QuantumScape Corporation (QS)

Should You Buy QuantumScape While It's Below $7.50?

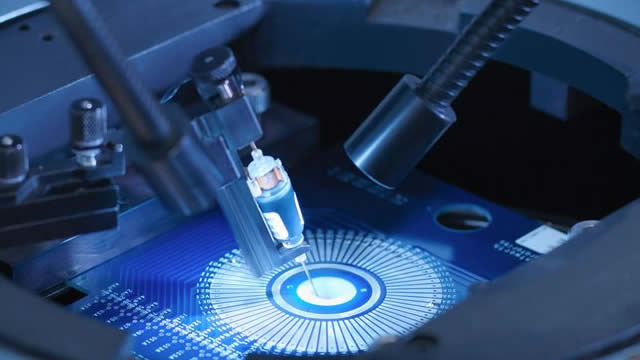

Electric vehicles (EVs) aim to transform transportation. However, like any groundbreaking technology, EV batteries have hurdles to overcome before EVs become widely adopted.

QuantumScape: High-Risk, High-Reward Solid-State Battery Play?

QuantumScape NYSE: QS is a developer of solid-state battery technology, and the company has experienced a significant share price decline of 27.05% year-to-date. This downturn raises questions about the company's future, creating a compelling opportunity for investors to assess whether QuantumScape is a hidden gem or a risky gamble.

Why QuantumScape Stock Jumped Higher Today

Why QuantumScape Stock Jumped Higher Today

How QuantumScape Is Quietly Setting Itself Up to Be a Huge Winning Stock

Huge progress toward commercialization and a big partner to help fund manufacturing.

Why QuantumScape, SolarEdge, and Sunnova Energy Plunged Today

Uncertainty around clean energy incentives and rising interest rates punished these clean energy leaders.

Why Shares of QuantumScape, First Solar, and ChargePoint Plunged in October

Why Shares of QuantumScape, First Solar, and ChargePoint Plunged in October

Why QuantumScape Stock Tumbled This Week

An updated presentation from QuantumScape brought investors back down to earth this week.

A Little Good News for QuantumScape Investors

Investors have good news from a company that's trying to do what hasn't been done before.

QuantumScape: Another Step Closer To Production

I reiterate my buy rating for QS due to significant progress in R&D and manufacturing, bringing them closer to revenue generation in FY25. QS met all FY24 goals, including shipping Alpha-2 prototypes, ramping up Raptor manufacturing, and starting B-sample production, showcasing strong execution. The balance sheet remains solid with $841 million in cash, providing a 2+ year runway, ensuring financial stability during the R&D phase.

Is QuantumScape a Millionaire Maker?

Investors must weigh QuantumScape's massive potential against its chances of realizing that potential.

QuantumScape: Solid State EV Batteries Nearing Commercialization

QuantumScape Co. NYSE: QS is a battery technology company that has been developing its next-generation solid-state lithium-metal electric vehicle (EV) battery for nearly 15 years. The auto/tires/trucks sector company is in its final stages before commercialization commences in 2025, when they start shipping their commercial batteries to start generating revenue.

Massive News for QuantumScape Stock Investors

The innovative battery technology company is making excellent progress.