Uber Technologies, Inc. (UBER)

Uber's Growing Partnerships And Sticky Ecosystem May Trigger Robust Autonomous Prospects

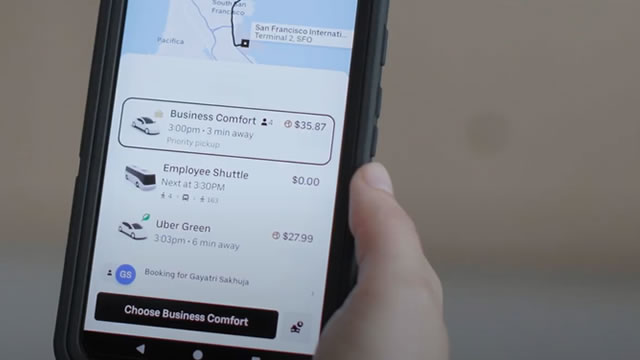

UBER's sideways trading since mid-2024 has already helped moderate part of the massive gains observed since 2022, allowing the stock to grow into its previously expensive valuations. This is significantly aided by the cheaper forward valuations, richer profit margins, and healthier balance sheet, allowing them to outperform despite the intensified autonomous investments. UBER has already hinted at its ongoing (and potentially rather successful) efforts in Austin, Texas, as they launch the Waymo robotaxi on its platform from March 2025 onwards.

Final Trades: Uber, NRG Energy, Franco-Nevada Corp and Meta

The Investment Committee give you their top stocks to watch for the second half.

Uber Technologies Stock: Bull vs. Bear

Uber Technologies (UBER -2.37%) has left investors with a range of views. On the one hand, it has performed well in recent quarters, delivering growth and profits.

Travis Kalanick thinks Uber screwed up: “Wish we had an autonomous ride-sharing product”

Travis Kalanick, the former CEO of Uber, made it clear on Wednesday: he believes the company's decision to abandon its autonomous driving program was a mistake. Said Kalanick at the Abundance Summit in L.A.

Uber Abandons Foodpanda Taiwan Buyout Bid: How to Play the Stock Now

Here we asses the investment worthiness of UBER stock at a time when its shares are moving south.

Should Investors Buy Grab Stock?

The company operates a similar business to my top stock to buy, Uber (UBER -3.30%).

Uber terminates Foodpanda Taiwan acquisition, citing regulatory hurdles

Uber Technologies has ended its acquisition of Delivery Hero's Foodpanda in Taiwan, the Germany-based tech firm said on Tuesday.

Uber terminates Delivery Hero's Foodpanda business acquisition

Uber has decided terminate its agreement to acquire Delivery Hero's Foodpanda business in Taiwan and will pay a termination fee of around $250 million, the food delivery company said on Tuesday.

Trade Tracker: Steve Weiss sells Dick's Sporting Goods, Uber, Vertiv, PDD and the KWEB

Steve Weiss, Founder and Managing Partner of Short Hills Capital Partners joins CNBC's “Halftime Report” to detail his latest stock sales.

Wall Street Analysts Think Uber (UBER) Is a Good Investment: Is It?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Is Uber Technologies a Buy, Sell, or Hold in 2025?

Uber Technologies' (UBER 1.75%) stock went through some wild swings in 2024, but its price still dipped 2% from the first to the last trading days of the year. The bulls were initially impressed by the ride-hailing and delivery services giant's robust growth in a tough macroeconomic environment, but some regulatory concerns drove its stock lower through the last quarter of the year.

This Little-Known Technology Company Just Doubled Down on a Partnership With Uber Technologies -- a Partnership That Boosted Growth for Domino's Pizza

On Feb. 24, the world's largest pizza business, Domino's Pizza (DPZ -1.70%), reported its financial results for 2024. Investors were pleasantly surprised to see its sales surpass $19 billion, which was a strong 6% year-over-year increase.