Aecom (ACM)

Aecom Technology (ACM) Beats Q2 Earnings Estimates

Aecom Technology (ACM) came out with quarterly earnings of $1.25 per share, beating the Zacks Consensus Estimate of $1.15 per share. This compares to earnings of $1.04 per share a year ago.

AECOM: Secular Trends, Digital Transformation And Margin Expansion Ahead

AECOM is a leading global infrastructure consulting firm poised to benefit from a multi-decade infrastructure boom and sustainability trends, making it a strong buy. The company's asset-light, high-margin services, and unique digital edge, including AI integration, are expected to drive significant efficiency gains and margin expansion. AECOM's strong growth and profitability prospects are supported by consistent backlog growth, increasing margins, and a focus on high-value services.

AECOM Secures Major Infrastructure Contracts in Hong Kong With JV

ACM strengthens its presence in Hong Kong with key infrastructure contracts to drive regional development.

AECOM Wins Design Role in Sydney Water Infrastructure Plan

ACM to deliver design services for Sydney Water program, strengthening its long-standing partnership.

AECOM Secures Key Contract to Boost Hong Kong Development

AECOM's latest win cements its role in Hong Kong's expansion.

Why Aecom Technology (ACM) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

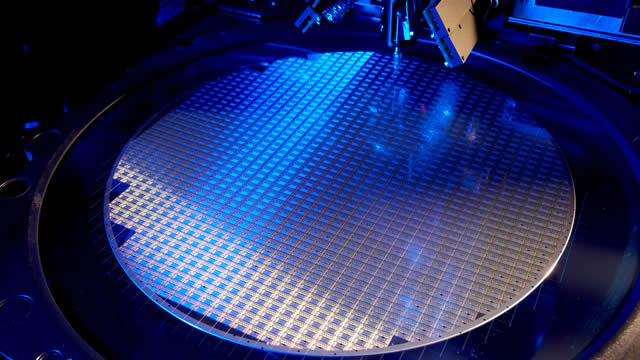

How This Chip Gear Player Is Cleaning Up In China On A 94% Tear This Year

ACM Research is cleaning up in the market for semiconductor wafer cleaning systems in China. And ACM stock is on a tear.

ACM Research Grows Revenue While Navigating Headwinds

Semiconductor industry supplier ACM Research, Inc. (ACMR) draws Big Money interest.

ACM Research Gains 13% in a Month: Should You Buy the Stock?

ACMR is gaining momentum with a growing portfolio, continuous product innovation and a rich customer base, positioning itself for long-term success.

ACM Research And SSR Mining Are Unstoppable Russell 2000 Growth Stocks to Buy in March

Persistently high interest rates continue to slam small-caps harder than the big dogs.

Should You Buy, Hold or Sell ACM Research Stock Before Q4 Earnings?

ACM Research's fourth-quarter results are likely to reflect benefits from an expanding portfolio despite risks from competition and U.S. export limits.

Here's Why Aecom Technology (ACM) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.