's Why Texas Instruments (TXN) Gained But Lagged the Market Today

Texas Instruments (TXN) reachead $194.90 at the closing of the latest trading day, reflecting a +0.52% change compared to its last close.

Texas Instruments (TXN) Aids Portfolio With DRV7308 Power Module

Texas Instruments (TXN) unveils DRV7308 gallium nitride (GaN) intelligent power module in a bid to expand its product portfolio.

Texas Instruments (TXN) Stock Dips While Market Gains: Key Facts

Texas Instruments (TXN) concluded the recent trading session at $197.44, signifying a -0.09% move from its prior day's close.

Texas Instruments Incorporated (TXN) BofA Securities 2024 Global Technology Conference (Transcript)

Texas Instruments Incorporated (NASDAQ:TXN ) BofA Securities 2024 Global Technology Conference June 5, 2024 6:20 PM ET Company Participants Rafael Lizardi - CFO & SVP, Finance & Operations Mike Beckman - IR Conference Call Participants Vivek Arya - Bank of America Vivek Arya Delighted and honored to have the team from Texas Instruments join us. Rafael Lizardi, the Chief Financial Officer; and Mike Beckman from the Investor Relations team.