Applied Industrial Technologies Inc. (AIT)

Here's Why Investors Should Consider Buying Applied Industrial Stock

AIT benefits from business strength, acquired assets and shareholder-friendly policies.

4 Industrial Manufacturing Stocks to Buy Despite Industry Headwinds

Persistent weakness in the manufacturing sector weighs on the Zacks Manufacturing - General Industrial industry's near-term prospects. DOV, AIT, GNRC and DXPE are a few stocks investors may consider buying.

Applied Industrial Technologies: A Disciplined Growth Story

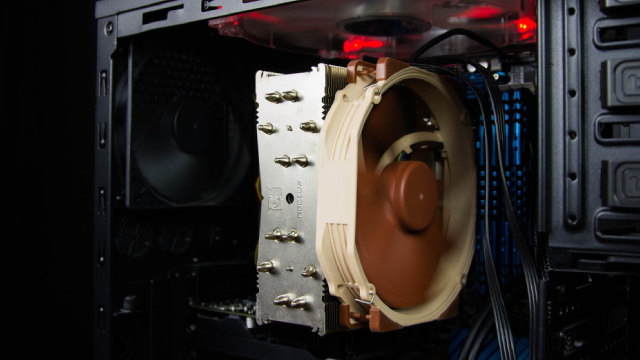

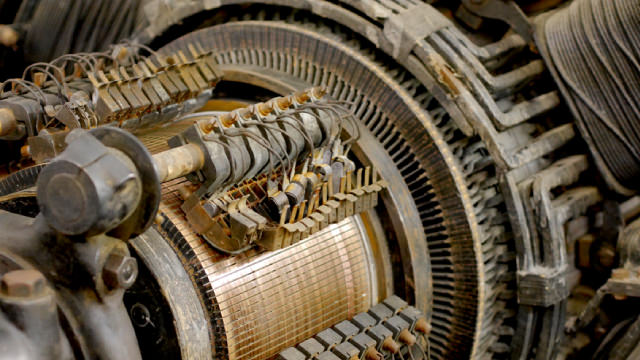

Applied Industrial Technologies leverages M&A for growth, focusing on high-margin segments like flow control and engineered solutions to drive long-term profitability. AIT benefits from reshoring trends and increasing investment into production automation, with 88% of revenue generated in the U.S., positioning it well for future growth. Strong financial performance in FY2023, with 15.8% YoY revenue growth and a 34.3% increase in EPS, highlights effective strategic acquisitions and robust demand.

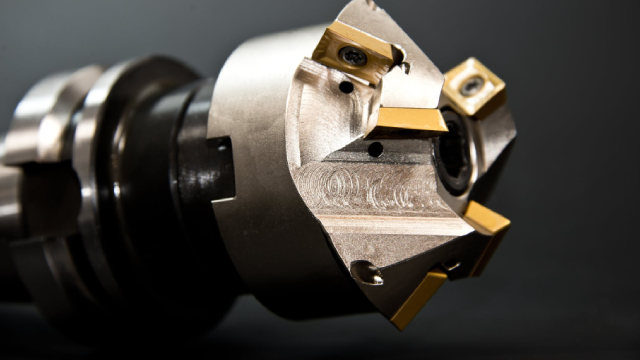

AIT Boosts Product Portfolio With the Acquisition of Hydradyne

Applied Industrial's acquisition of Hydradyne is set to expand its footprint in the strategic Southeast U.S. region.

Is Applied Industrial Technologies (AIT) Outperforming Other Industrial Products Stocks This Year?

Here is how Applied Industrial Technologies (AIT) and Mueller Water Products (MWA) have performed compared to their sector so far this year.

4 Industrial Stocks Poised to Continue Their Winning Streak in 2025

Despite weakness in the manufacturing sector, recovery in the demand environment, with an improvement in the supply chain, augurs well for the industrial sector heading into 2025. ZBRA, RBC, AIT and POWL are likely to continue their momentum.

5 Stocks With Upgraded Broker Ratings to Buy for Solid Returns in 2025

Brokers have deeper insights into stocks and the macroeconomic backdrop. One must follow broker rating upgrades to pick stocks like GAP, CAH, AIT, JLL and UAL.

Applied Industrial Stock Exhibits Strong Prospects Despite Headwinds

AIT is set to benefit from strong momentum in the Service Center Based Distribution segment. However, weakness in the Engineered Solutions segment remains concerning.

AIT to Boost Product Portfolio With the Acquisition of Hydradyne

Applied Industrial is set to expand its footprint in the strategic Southeast U.S. region with the acquisition of Hydradyne.

Here's Why You Should Retain Applied Industrial in Your Portfolio

AIT stands to gain from strength in its Service Center Based Distribution segment. The company's measures to reward its shareholders are also encouraging.

Applied Industrial Technologies Can Continue To Outperform

AIT's organic growth is expected to accelerate due to pent-up demand, reshoring, automation trends, and a strong acquisition pipeline. Margins should improve from operating leverage, productivity initiatives, and focus on high-margin markets, despite recent headwinds from volume deleverage and higher costs. AIT trades at a discount to peers like W.W. Grainger and Fastenal, with potential for upward estimate revisions and continued valuation re-rating.

Interpreting Applied Industrial Technologies (AIT) International Revenue Trends

Explore Applied Industrial Technologies' (AIT) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.