ADT Inc. (ADT)

Is ADT (ADT) Outperforming Other Industrial Products Stocks This Year?

Here is how ADT (ADT) and Flowserve (FLS) have performed compared to their sector so far this year.

Are Investors Undervaluing ADT (ADT) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Are Industrial Products Stocks Lagging ADT (ADT) This Year?

Here is how ADT (ADT) and Kennametal (KMT) have performed compared to their sector so far this year.

Should Value Investors Buy ADT (ADT) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

ADT Inc. (ADT) Q3 2025 Earnings Call Transcript

ADT Inc. ( ADT ) Q3 2025 Earnings Call November 4, 2025 10:00 AM EST Company Participants Elizabeth Landers - Investor Relations Officer James DeVries - CEO, President & Chairman Jeffrey Likosar - CFO and President of Corporate Development & Transformation Conference Call Participants Peter Christiansen - Citigroup Inc., Research Division Ashish Sabadra - RBC Capital Markets, Research Division John Ronan Kennedy - Barclays Bank PLC, Research Division Toni Kaplan - Morgan Stanley, Research Division Keen Fai Tong - Goldman Sachs Group, Inc., Research Division Presentation Operator Hello, and thank you for standing by. My name is Mark, and I will be your conference operator today.

ADT (ADT) Tops Q3 Earnings and Revenue Estimates

ADT (ADT) came out with quarterly earnings of $0.23 per share, beating the Zacks Consensus Estimate of $0.22 per share. This compares to earnings of $0.2 per share a year ago.

ADT: The IPO Of Verisure Highlights The Potential For Upside

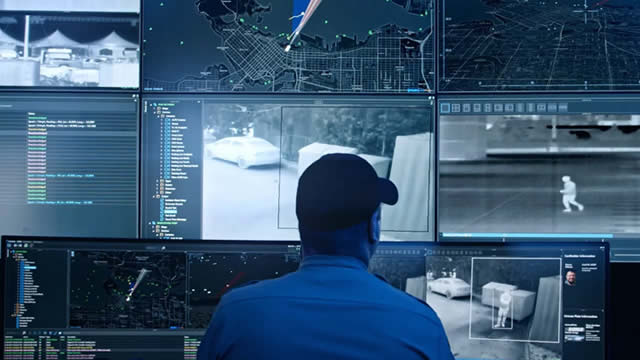

ADT remains undervalued versus newly listed peer Verisure, supported by strong revenue growth, improving profitability, and a high share of recurring revenue. ADT's business is supported by partnerships with Google and State Farm, ongoing debt reduction, and aggressive share buybacks, boosting shareholder yield to 11%. Customer churn and static subscriber numbers remain challenges, but investments in AI, remote assistance, and smart home solutions aim to improve retention.

Is ADT (ADT) Outperforming Other Industrial Products Stocks This Year?

Here is how ADT (ADT) and Ashtead Group PLC (ASHTY) have performed compared to their sector so far this year.

Is ADT (ADT) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

4 Security & Safety Stocks to Consider on Promising Industry Trends

Rising awareness for safety and security among people favors the Zacks Security and Safety Services industry's near-term prospects. ALLE, ADT, LIF and ALRM are some notable stocks in the industry.

Pick These 5 Bargain Stocks With Impressive EV-to-EBITDA Ratios

ASTH, BJRI, ADT, KT and GSL stand out with low EV-to-EBITDA ratios and strong earnings growth forecasts.

Has ADT (ADT) Outpaced Other Industrial Products Stocks This Year?

Here is how ADT (ADT) and Ashtead Group PLC (ASHTY) have performed compared to their sector so far this year.