MACOM Technology Solutions Holdings, Inc. (1MA)

Summary

1MA Chart

What Makes M/A-Com (MTSI) a Strong Momentum Stock: Buy Now?

Does M/A-Com (MTSI) have what it takes to be a top stock pick for momentum investors? Let's find out.

Looking for a Growth Stock? 3 Reasons Why M/A-Com (MTSI) is a Solid Choice

M/A-Com (MTSI) is well positioned to outperform the market, as it exhibits above-average growth in financials.

International Markets and M/A-Com (MTSI): A Deep Dive for Investors

Examine the evolution of M/A-Com's (MTSI) overseas revenue trends and their effects on Wall Street's forecasts and the stock's prospects.

MACOM Technology Solutions Holdings, Inc. (1MA) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has MACOM Technology Solutions Holdings, Inc. ever had a stock split?

MACOM Technology Solutions Holdings, Inc. Profile

| - Industry | - Sector | Stephen G. Daly CEO | XBER Exchange | US55405Y1001 ISIN |

| US Country | 1,700 Employees | - Last Dividend | - Last Split | 15 Mar 2012 IPO Date |

Overview

MACOM Technology Solutions Holdings, Inc., is a prominent manufacturer of analog semiconductor solutions, catering to a wide range of applications within the wireless and wireline sectors across various spectrums including radio frequency (RF), microwave, millimeter wave, and lightwave. The company operates on a global scale, with markets in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, among others. Founded in 1950 and based in Lowell, Massachusetts, MACOM is dedicated to offering both standard and custom semiconductor solutions, addressing the needs of diverse markets such as telecommunications, industrial and defense, and data centers. MACOM prides itself on its direct sales approach, supported by a skilled applications engineering staff, along with its global network of independent sales representatives, resellers, and distributors.

Products and Services

The company's product array spans a broad range of solutions designed to address the complex demands of its clientele, including:

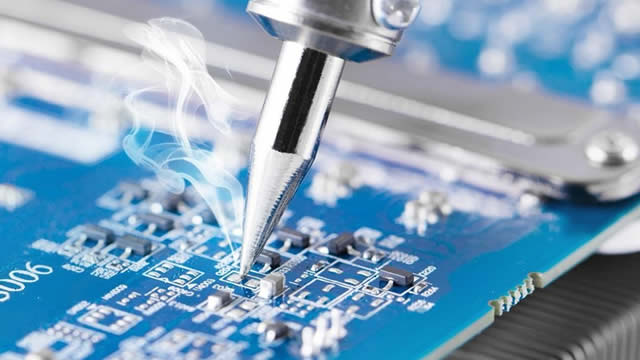

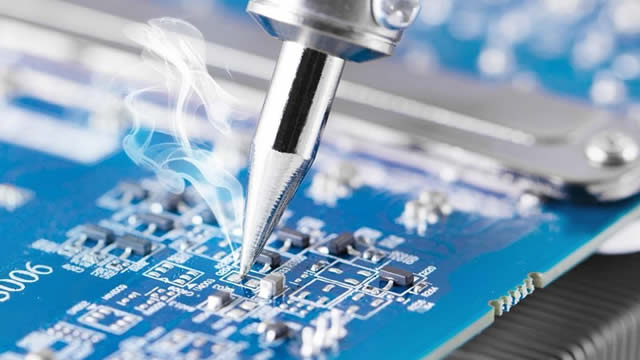

- Integrated Circuits: These are fundamental components for electronic systems, designed to perform a variety of functions in applications ranging from wireless base stations to high-capacity optical networks and medical systems.

- Multi-chip Modules: Comprising multiple integrated circuits, these modules are crafted for enhanced performance in complex electronic systems, such as radar and advanced communication networks.

- Diodes: Essential for directing current flow in electronic circuits, MACOM’s diodes find their utilization in a wide array of applications, from RF jammers to medical equipment.

- Amplifiers: Amplifiers from MACOM boost the signal strength necessary for communication systems, industrial machinery, and test and measurement equipment, ensuring reliability and efficiency across various applications.

- Switches and Switch Limiters: These components are crucial for controlling signal flow within electronic systems, finding applications in military and commercial radar systems, as well as in telecommunications infrastructure.

- Passive and Active Components: MACOM provides a comprehensive range of components that either do not require power to operate (passive) or do (active), catering to a diverse set of electronic system needs.

- Subsystems: These are complex assemblies that incorporate several components, designed to perform specific, comprehensive functions within electronic systems, such as in optical networking or data center infrastructure.

MACOM serves a variety of markets, including telecommunications with a focus on carrier infrastructure like long-haul/metro, 5G, and fiber-to-the-X/passive optical networks; industrial and defense sectors with applications in military and commercial radar, RF jammers, and electronic countermeasures; as well as multi-market sectors involving industrial, medical, test and measurement, and scientific applications. Through its extensive portfolio, MACOM ensures it meets the evolving needs of its customers, providing solutions that enhance the performance and reliability of electronic systems globally.