Robinhood Markets, Inc. (HOOD)

1 Jim Cramer Stock To Buy In July

Key Points Cramer has identified one fintech stock that is on an impressive rally.

Robinhood Markets, Inc. (HOOD) Falls More Steeply Than Broader Market: What Investors Need to Know

In the latest trading session, Robinhood Markets, Inc. (HOOD) closed at $91.27, marking a -2.34% move from the previous day.

Robinhood Tokenized Stocks Face Scrutiny From Lithuania Central Bank

HOOD's new tokenized stock products draw scrutiny from Lithuania's central bank, raising EU compliance questions.

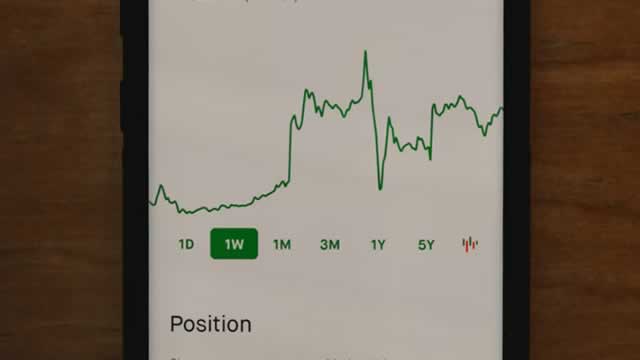

Why Robinhood Stock Was Scorching Hot Last Month

June is a sluggish month for some, but it sure was active for next-generation brokerage Robinhood Markets (HOOD -3.60%). The company launched a set of new features on its platform, closed an acquisition, and published monthly operating metrics that pleased the market.

What Are These OpenAI and SpaceX Stock Tokens Robinhood Is Giving Away?

Robinhood Markets earlier this week said it would offer European users the option to trade “stock tokens,” and that it would give away $5 worth of “tokenized” stock in two major private companies, OpenAI and SpaceX, to eligible investors.

Robinhood missed the S&P 500 again. But Trump's megabill may be more important for the stock.

President Donald Trump's megabill could have a big impact on financial-services platform Robinhood Markets.

What you need to know about stablecoins and stock tokens as Robinhood and Circle pop

Also: A look ahead as the S&P 500 returns to setting record highs; how to decide on a Roth IRA conversion; and more pointed advice from the Moneyist.

OpenAI rejects Robinhood's tokenised equity claims

OpenAI has distanced itself from Robinhood Markets Inc (NASDAQ:HOOD) recent launch of so-called “OpenAI tokens”, clarifying that the sale does not equate to holding real equity in the company. In a post on X, OpenAI stated it had no involvement in the token sale and did not approve any transfer of its shares, warning consumers to “be careful.

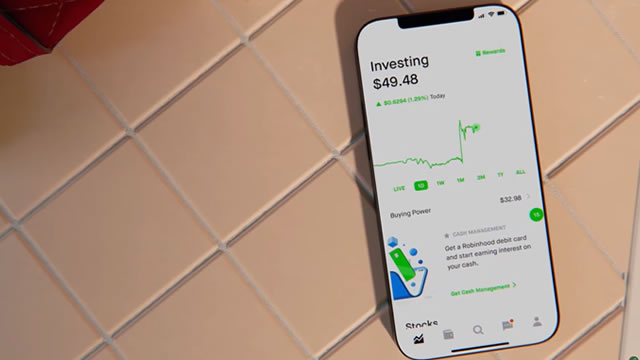

HOOY: When Covered Calls Meet Robinhood's Volatility

The YieldMax HOOD Option Income Strategy ETF offers a covered call strategy on HOOD, providing income but capping upside and exposing investors to capital erosion in volatile markets. High yields from HOOY are often a return of capital, not true income, and can be misleading if HOOD's price doesn't continue to appreciate. HOOY is best suited for high-risk investors seeking tactical exposure to HOOD with some downside cushion, but not for those seeking long-term capital growth.

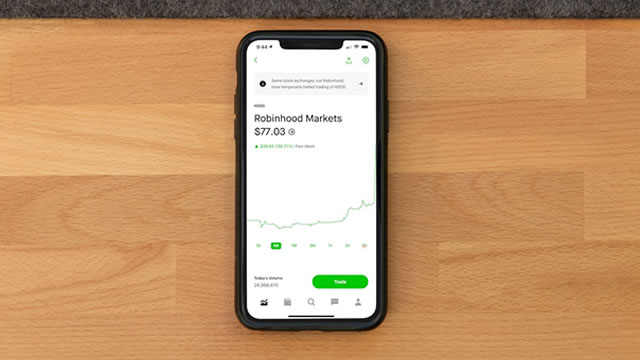

OpenAI says Robinhood's tokens aren't equity in the company

OpenAI said it did not partner with Robinhood on the tokens and emphasized no equity transfer was approved. Robinhood unveiled the tokens at a Cannes product event, sending its stock to a new all-time high.

Why Robinhood Markets (HOOD) Could Beat Earnings Estimates Again

Robinhood Markets (HOOD) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Robinhood's On-Chain Revolution

Robinhood Markets is making bold moves in tokenization, stablecoins, and fintech, positioning itself as a future leader in digital finance. New initiatives like tokenized stocks in Europe, expanded crypto products, and its own L2 blockchain could supercharge revenue growth. Significant growth opportunities exist in underserved European markets, prediction markets, and the evolving stablecoin ecosystem via the Kraken partnership.