American Electric Power Company, Inc. (AEP)

eHealth Stock Rises 45% in a Week: Medicare Boom or AEP Magic?

EHTH exceeds expectations in telephonic and online conversion rates and leverages strong consumer demand for its omnichannel platform.

Down 8%, 9%, and 13% in 3 Months, these 3 High-Yield Dividend Stocks Are Buys in December

This past summer, utilities were one of the best-performing stock market sectors year to date -- even better than technology. Despite a sustained rally in the S&P 500, many top utility stocks have sold off in recent months, including industry leaders like Southern Company (SO -0.20%), American Electric Power (AEP -0.22%), and NextEra Energy (NEE 0.46%).

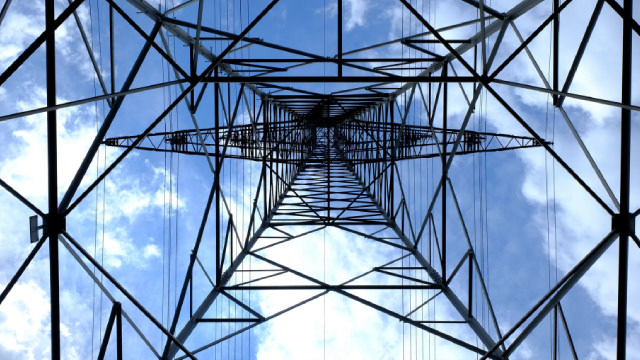

American Electric Power: Light Up Your Income Portfolio With This Mission Critical Utility

Market volatility can offer buying opportunities, but emotional reactions can lead to costly mistakes; focus on fundamentals to maintain perspective. AEP's five-year capital spending plan and robust growth outlook, driven by data centers, make it a compelling investment. AEP's financial health, undervaluation, and strong dividend growth potential justify a buy rating, with expected 30% cumulative returns through 2026.

AEP (AEP) Up 1.2% Since Last Earnings Report: Can It Continue?

AEP (AEP) reported earnings 30 days ago. What's next for the stock?

AEP Stock Rides on Investments & Renewable Portfolio Expansion

AEP continues to benefit from its systematic investment plan and renewable portfolio expansion initiatives.

Bloom stock poised for massive gains after AEP deal, analyst says

Bloom Energy Corp (NYSE: BE) announced a supply agreement with American Electric Power Company Inc (NASDAQ: AEP) for up to 1 gigawatt of its solid oxide fuel cells on Friday. Shares of the renewable energy company opened about 50% up today.

Why Bloom Energy Could Reach Revenues Of $1.8B Next Year, Says Bullish Analyst

Bloom Energy Corp BE announced a 1 GW fuel cell supply deal with American Electric Power Company Inc AEP, which sent its stock soaring in early trading on Friday.

3 Unstoppable Dividend Stocks Yielding More Than 3% to Buy Now

These passive income powerhouses use dividends to pass along profits directly to shareholders.

American Electric Power Company, Inc. (AEP) Q3 2024 Earnings Call Transcript

American Electric Power Company, Inc. (NASDAQ:AEP ) Q3 2024 Earnings Conference Call November 6, 2024 9:00 AM ET Company Participants Darcy Reese - VP, IR William Fehrman - President, CEO Charles Zebula - EVP & CFO Conference Call Participants Shar Pourezza - Guggenheim Partners Steven Fleischman - Wolfe Research Jeremy Tonet - JPMorgan David Arcaro - Morgan Stanley Julien Dumoulin-Smith - Jefferies Nicholas Campanella - Barclays Carly Davenport - Goldman Sachs Andrew Wiesel - Scotiabank. William Appicelli - UBS Anthony Crowdell - Mizuho Ryan Levine - Citi Operator Thank you for standing by.

American Electric's Q3 Earnings Beat Estimates, Revenues Rise Y/Y

AEP's third-quarter earnings beat the Zacks Consensus Estimate by 3.9%. The company trims its 2024 adjusted EPS outlook.

AEP (AEP) Reports Q3 Earnings: What Key Metrics Have to Say

The headline numbers for AEP (AEP) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

American Electric Power (AEP) Q3 Earnings and Revenues Beat Estimates

American Electric Power (AEP) came out with quarterly earnings of $1.85 per share, beating the Zacks Consensus Estimate of $1.78 per share. This compares to earnings of $1.77 per share a year ago.