Qualcomm Inc. (QCOM)

We are really focused on diversifying and growing, says Qualcomm CEO Cristiano Amon

Cristiano Amon, Qualcomm CEO, joins 'Closing Bell Overtime' to talk its investors day, growth targets, and more.

Qualcomm says it expects $4 billion in PC chip sales by 2029, as company gets traction beyond smartphones

Qualcomm said at its investor day on Tuesday that it expects its so-called internet of things business to more than quadruple in sales by 2029 to around $22 billion. CEO Cristiano Amon took over Qualcomm in 2021 with a promise to diversify the company away from a reliance on chips for smartphones.

Qualcomm expects $12 bln in revenue from autos, PC chips in five years

Qualcomm expects $8 billion in automotive chip revenue and $4 billion in PC chip sales by fiscal 2029, it said at an investor event held in New York on Tuesday.

Qualcomm: Is It Still A Good Buy With China Risks In 2025

Qualcomm remains a strong semiconductor investment, replacing Intel with a conservative IT play due to its high free cash flow, dividend growth, and significant share buybacks. Despite a recent dip, Qualcomm's Q4 earnings beat expectations with an EPS of $2.69 and revenue of $10.24B. Qualcomm's Magic Formula score of 30.9, though lower than 2023, still indicates strong returns on invested capital and earnings yield.

Why Qualcomm's Growth Looks Unstoppable

Qualcomm posted $10.2 billion in Q4 revenue (+18% YoY) with 35% YoY EPS growth. Record $899 million in automotive revenue (+68% YoY), driven by new vehicle content and AI platforms. IoT revenues grew 24% sequentially, powered by new product launches and normalized channel inventory.

Qualcomm: Why I'm Bullish On Both Fundamental And Technical Indicators

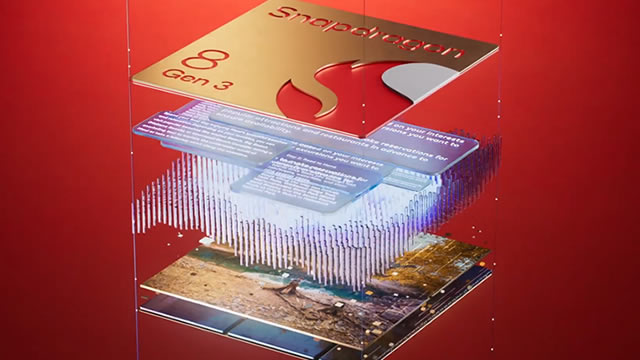

Despite strong 4Q FY2024 earnings, Qualcomm's stock fell below its pre-earnings release level due to a broader semi sector pullback and rising geopolitical risks under Trump's administration. 1Q FY2025 outlook indicates a strong growth momentum continues, driven by the Snapdragon 8 Series, topping all market consensuses. The company forecasts a "mid-single-digit growth" in QCT Handset revenue (60% of total revenue in 4Q), despite the absence of Huawei revenue in its 1Q FY2025 guidance.

The Artificial Intelligence (AI) Boom Isn't Over. 3 AI Stocks to Buy Right Now.

AI could become a multitrillion-dollar industry. There are still high-quality stocks with compelling risk-reward upside potential.

Prediction: This Artificial Intelligence (AI) Stock Will Crush the Market in 2025

The robust demand for generative AI smartphones could give this chipmaker a big boost in 2025.

Qualcomm Stock Analysis: Here's What Investors Should Know

Qualcomm Stock Analysis: Here's What Investors Should Know

Want $1 Million In Retirement? Invest $100,000 in These 3 Stocks and Wait a Decade

Indicators point to considerable gains for these three tech names.

Qualcomm (QCOM) is a Top-Ranked Value Stock: Should You Buy?

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.