SoftBank Group Corp. (SFTBY)

Summary

The Convoluted History Between Billionaire Behind SoCal Rail And Trump

SOUTHERN CALIFORNIA — Construction continues on a $12 billion high-speed rail project that will transport passengers between the Inland Empire and Las Vegas. The Trump administration gave the work a thumbs up at the same time it announced an investigation into California's controversial high-speed rail project between Los Angeles and San Francisco. One major difference: the billionaire behind the Las Vegas high-speed rail project co-founded the investment firm that loaned Donald Trump $130 million to help build Trump International Hotel and Tower, Chicago, and then forgave the loan. The Las Vegas to IE rail project, named Brightline West, has been embraced from the start. During an April 22 groundbreaking ceremony with a large gathering of VIPs in Nevada, then President Joe Biden's U.S. Secretary of Transportation Pete Buttigieg praised the project. "People have been dreaming of high-speed rail in the U.S. for decades. Thanks to the President’s leadership and that of members of Congress like those here, as well as our state partners in Nevada and California, the men and women of organized labor, and the terrific work of Brightline West, it’s happening," Buttigieg said. "So, on behalf of the Biden Administration, it is my great honor to help break ground on what will be the first high-speed rail in American history," Buttigieg continued. "It's really happening this time." In total, the Brightline West project will see 218 miles of new track laid between a to-be-constructed terminal just south of the Las Vegas Strip and another new facility in Rancho Cucamonga. With its trains traveling up to 200 mph, Brightline West is slated to be in service in time for the 2028 Olympics in Los Angeles. In addition to the Rancho Cucamonga station, two other Inland Empire stations are planned along the Brightline West route: Hesperia and the Victorville area. Additionally, Rancho Cucamonga offers connections to existing Metrolink routes. The project's current construction work includes geotechnical borings and sampling, utility potholing, and land surveying in San Bernardino County. The project has received billions in federal funding, and unlike the fate of another California high-speed rail project, there are no signs of trouble brewing with the administration of U.S. President Donald Trump. On Thursday, current U.S. Secretary of Transportation Sean P. Duffy announced that the Federal Railroad Administration has launched a review of the California High-Speed Rail Authority and its proposed bullet train project. If completed, the long-promised and costly endeavor would shuttle riders between San Francisco and Los Angeles. Trump appears to be done with it, as are many Californians. "For too long, taxpayers have subsidized the massively over-budget and delayed California High-Speed Rail project," Duffy said last week. "President Trump is right that this project is in dire need of an investigation. That is why I am directing my staff to review and determine whether the CHSRA has followed through on the commitments it made to receive billions of dollars in federal funding. If not, I will have to consider whether that money could be given to deserving infrastructure projects elsewhere in the United States." Conversely, the Brightline West project received approval from Duffy. It was the only other infrastructure project named in the secretary's remarks. "The slow progress by CHSRA contrasts with the impressive work of Brightline West to build a high-speed rail system," Duffy said. Besides taxpayer dollars, Brightline West has big money behind it. Wes Edens founded the Brightline company. The venture currently operates a rail system in Florida, with dozens of passenger trains running between Miami and Orlando. In addition to being a private equity investor and co-owner of the Milwaukee Bucks NBA team, Edens is co-founder of New York City-based Fortress Investment Group. The billionaire businessman also has complex financial ties to Trump. Fortress was spotlighted after New York Attorney General Letitia James launched an investigation in 2019 into Trump’s finances. Court documents revealed the president received a multi-million-dollar loan during the aughts from Fortress for his Trump International Hotel and Tower, Chicago, project. Fortress issued the Trump Organization a $130 million loan for the project, but Trump did not repay the bulk of the loan, according to the complaint filed by James in 2020. Trump subsequently defaulted on the loan and sued Fortress, according to a 2020 New York Times report. Fortress forgave more than $100 million in debt owed by the Trump Organization, court documents show. The A.G.'s office wanted to know if Trump documented the loan forgiveness as income, as required by the Internal Revenue Service, and paid taxes on the money. It was part of a much broader investigation into Trump's business dealings that ultimately led to a Feb. 16, 2024, court ruling against Trump and his company. In total, the defendants were ordered to pay more than $450 million. Neither Edens nor Fortress were accused of any wrongdoing. In addition to loaning Trump's company money, Fortress reportedly made at least one multi-million-dollar loan to the president's son-in-law, Jared Kushner.

