Pinterest, Inc. Class A (PINS)

Pinterest (PINS) Declines More Than Market: Some Information for Investors

Pinterest (PINS) reached $25.99 at the closing of the latest trading day, reflecting a -3.31% change compared to its last close.

Pinterest Plans to Extend Reach to Connected TV with tvScientific Acquisition

Pinterest plans to extend its performance advertising capabilities to connected TV (CTV) by acquiring CTV performance advertising platform tvScientific.

Pinterest, Inc. (PINS) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Pinterest (PINS) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Pinterest Down 14.7% in a Year: Should You Avoid the Stock?

PINS faces falling ad prices, slowing regional growth and weaker estimates as macro and competitive pressures weigh on its outlook.

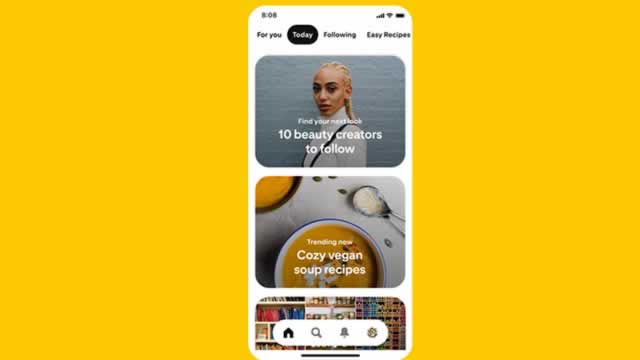

Pinterest and Walmart Plan to Make Recipes Shoppable

Pinterest and Walmart plan to pilot a shoppable recipe experience in the United States and will roll it out over the coming weeks.

Pinterest downgraded, price target lowered on emerging AI risks

Pinterest Inc (NYSE:PINS) has been downgraded by Wedbush analysts to a ‘Neutral' rating from ‘Outperform,' with the firm citing emerging risks from AI and mixed financial results. The analysts also lowered their 12-month price target to $30 from $34.

Meta Stock Vs. Pinterest: Which Internet Giant Offers The Better Bet?

Pinterest decreased by 17% over the last month. You might feel inclined to purchase more or consider decreasing your holdings.

Meta Vs Pinterest - Which Internet Stock To Bet On?

Pinterest decreased by 17% over the last month. You might feel inclined to purchase more or consider decreasing your holdings.

Pinterest (PINS) Up 6.5% Since Last Earnings Report: Can It Continue?

Pinterest (PINS) reported earnings 30 days ago. What's next for the stock?

Wall Street Bulls Look Optimistic About Pinterest (PINS): Should You Buy?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Pinterest, Inc. (PINS) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Pinterest (PINS) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Pinterest Post-Q3: Strong Growth Amid Ad-Spend Pressures - A GARP Opportunity

Pinterest shows steady user growth and mid-teens revenue expansion, outperforming peers during downturns, driven by intent-based engagement and high ROI ad conversions, particularly in performance and commerce campaigns. Emerging markets and Europe offer significant upside; AI enhancements, Gen Z adoption, and visual discovery can improve ARPU and monetization in underpenetrated regions. Free cash flow margins exceed 25%, reflecting asset-light operations and scalable growth; AI-driven ad targeting can boost efficiency without major cost increases.