Enerpac Tool Group Corp. (EPAC)

Summary

Enerpac (EPAC) Q1 Earnings and Revenues Miss Estimates

Enerpac (EPAC) came out with quarterly earnings of $0.36 per share, missing the Zacks Consensus Estimate of $0.37 per share. This compares to earnings of $0.4 per share a year ago.

Enerpac Tool Group's Surge Isn't Proof You Should Pile In

Enerpac Tool Group Corp. delivered strong Q4 2025 results, beating analyst expectations on both revenue and earnings, and issued robust 2026 guidance. EPAC's growth is driven by acquisitions and solid demand in infrastructure, petrochemicals, and power generation, despite macroeconomic and regional headwinds. Management announced a new $200 million EPAC share buyback program, reflecting confidence but raising concerns about capital allocation given the stock's high valuation.

Enerpac Tool Group: This Dip Is Not Worth Buying

Enerpac Tool Group exceeded Q3 expectations, but management remains cautious due to market headwinds and tariff impacts, maintaining a conservative outlook for Q4. Despite solid revenue and adjusted earnings growth, margins contracted, and tariff expenses are set to rise significantly, pressuring future profitability. Enerpac shares appear fairly valued, if not slightly expensive, compared to peers, making the current dip less attractive as a buying opportunity.

Enerpac Tool Group Corp. (EPAC) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Enerpac Tool Group Corp. ever had a stock split?

Enerpac Tool Group Corp. Profile

| Machinery Industry | Industrials Sector | Paul E. Sternlieb CEO | NYSE Exchange | 292765104 CUSIP |

| US Country | 2,000 Employees | 7 Oct 2025 Last Dividend | 9 Nov 2007 Last Split | 24 Jul 2000 IPO Date |

Overview

Enerpac Tool Group Corp., originally founded in 1910 and headquartered in Menomonee Falls, Wisconsin, stands as a prolific provider of industrial products and solutions on a global scale, including in the United States, the United Kingdom, Germany, Australia, Canada, China, Saudi Arabia, Brazil, France, among other international markets. It caters to a wide range of industries through its Industrial Tools & Services and Other segments, underscoring its pivotal role in various key markets such as infrastructure, maintenance, oil and gas, mining, and renewable energy sectors. Initially known as Actuant Corporation, the company underwent a rebranding to Enerpac Tool Group Corp. in January 2020, signifying a focused pivot towards its core strengths in high-force tools and controlled force products and services.

Products and Services

Enerpac Tool Group Corp. delivers a comprehensive suite of products and services designed to meet the diverse needs of several vital industries:

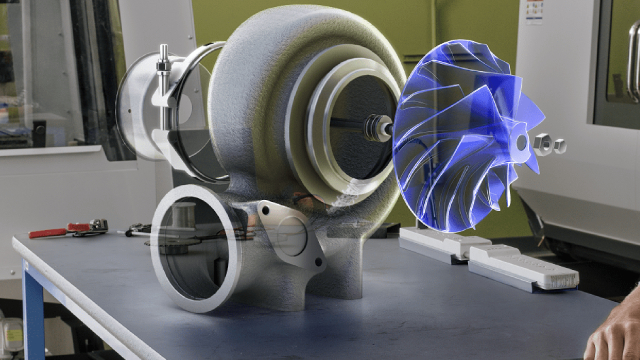

- Hydraulic and Mechanical Tools: This includes a vast range of cylinders, pumps, valves, and specialty tools designed for high-force applications. These tools are essential for infrastructure projects, maintenance activities, and operations requiring precise and powerful force application.

- Engineered Heavy Lifting Technology Solutions: The company excels in providing solutions designed for the safe and efficient lifting of heavy loads. This includes hydraulic gantries, modular units, and other custom-engineered lifting solutions tailored to meet specific project requirements.

- Hydraulic Torque Wrenches: Enerpac offers a selection of hydraulic torque wrenches for controlled bolting applications. This product line is critical for ensuring the safety and reliability of bolted joints in various industrial settings.

- Maintenance and Manpower Services: Beyond the manufacturing of tools, Enerpac provides dedicated services and tool rentals. These services are designed to support customers through maintenance intervals, emergency repairs, or when specialized equipment or manpower is needed.

- Bolt Tensioners and Miscellaneous Products: The company's range extends to bolt tensioners and various other tools tailored for specific tasks. These products enhance the company's ability to serve as a one-stop source for industrial tooling and solutions.

Marketed primarily under the Enerpac, Hydratight, Larzep, and Simplex brands, these products and services play a pivotal role in numerous markets, including oil and gas, mining, and renewable energy, to name a few. Additionally, the company's Other segment delivers innovation through the design and manufacture of synthetic ropes and biomedical textiles, underlining its diversification into adjacent markets.