Broadwind Inc. (9IRA)

Summary

9IRA Chart

Wall Street Analysts Look Bullish on Broadwind Energy (BWEN): Should You Buy?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Broadwind, Inc. (BWEN) Q3 2025 Earnings Call Transcript

Broadwind, Inc. ( BWEN ) Q3 2025 Earnings Call November 13, 2025 11:00 AM EST Company Participants Thomas Ciccone - VP & CFO Eric Blashford - CEO, President & Director Conference Call Participants Amit Dayal - H.C. Wainwright & Co, LLC, Research Division Sameer Joshi - H.C.

Is It Worth Investing in Broadwind Energy (BWEN) Based on Wall Street's Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Broadwind Inc. (9IRA) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Broadwind Inc. ever had a stock split?

Broadwind Inc. Profile

| Machinery Industry | Industrials Sector | Eric B. Blashford CEO | XSTU Exchange | US11161T2078 ISIN |

| US Country | 411 Employees | - Last Dividend | 23 Aug 2012 Last Split | 29 Mar 2004 IPO Date |

Overview

Broadwind, Inc. stands out as a pivotal manufacturer and seller of structures, equipment, and components focused on clean technology and other specialized applications, primarily servicing the United States. The company's operations are spread across three main segments: Heavy Fabrications, Gearing, and Industrial Solutions, catering to a diverse range of industrial markets. Originally known as Broadwind Energy, Inc., the company underwent a name change to Broadwind, Inc. in May 2020, marking a significant milestone in its evolution. With its headquarters located in Cicero, Illinois, Broadwind, Inc. is dedicated to delivering innovative solutions to the energy, mining, and infrastructure sectors through a combination of direct sales efforts and partnerships with independent sales agents.

Products and Services

- Heavy Fabrications - This segment offers an array of fabrications catering to various industrial markets, including the provision of steel towers and adapters primarily for wind turbine manufacturers. The focus lies on supplying essential components that support the generation of renewable energy.

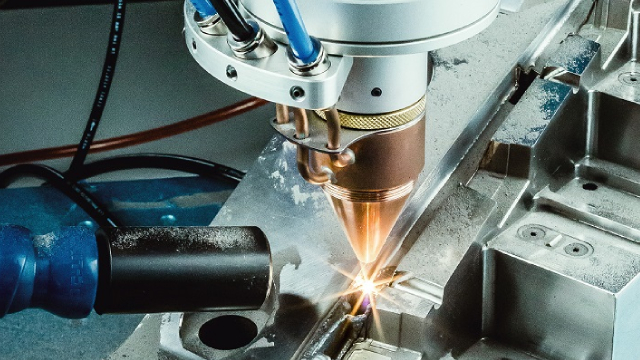

- Gearing - Specializing in the production of gearing, gearboxes, and precision machined components, this segment serves a diverse portfolio of customers across multiple markets such as surface and underground mining, wind energy, steel, material handling, infrastructure, onshore and offshore oil and gas fracking and drilling, and marine among others. This broad applicability highlights Broadwind's capacity to deliver complex mechanical solutions. Furthermore, it offers heat treat services catering to aftermarket and original equipment manufacturer (OEM) applications, ensuring longevity and reliability in its products.

- Industrial Solutions - Providing comprehensive supply chain solutions, this segment caters to a wide array of needs including instrumentation and controls, valve assemblies, sensor devices, fuel system components, electrical junction boxes and wiring, energy storage services, and electromechanical devices. Additionally, it provides light fabrication, inventory management, kitting and assembly services, and packaging solutions, particularly targeting the combined cycle natural gas turbine market. This varied suite of services underscores Broadwind’s role in enhancing operational efficiency and product reliability for its clients.