Applied Industrial Technologies Inc. (AIT)

Applied Industrial Technologies (AIT) Q4 Earnings and Revenues Beat Estimates

Applied Industrial Technologies (AIT) came out with quarterly earnings of $2.8 per share, beating the Zacks Consensus Estimate of $2.6 per share. This compares to earnings of $2.64 per share a year ago.

AIT Gears Up to Post Q4 Earnings: What Lies Ahead for the Stock?

Applied Industrial's Q4 results are likely to show revenue gains from automation and acquisitions, offset by weakness in Service Center operations.

Applied Industrial Technologies (AIT) Q4 Earnings on the Horizon: Analysts' Insights on Key Performance Measures

Get a deeper insight into the potential performance of Applied Industrial Technologies (AIT) for the quarter ended June 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Analysts Estimate Applied Industrial Technologies (AIT) to Report a Decline in Earnings: What to Look Out for

Applied Industrial Technologies (AIT) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Applied Industrial Gains From Business Strength Amid Headwinds

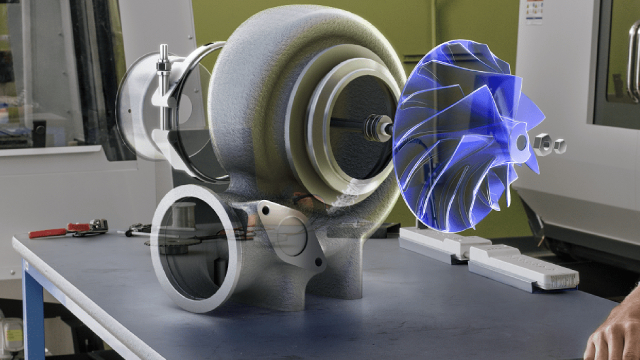

AIT shares surge in three months as Engineered Solutions' growth and acquisitions offset distribution headwinds.

Applied Industrial Technologies: Which Direction Will The Stock Go?

Applied Industrial Technologies has outperformed the market long-term, but recent earnings and organic growth are showing signs of weakness. Financial metrics like revenue per share, gross margin, and ROIC are trending positively, but dividend growth has historically lagged despite a recent large increase. The stock is currently trading at a 23% premium to fair value, resulting in a mediocre long-term expected return of just 2.6%.

Here's Why Applied Industrial Technologies (AIT) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Applied Industrial Exhibits Strong Prospects Amid Persisting Headwinds

AIT's growth surges on strength in the Engineered Solutions unit and strategic buyouts, despite rising costs and soft MRO trends.

Is the Options Market Predicting a Spike in Applied Industrial Technologies Stock?

Investors need to pay close attention to AIT stock based on the movements in the options market lately.

Applied Industrial Technologies: Well Positioned To Capitalize On Automation In U.S. Manufacturing

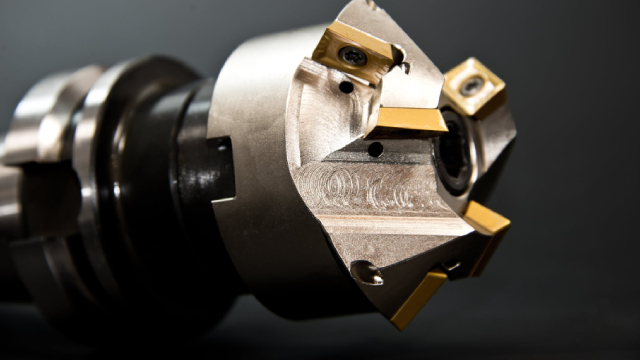

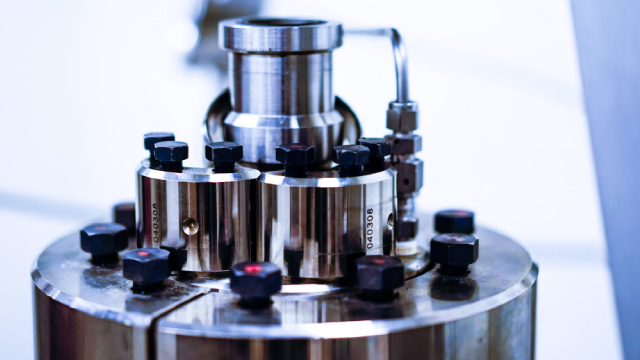

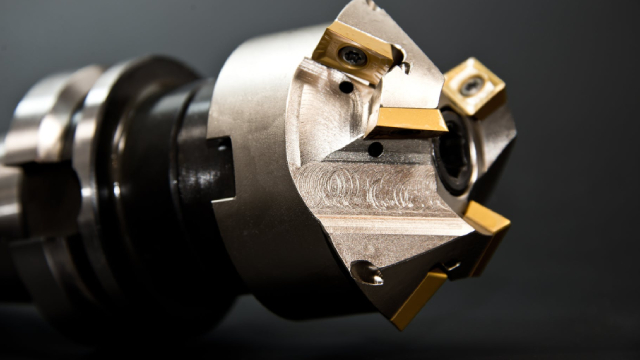

AIT has transformed from a parts distributor to a value-added engineering services firm, driving higher margins and a premium valuation. The company is well-positioned to benefit from automation, reshoring, and supply chain modernization trends in US manufacturing. Disciplined capital allocation, strong balance sheet, and strategic acquisitions support long-term growth and shareholder value.

Investing in Applied Industrial Technologies (AIT)? Don't Miss Assessing Its International Revenue Trends

Review Applied Industrial Technologies' (AIT) international revenue performance and how it affects the predictions of financial analysts on Wall Street and the future prospects for the stock.

Here's Why Applied Industrial Technologies (AIT) is a Strong Growth Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.