Vertiv Holdings Co. (VRT)

Is Trending Stock Vertiv Holdings Co. (VRT) a Buy Now?

Vertiv (VRT) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Vertiv Holdings Co. (VRT) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Vertiv (VRT) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Vertiv Holdings stock forms a risky pattern; Oct. 23 will be key

Vertiv Holdings' (VRT) stock price has done well since going public in a SPAC merger in 2020. It has risen from around $12 a share to $109, pushing its market cap to over $40 billion and making it one of the best-performing companies on Wall Street.

Recent Price Trend in Vertiv (VRT) is Your Friend, Here's Why

Vertiv (VRT) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

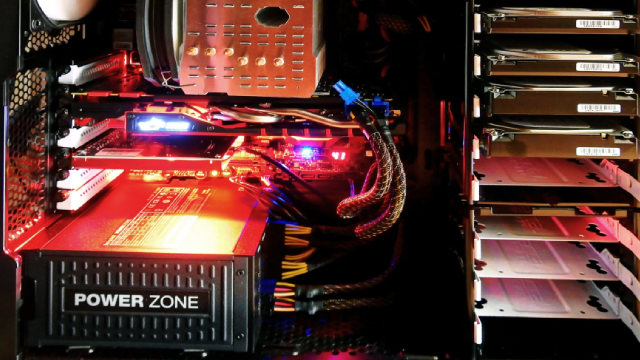

Can VRT's Expanding Liquid Cooling Portfolio Push the Stock Higher?

Vertiv shares ride on strong prospects, driven by solid AI-driven order growth and expanding market share in the thermal management space.

Vertiv Expands CDU Product Line: Should Investors Buy the Stock?

VRT expands its cooling solutions portfolio with the launch of CoolPhase CDU and the CoolChip Fluid Network.

Vertiv Holdings Co. (VRT) Rises As Market Takes a Dip: Key Facts

Vertiv Holdings Co. (VRT) concluded the recent trading session at $106.73, signifying a +1.45% move from its prior day's close.

Vertiv Stock Breaks Out; This Bull Put Spread Could Produce A 43% Return By Mid-November

The break-even point for the trade stands at 93.50.

Vertiv Holdings Co. (VRT) is Attracting Investor Attention: Here is What You Should Know

Vertiv (VRT) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Vertiv Thriving on AI, Cloud Trends

Vertiv Holdings Co. (VRT) is poised to thrive in AI and cloud computing markets.

Vertiv Holdings Co. (VRT) Is Up 4.09% in One Week: What You Should Know

Does Vertiv Holdings Co. (VRT) have what it takes to be a top stock pick for momentum investors? Let's find out.

Vertiv's New Lithium Cabinets Expands Portfolio: Is the Stock a Buy?

VRT shares ride on strong prospects driven by solid AI-driven order growth and expanding market share in the thermal management space.