Andritz AG (ADRZY)

Summary

Andritz (ADRZY) Upgraded to Buy: Here's What You Should Know

Andritz (ADRZY) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

Are Industrial Products Stocks Lagging Andritz (ADRZY) This Year?

Here is how Andritz (ADRZY) and Intellicheck Mobilisa, Inc. (IDN) have performed compared to their sector so far this year.

Should Value Investors Buy Andritz (ADRZY) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Andritz AG (ADRZY) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Andritz AG ever had a stock split?

Andritz AG Profile

| Consumer Staples Distribution & Retail Industry | Consumer Staples Sector | Dr. Joachim Schönbeck CEO | OTC PINK Exchange | 034522102 CUSIP |

| AT Country | 30,221 Employees | 1 Apr 2025 Last Dividend | 2 May 2012 Last Split | - IPO Date |

Overview

Andritz AG is a prominent global supplier specializing in the delivery of comprehensive plant, equipment, and service solutions across a wide range of industries, including pulp and paper, metalworking and steel, hydropower, and solid/liquid separation for municipal and industrial applications. With a history dating back to 1852, the company has established itself as a key player in its field, actively operating across Europe, North America, South America, China, Asia, and other international markets. The firm is structured into four main segments: Pulp & Paper, Metals, Hydro, and Separation, each dedicated to serving the specific needs of its customers with cutting-edge technology, automation, and bespoke service solutions. Headquartered in Graz, Austria, Andritz AG has built a reputation for its innovative and reliable solutions in various sectors of the global economy.

Products and Services

Andritz AG's offerings are diverse and cater to multiple sectors, outlined across its four main operational segments:

- Pulp & Paper:

This segment focuses on providing a broad spectrum of technology, automation, and service solutions tailored for the production of pulp, paper, board, and tissue. Furthermore, it offers boilers for power generation, flue gas cleaning systems, nonwovens technologies, panelboard production systems, and innovative recycling, shredding, and energy solutions for handling various waste materials.

- Metals:

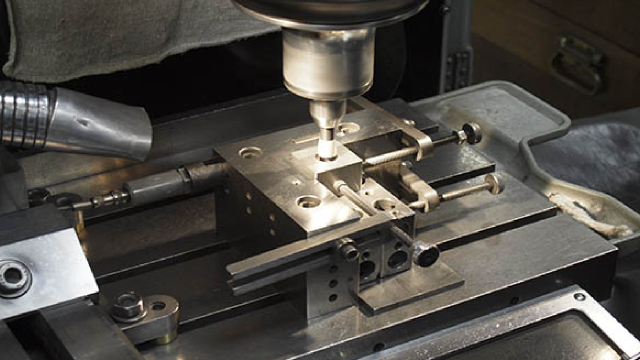

Serving the metalworking and steel industries, this segment delivers technologies, plants, digital solutions (including automation and software solutions), and extensive process know-how and services. It also includes solutions for the production and processing of flat products, welding systems, industrial furnaces, and a comprehensive range of services for the metals processing sector.

- Hydro:

In the realm of clean and renewable energy sources, the Hydro segment offers electromechanical equipment and services for hydropower plants. This includes providing diagnostics, refurbishment, modernization, and upgrading services for existing hydropower facilities, as well as supplying pumps for irrigation, water supply, and flood control and turbo generators.

- Separation:

This segment is tailored to the solid/liquid separation needs in the chemical, environmental, food, mining, and minerals industries. It offers both mechanical and thermal separation technologies, alongside services and related automation solutions. Additionally, it provides technologies and services for the production of animal feed and biomass pellets.