ASML Holding N.V. New York Registry Shares (ASML)

ASML (ASML) Ascends While Market Falls: Some Facts to Note

ASML (ASML) reached $1 at the closing of the latest trading day, reflecting a +1.1% change compared to its last close.

Is ASML About to Unleash a 50% AI Chip Output Explosion by 2030?

ASML Holding ( NASDAQ:ASML ) stands at the forefront of the artificial intelligence (AI) revolution.

Top Wide-Moat Stocks to Invest in for Long-term Growth

LRCX, NVDA, ASML and MCO use strong moats to fend off rivals and deliver consistent returns amid market shifts.

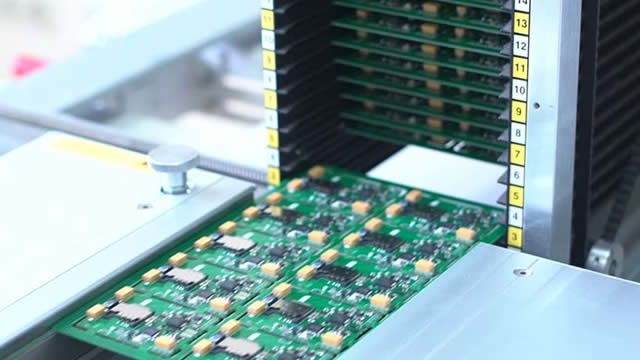

Exclusive: ASML unveils EUV light source advance that could yield 50% more chips by 2030

Researchers at ASML Holding say they have found a way to boost the power of the light source in a key chip making machine to turn out up to 50% more chips by decade's end, to help retain the Dutch company's edge over emerging U.S. and Chinese rivals.

ASML Holding N.V. (ASML) is Attracting Investor Attention: Here is What You Should Know

ASML (ASML) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

ASML: EUV Orders Explode, The Setup Into 2026-2028 Just Improved

ASML Holding N.V. delivered mixed Q4 results, but order momentum and AI-driven demand support a constructive outlook. Q4 bookings surged 86%, notably with a 150% increase in EUV bookings, signaling robust growth potential into 2027-2028. Guidance points to double-digit sales growth in 2026, with margin expansion driven by EUV and High NA shipments.

ASML Climbs 11% in a Month: Time to Buy, Sell or Hold the Stock?

ASML Holding jumps 11% in a month as AI-driven EUV demand, a EUR 38.8B backlog and rising 2026 estimates fuel bullish momentum despite valuation concerns.

Here is Why Growth Investors Should Buy ASML (ASML) Now

ASML (ASML) possesses solid growth attributes, which could help it handily outperform the market.

ASML (ASML) Recently Broke Out Above the 20-Day Moving Average

From a technical perspective, ASML (ASML) is looking like an interesting pick, as it just reached a key level of support. ASML recently overtook the 20-day moving average, and this suggests a short-term bullish trend.

Wall Street Bulls Look Optimistic About ASML (ASML): Should You Buy?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

ASML: Why I Remain Bullish On The Dutch Lithography Giant

ASML remains a buy as robust bookings and a massive backlog reinforce a strong long-term growth story despite soft FY2026 guidance. Despite FY 2026 growth deceleration and a higher forward P/E of 40.69, ASML's valuation is still below its multiyear peak, leaving room for multiple expansion. Q4 results showed net sales of €9.7B, 23% YoY USD EPS growth, and a sharp rise in bookings to €13.2B, signaling resilient demand.

ASML (ASML) is a Great Momentum Stock: Should You Buy?

Does ASML (ASML) have what it takes to be a top stock pick for momentum investors? Let's find out.