Advanced Micro Devices, Inc. (AMD)

AMD: OpenAI Got A Bargin - I Wouldn't Hold Into Earnings

Advanced Micro Devices is now up+40% over the past five days on news of a partnership with OpenAI for a potential 10% stake and up to 6GW worth of chips. In our opinion, this is a very clever deal that hitched AMD to OpenAI's wagon and put it back in the AI story with leverage for 2H26. AMD's rally is overextended at current levels. High expectations are priced in, while concerns about gross margins and competitive threats from Nvidia and Intel remain.

5 Stocks Congress Quietly Bought in Q3—Should You Follow?

Few topics stir as much public frustration as lawmakers trading the same stocks they help regulate. While Congress is required to disclose its financial transactions, the system isn't exactly built for transparency.

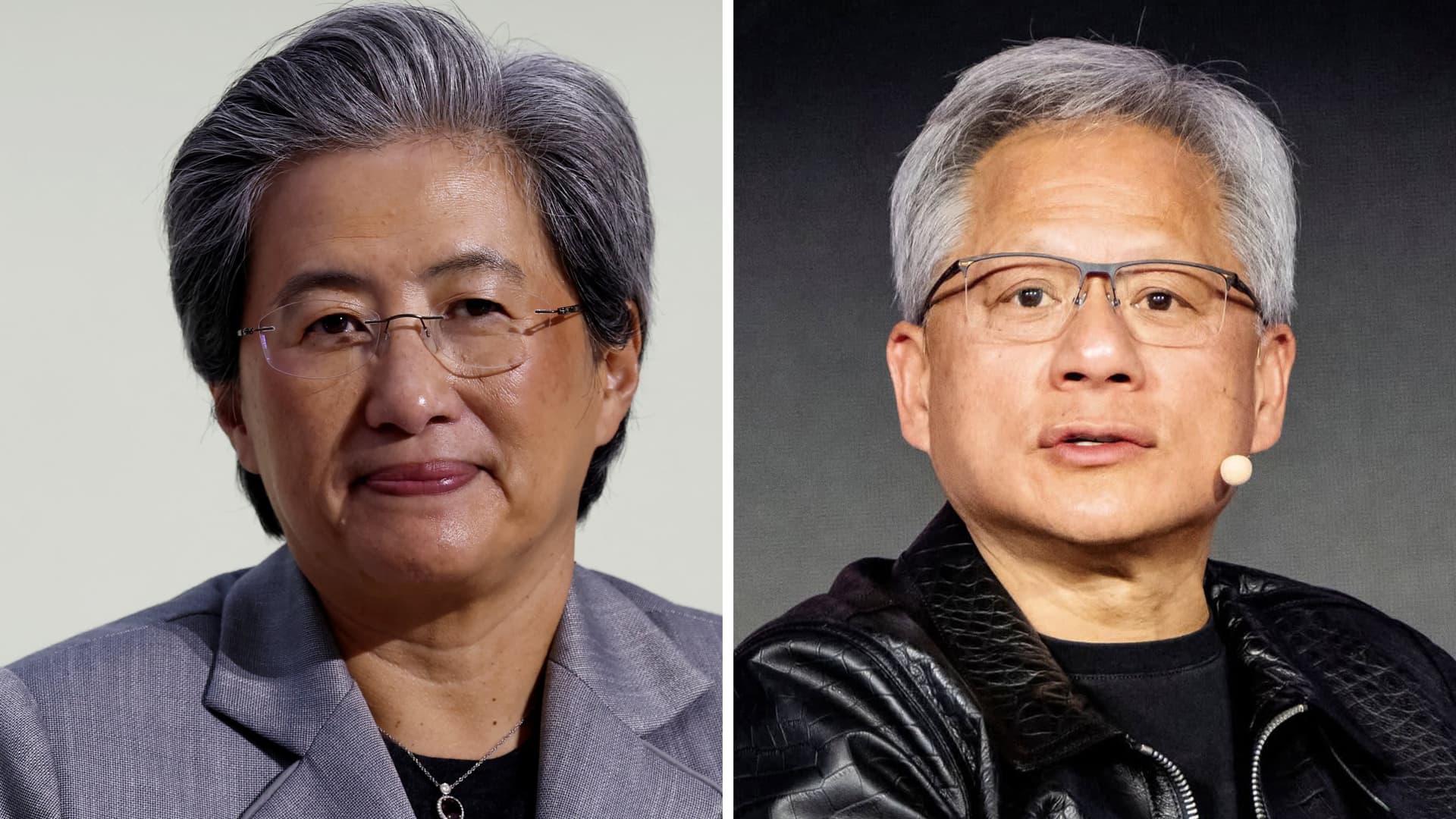

Is AMD Turning Into Nvidia's Kryptonite? Here's How High It Can Go

AMD (NASDAQ:AMD ) and Nvidia (NASDAQ:NVDA ) have been locked in a high-stakes AI chip race that has sent investors into a frenzy, especially around AMD.

Advanced Micro Devices (AMD) Suffers a Larger Drop Than the General Market: Key Insights

Advanced Micro Devices (AMD) closed the most recent trading day at $232.89, moving 1.13% from the previous trading session.

Goldman Sachs sees OpenAI partnership a ‘substantial positive' for AMD, raises price target

Goldman Sachs Group Inc (NYSE:GS, ETR:GOS) analysts view Advanced Micro Devices Inc (NASDAQ:AMD, ETR:AMD)'s strategic partnership with OpenAI as “a substantial positive for AMD,” pointing to improved competitive positioning in the accelerator market for both training and inference workloads. While the firm maintained its ‘Neutral' rating on the stock “given the potential funding risks tied to the business and likely high customer concentration for AMD's GPU datacenter business,” it noted that it “could be more constructive if we gain incremental confidence on the revenue stream and execution timeline for this deal in the coming quarters.

Why A Bad Deal Makes AMD A Strong Buy

AMD secures a landmark multi-year GPU supply deal with OpenAI, potentially adding tens of billions in incremental annual revenue from 2027 onward. The deal includes 160 million warrants for OpenAI, complicating the true economics but providing strong incentives for OpenAI to adopt AMD's products. Risks remain around OpenAI's ability to fund such large commitments, but the structure mitigates some risk and signals AMD's rising relevance in AI compute.

Wall Street Analysts Just Upgraded These Five Stocks

The image featured for this article is © mezzotint / Shutterstock.com

AMD Stock To $450?

