United Airlines Holdings Inc. (UAL)

United Airlines Jumps On Q4 Earnings, 2025 Guidance Amid Strong Travel Demand

United Airlines stock eyed a new high Wednesday after its Q4 beat late Tuesday. Revenue increased across the board.

United Stock Gains on Stronger-Than-Expected Results, Upbeat Outlook

United Airlines (UAL) shares are rising in premarket trading Wednesday after the Chicago-based carrier posted better-than-estimated fourth-quarter results and gave a bullish current-quarter outlook.

United Airlines gains altitude as record passenger figures fuel profit

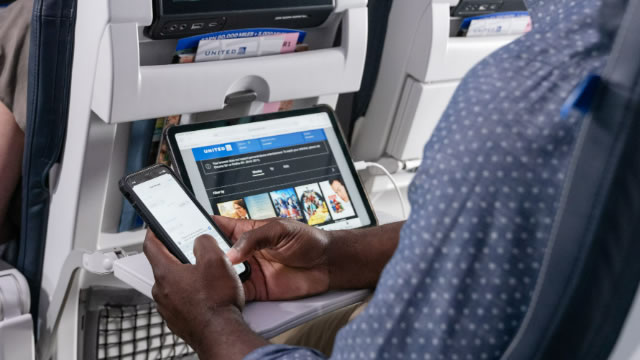

United Airlines Holdings Inc shares climbed in Wednesday's pre-market trading following news of record passenger figures last year and profit in the fourth quarter. Almost 174 million passengers travelled with the airline last year, it said on Tuesday evening, as demand for premium, corporate and economy seats all picked up.

United (UAL) Reports Q4 Earnings: What Key Metrics Have to Say

The headline numbers for United (UAL) give insight into how the company performed in the quarter ended December 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

United Airlines (UAL) Surpasses Q4 Earnings and Revenue Estimates

United Airlines (UAL) came out with quarterly earnings of $3.26 per share, beating the Zacks Consensus Estimate of $3.01 per share. This compares to earnings of $2 per share a year ago.

United Airlines shares rally on profit forecast, helped by premium and economy demand

Shares of United Airlines Holdings Inc. rallied in after-hours trading Tuesday, after the airline reported fourth-quarter results that beat expectations and offered an upbeat first-quarter profit outlook, helped by a jump in premium and economy sales.

United Airlines' first-quarter outlook outpaces estimates after profits surge to end 2024

United Airlines forecast first-quarter adjusted earnings of 75 cents to $1.25 a share. The company will hold a conference call with analysts Wednesday at 10:30 a.m.

United Airlines Technical Signals Show Clear Skies Ahead Of Earnings

United Airlines Holdings Inc UAL will be reporting its fourth-quarter earnings on Tuesday. Wall Street expects $2.99 in EPS and $14.40 billion in revenues as the company reports after market hours.

United Airlines Stock Is on a Tear. Why Earnings Can Push It Even Higher.

Delta Air Lines set the tone for earnings season earlier this month with a strong outlook. United Airlines can benefit from the same trends.

Can United Airlines (UAL) Stock Fly Higher as Q4 Earnings Approach?

Soaring over +170% in the last year, investors are surely wondering if United Airlines (UAL) stock can fly higher as its Q4 earnings approach after-market hours on Tuesday, January 21.

Here's Why United Airlines (UAL) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

United Flying High on Big Money Buys

Capacity growth, share buybacks lifting United Airlines Holdings, Inc. (UAL).