SoftBank Group downgraded to Hold from Buy at Jefferies

Jefferies downgraded SoftBank Group to Hold from Buy with a price target of $32.20, up from $31.50. SoftBank's $100B-$200B U.S. investment pledge over four years raises concerns about funding sources and impact on its stock, the analyst tells investors in a research note. The firm says the spending may hinder SoftBank's ability to conduct share buybacks, widening the gap between its stock price and net asset value. Jefferies does not see investors "lining up to invest in another vision fund" alongside SoftBank.

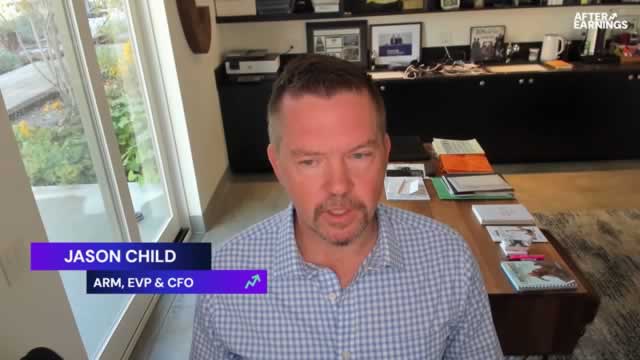

Arm: SoftBank Ownership, Licensing Growth, and Global Reach with CFO Jason Child

In this episode of After Earnings, Arm CFO Jason Child joined to talk about the company's growth since its IPO, its relationship with SoftBank, and its approach to AI. He shared insights on Arm's engineering culture, key partnerships with tech giants like Google and Microsoft, and how going public has impacted recruitment. Jason also discussed Arm's strategies in mergers and acquisitions, as well as managing investor relations.

SoftBank Group Corp. (SFTBY) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has SoftBank Group Corp. ever had a stock split?

SoftBank Group Corp. Profile

| Diversified Telecommunication Services Industry | Communication Services Sector | Masayoshi Son CEO | OTC PINK Exchange | 83404D109 CUSIP |

| JP Country | 65,352 Employees | 30 Sep 2025 Last Dividend | 8 Jan 2026 Last Split | - IPO Date |

Overview

SoftBank Group Corp., originally known as SoftBank Corp. until its rebranding in July 2015, is a telecommunications titan with a global footprint extending beyond Japan where it is headquartered. Its operations are diversified across various segments including the Investment Business of Holding Companies, SoftBank Vision Funds, SoftBank, Arm, and others. The company's foundational services span mobile communications and solutions targeted at enterprise customers, alongside broadband solutions for retail consumers. Further expanding its business scope, SoftBank is also deeply integrated into internet services, ranging from advertising to e-commerce, financial services, and even into the realms of entertainment and renewable energy.

Products and Services

The array of products and services offered by SoftBank Group Corp. is extensive, covering both traditional telecommunication services and innovative technology solutions across various sectors.

- Mobile Communications and Solutions: Provision of mobile services and solutions primarily directed towards enterprise customers, facilitating their mobile communication needs.

- Broadband Services: Offering high-speed internet services to retail customers, ensuring reliable broadband connectivity.

- Mobile Devices and Software Tools: Sale of mobile devices coupled with an array of software tools and related services, catering to both individual and enterprise needs.

- Internet Advertising and E-commerce Services: Engaging in the digital marketplace through internet advertising services and the operation of e-commerce platforms.

- Payment and Financial Services: Delivering financial solutions including payment services, addressing the financial transaction needs of users.

- ICT Services Products: Offering a range of Information and Communication Technology (ICT) products to enterprise customers, aiding their operational efficiencies.

- Communication Device-Related Products and IoT Equipment: Distribution of a variety of communication devices and IoT (Internet of Things) equipment to retail customers, enhancing their connectivity and smart device usage.

- Microprocessor Intellectual Property and Technology Design: SoftBank is involved in the design and intellectual property aspects of microprocessors, contributing to advancements in technology infrastructure.

- Alternative Investment Management: Managing alternative investment ventures, diversifying its investment portfolio across different assets and industries.

- Professional Baseball Team Ownership and Management: SoftBank’s unique portfolio includes the ownership and operational management of a professional baseball team, showcasing its diversification into sports entertainment.

- Renewable Energy Generation and Supply: Commitment to sustainability through the generation of electricity from renewable sources and its subsequent supply and sale, marking SoftBank’s foray into the energy sector.