Uber Technologies, Inc. (UBER)

1 Magnificent S&P 500 Dividend Stock Down 30% to Buy and Hold Forever

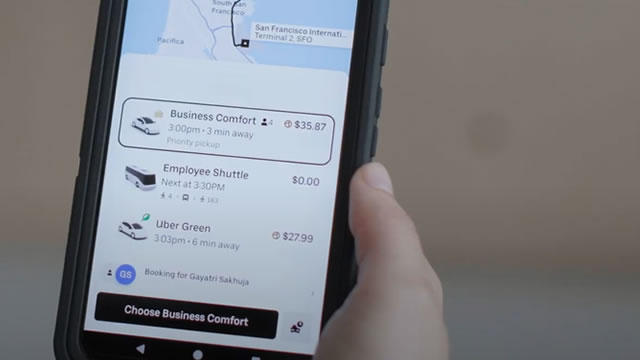

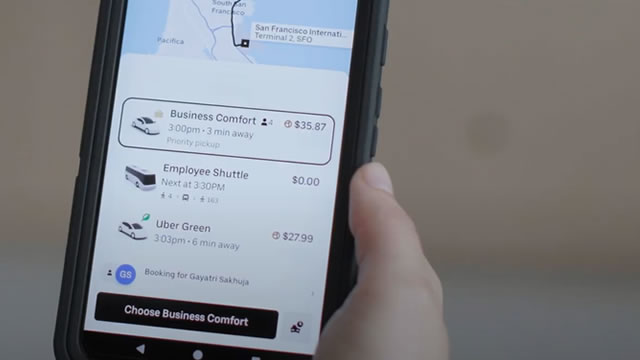

Uber Technologies (UBER 0.86%) has defined the ride-hailing industry. The company is the dominant ride-hailing company in the United States and operates in 70 countries worldwide.

UBER: Debunking The Bear Arguments

UBER's strong platform and AV partnerships, including potential with Tesla, position it well in the robotaxi market despite investor concerns. The current stock price drop is seen as a buying opportunity due to UBER's underappreciated AV market value and supply demand dynamics. Gross bookings deceleration is not alarming; 24% growth remains impressive for UBER's size, and past high-growth rates skew current comparisons.

Stocks on the Move: Uber, Carmax, Novo Nordisk, Eli Lilly, Merck, Crown Castle and Accenture

The CNBC 'Halftime Report' Investment Committee discusses today's market movers.

UBER Stock Price Decreases 13% in a Month: Should You Buy the Dip?

With UBER shares moving south lately, we assess the investment worthiness of the stock at current levels.

Darden Restaurants' Diversified Portfolio And Uber Delivery Partnership Offer Confidence In Overcoming Fine Dining Challenges: Analysts

Darden Restaurants, Inc. DRI shares are trading relatively flat on Friday.

Uber sues Seattle over new law regulating how delivery platforms boot drivers off their apps

Uber is suing the City of Seattle over a new law, set to take effect in January, that regulates how companies can deactivate workers who deliver food, shop for groceries, and complete other tasks via on-demand apps.

Is It Worth Investing in Uber (UBER) Based on Wall Street's Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Uber faced growth opportunities and hurdles with Robotaxi launch, says Oppenheimer

Tesla Inc (NASDAQ:TSLA)'s upcoming Robotaxi fleets present both a growth avenue and a series of logistical hurdles for ride-hailing OG Uber Technologies Inc (NYSE:UBER, ETR:UT8), reckon investment bank Oppenheimer. In a future where multiple providers compete, Uber's strength as a leading logistics and matching platform could enable it to achieve lower costs and higher vehicle utilization rates, said analysts.

Analyst Sees 'Buying Opportunity' After Uber Stock Sell-Off On Waymo, Tesla Robotaxi Concerns

An Uber stock analyst with Oppenheimer says the ride-hail market leader's recent sell-off is an opportunity for investors. The post Analyst Sees 'Buying Opportunity' After Uber Stock Sell-Off On Waymo, Tesla Robotaxi Concerns appeared first on Investor's Business Daily.

Down 30% From Its High, Should You Buy Uber Technologies Stock on the Dip?

Shares of Uber Technologies (UBER 0.33%) have been nosediving this month as investors worry about rising competition and the company's long-term growth prospects. As of this writing, the stock has declined 2% year to date and is down about 30% from its all-time high.

Uber Technologies (UBER) Increases Despite Market Slip: Here's What You Need to Know

The latest trading day saw Uber Technologies (UBER) settling at $61.23, representing a +0.33% change from its previous close.

Uber and its CEO donate $1m each to Trump's inaugural fund

Donation adds to list of tech companies and executives seeking to foster favorable relationship with president-elect