Lam Research Corporation (0JT5)

Summary

0JT5 Chart

Similar

Why Lam Research (LRCX) Dipped More Than Broader Market Today

Lam Research (LRCX) closed at $160.52 in the latest trading session, marking a -4.85% move from the prior day.

Lam Research Corporation (LRCX) Soars to 52-Week High, Time to Cash Out?

Lam Research (LRCX) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Here's Why Lam Research (LRCX) is a Great Momentum Stock to Buy

Does Lam Research (LRCX) have what it takes to be a top stock pick for momentum investors? Let's find out.

Lam Research Corporation (0JT5) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Lam Research Corporation ever had a stock split?

Lam Research Corporation Profile

| Semiconductors & Semiconductor Equipment Industry | Information Technology Sector | Timothy M. Archer CEO | LSE Exchange | US5128073062 ISIN |

| US Country | 18,600 Employees | 3 Dec 2025 Last Dividend | 3 Oct 2024 Last Split | 11 May 1984 IPO Date |

Overview

Lam Research Corporation, established in 1980 and based in Fremont, California, operates as a key player in the semiconductor industry, focusing on the design, manufacture, marketing, refurbishment, and servicing of semiconductor processing equipment essential for the fabrication of integrated circuits. With a global footprint, the company caters to the semiconductor industry's needs across the United States, China, Europe, Japan, Korea, Southeast Asia, Taiwan, and other international markets. The extensive range of products offered by Lam Research meets various critical processes involved in semiconductor manufacturing, emphasizing innovation and precision in creating technologies that shape the future of electronics.

Products and Services

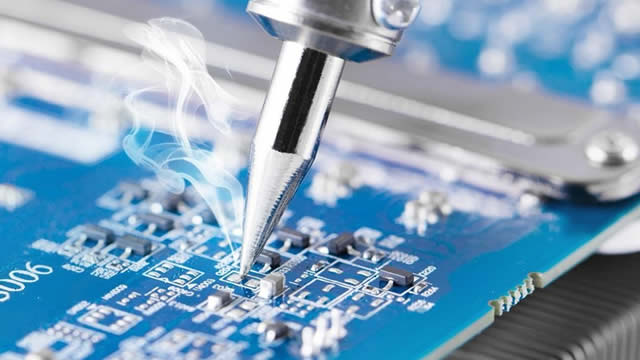

Lam Research provides a comprehensive portfolio of products and services designed to address the intricate and evolving needs of semiconductor fabrication. Each product line is tailored for specific semiconductor processing applications, ensuring high-quality and efficiency in chip production.

- ALTUS Systems: Designed for tungsten metallization applications, ALTUS systems are instrumental in depositing conformal films, crucial for creating the pathways that connect different regions of a semiconductor device.

- SABRE Electrochemical Deposition Products: Cater to the transition to copper interconnects by offering manufacturing solutions for copper damascene, an essential process in modern semiconductor device fabrication.

- SOLA Ultraviolet Thermal Processing Products: Serve for film treatments with ultraviolet thermal processing technology, enhancing the film characteristics crucial for the semiconductor manufacturing process.

- VECTOR Plasma-enhanced CVD ALD Products: Utilize plasma-enhanced chemical vapor deposition and atomic layer deposition for a variety of applications, ensuring high-quality dielectric and conductive films.

- SPEED Gapfill High-density Plasma Chemical Vapor Deposition Products: Specialize in filling high-density structures with insulating material, a key step in ensuring the reliability and functionality of semiconductor devices.

- Striker Single-wafer Atomic Layer Deposition Products: Provide solutions for dielectric film deposition, essential in creating the insulating layers between metal connections within a chip.

- Flex for Dielectric Etch Applications: Tailored for shaping dielectric materials, Flex products support the etching process necessary for creating structures within semiconductor devices.

- Kiyo for Conductor Etch Applications: Focus on etching conductive materials, which is vital for shaping the metallic components of semiconductor circuits.

- Syndion for Through-silicon Via Etch Applications: Address the needs of creating through-silicon vias, enabling three-dimensional integration of semiconductor devices for enhanced performance and miniaturization.

- Versys Metal Products: Specialized in metal etching processes, these products are essential in the fabrication of intricate metallic structures within semiconductor devices.

- Coronus Bevel Clean Products: Enhance die yield through the cleaning of the bevel edge of wafers, an essential step in ensuring the quality and reliability of semiconductor devices.

- Da Vinci, DV-Prime, EOS, and SP Series Products: Address a wide range of wafer cleaning applications, critical for maintaining the purity and integrity of semiconductor substrates throughout the manufacturing process.

- Metryx Mass Metrology Systems: Offer high-precision in-line mass measurements, providing critical data for controlling and optimizing semiconductor wafer manufacturing processes.