Aalberts N.V. (AALBF)

Summary

AALBF Chart

Aalberts N.V. (AALBF) Q2 2025 Earnings Call Transcript

Aalberts N.V. (OTCPK:AALBF) Q2 2025 Earnings Conference Call July 24, 2025 3:00 AM ET Company Participants Frans den Houter - Corporate Participant Rutger Relker - Director Investor Relations Stephane Simonetta - CEO & Member of the Management Board Conference Call Participants Chase Coughlan - Unidentified Company Christoph Greulich - Joh.

Aalberts: The Company Became Better And Cheaper

Aalberts is a resilient, undervalued compounder with strong brands, benefiting from megatrends like energy efficiency, semiconductors, and reshoring. Despite recent revenue softness, Aalberts is executing cost-saving measures, portfolio optimization, and targeting growth in the U.S. AALBF maintains a solid dividend policy, strong free cash flow, and has initiated a buyback program, highlighting commitment to shareholder returns.

Aalberts N.V. (AALBF) Q4 2024 Earnings Call Transcript

Aalberts N.V. (OTCPK:AALBF) Q4 2024 Earnings Conference Call February 27, 2025 3:00 AM ET Company Participants Rutger Relker - Director, Investor Relations Stephane Simonetta - Chief Executive Officer Arno Monincx - Chief Financial Officer Conference Call Participants David Kerstens - Jefferies Martijn den Drijver - ABN AMRO Alex Virgo - Bank of America Chase Coughlan - Van Lanschot Kempen Ruben Devos - Kepler Cheuvreux Rutger Relker Good morning, ladies and gentlemen.

Aalberts N.V. (AALBF) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Aalberts N.V. ever had a stock split?

Aalberts N.V. Profile

| Machinery Industry | Industrials Sector | Mr. Stephane Simonetta CEO | OTC PINK Exchange | NL0000852564 ISIN |

| NL Country | 13,124 Employees | 15 Apr 2025 Last Dividend | - Last Split | - IPO Date |

Overview

Aalberts N.V. specializes in delivering critical technologies for multiple key sectors, including aerospace, automotive, building, and maritime. With a history stretching back to 1975, the company has established itself through a combination of strategic growth and technological innovation, evolving to meet the needs of a diverse range of industries. Initially known as Aalberts Industries N.V., it underwent a rebranding to Aalberts N.V. in April 2019, reflecting perhaps a refined focus or expansion of its mission. Its operations are global, extending across Western Europe, the United States, Russia, Eastern Europe, the Asia-Pacific, the Middle East, and Africa, with its headquarters situated in Utrecht, the Netherlands. The organization's structure encompasses two primary sectors: Building Technology and Industrial Technology, each dedicated to addressing specific challenges within their domains with sustainable and efficient solutions.

Products and Services

-

Building Technology Segment:

This segment is focused on enhancing energy efficiency through hydronic flow control systems used in heating and cooling applications. Aalberts N.V. innovates in the creation, manufacturing, and monitoring of these systems, contributing to the development of eco-friendly buildings. It also boasts expertise in the development, design, and manufacturing of integrated piping systems. These systems are essential for distributing and regulating water or gas flows within a variety of settings, including heating, cooling, water, gas, and sprinkler systems in environmentally conscious buildings and specific industrial niches.

-

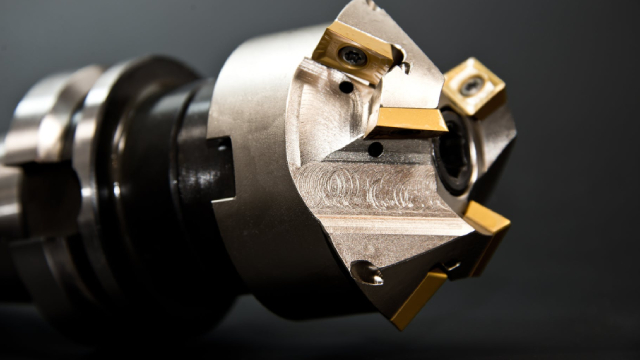

Industrial Technology Segment:

Aalberts N.V. plays a pivotal role in the co-development, engineering, and manufacturing of advanced mechatronics and technologies aimed at regulating, measuring, and controlling fluids under extreme and critical conditions. This segment primarily serves active OEMs in areas such as semiconductor efficiency, sustainable transportation, and various industrial niches. Additionally, Aalberts N.V. offers a spectrum of surface technologies tailored to the needs of customers involved in sustainable transportation and industrial niches, leveraging a vast network of service locations and local expertise to deliver these services effectively.