Airbnb, Inc. (ABNB)

Stock Of The Day: Will Airbnb Make A Rapid Reversal?

Airbnb, Inc. ABNB shares are staging a small rebound Monday. This comes following Friday's sell-off of almost 5%.

Into 2025: Top 8 Stocks I Own And Why (Part I)

The S&P 500 hit record highs 55 times so far in 2024, driven by AI enthusiasm, a resilient economy, and interest rate reduction hopes. There are pockets of extreme valuations; however, there are still excellent stocks to own. Here are four of my top holdings heading into 2025.

3 Facts About Airbnb You Must Know Before Buying the Stock

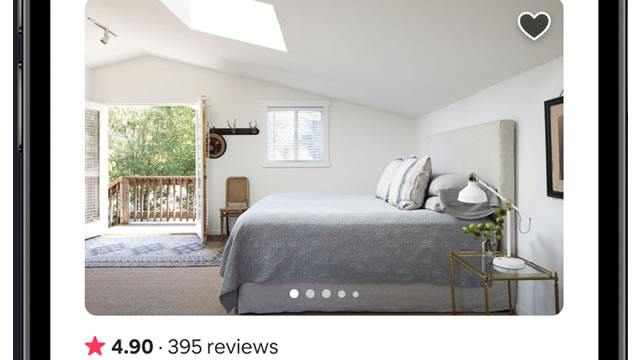

There aren't many businesses that have disrupted entire categories to the point that their name has become a verb. But that is precisely what Airbnb (ABNB -4.74%) has accomplished.

Airbnb Falls 7% in 6 Months: How Should You Approach the Stock?

ABNB capitalizes on strong growth in Nights and Experiences Booked but faces challenges from macroeconomic uncertainties and rising competition.

My Top 10 Stocks to Buy in 2024 Are Beating the Market by 48%. Should You Buy Them for 2025?

In Jan. 2023, I wrote about my 10 top stocks to buy for the new year. I ended up pretty proud of my list because if you'd invested $1,000 in each of the 10 stocks the day the article was published, you'd have ended 2023 with $13,301, including dividends.

1 Monster Stock to Hold for the Next 5 Years

Wall Street and Main Street are abuzz with talk of artificial intelligence (AI). Companies are rapidly integrating AI tools, such as Microsoft's Copilot and Salesforce's Einstein AI.

Investors Heavily Search Airbnb, Inc. (ABNB): Here is What You Need to Know

Zacks.com users have recently been watching Airbnb (ABNB) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

A Growth Stock With a Hidden Cash Machine

Shares of Airbnb (ABNB -0.89%) have struggled lately, but the business is still growing and management is expanding into new markets. In this video, Travis Hoium highlights the strategy, growth prospects, and risks behind Airbnb's business.

Is Buying Airbnb Stock Below $135 a Smart Idea?

Airbnb (ABNB 3.06%) has become so popular that the company's name is often used as a verb when people are looking to travel and book their accommodations. Shares have recently been a disappointment, though, as they are down 2% year to date, as of this writing.

1 Brilliant Growth Stock to Buy Now and Hold for the Long Term

The stock market indexes recently made new all-time highs. A resilient economy, interest rates that should trend down, enthusiasm for an expected corporate-friendly incoming administration, enthusiasm for artificial intelligence (AI), and high-flying tech stocks like Nvidia and Microsoft all play a role in this bull market.

How to Profit From Airbnb's "Stuck" Share Price

Airbnb (ABNB) is sitting in a wide range into its next earnings cycle in February and it seems reasonable that the price action might stay in that range.

3 Stocks That Could Turn $1,000 into $5,000 by 2030

These three stocks are reporting rapid growth and have the potential to multiply your portfolio's value.