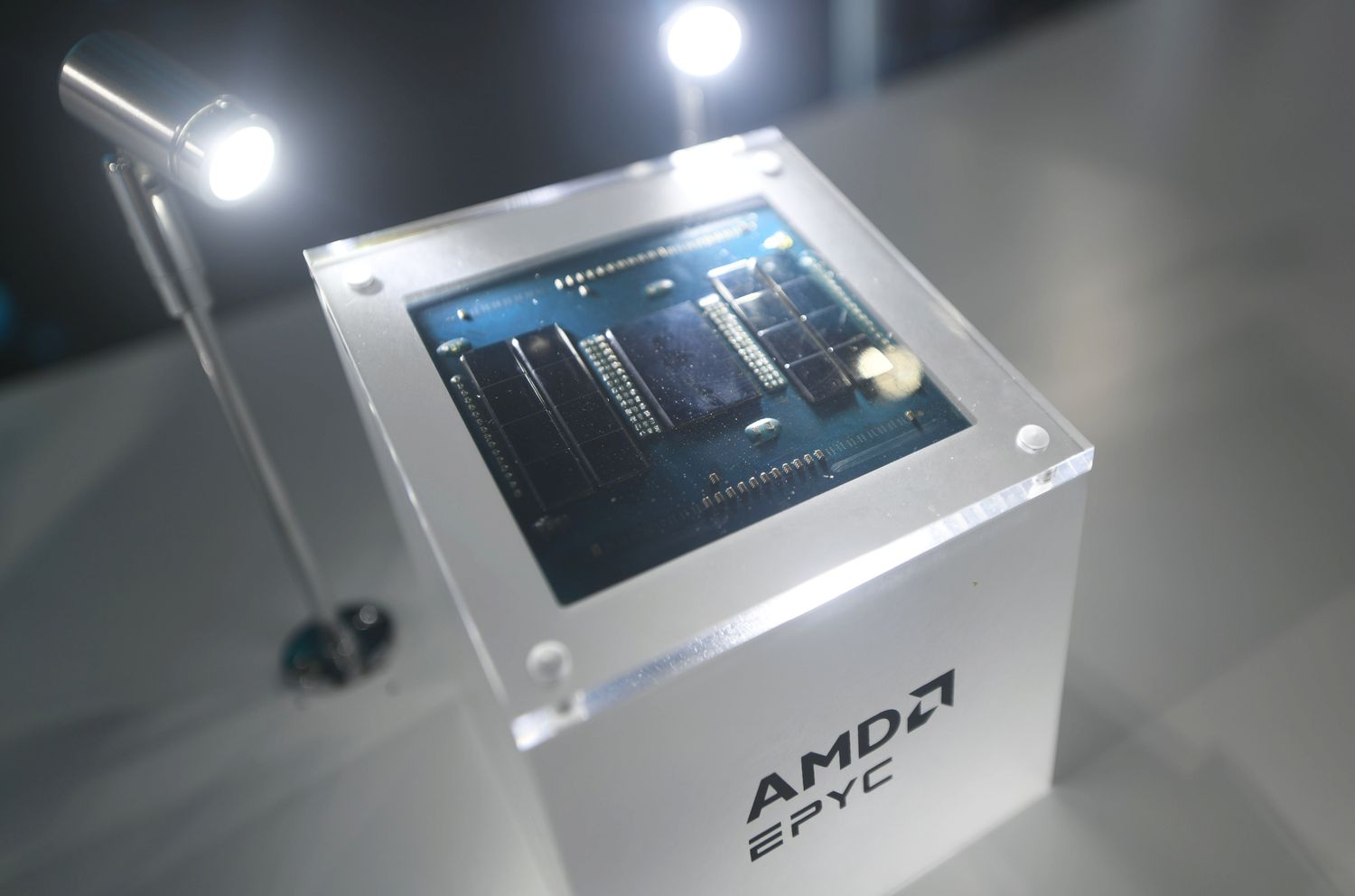

On Monday, AMD (NASDAQ:AMD) made headlines by landing a major deal with ChatGPT maker OpenAI, to supply tens of thousands of its GPU chips for 6 gigawatts of computing capacity over the next five years. The deal represents one of the largest chip orders ever placed in the AI sector and underscores how OpenAI is looking to diversify its hardware supply chain beyond industry standard Nvidia (NASDAQ:NVDA), which holds over 75% of the AI compute market.

AMD, Marvell, Intel: Which Is The Next Multi-Trillion Chip Stock

On Monday, AMD (NASDAQ:AMD) made news by entering into a significant agreement with OpenAI, the developer of ChatGPT, to provide tens of thousands of its GPU chips for 6 gigawatts of computing power over the forthcoming five years. The initial gigawatt comprising AMD's next-generation Instinct MI450 chips will be delivered in the latter half of 2026.

Lowe's vs. Home Depot: Which Benefits More From Lower Rates?

When large-cap stocks like Advanced Micro Devices Inc. NASDAQ: AMD are soaring 25% and adding $80 billion to their market cap in a single session, who has time to concentrate on the laggards?

S&P 500 Gains and Losses Today: AI-Fueled Rally Powers Index to Fresh High

An AI chipmaker's stock extended its rally in the wake of a major artificial intelligence deal. Meanwhile, the latest salvo in an escalating competition between credit score providers weighed on one of the industry's big players.

AMD's deal with OpenAI gives Nvidia much-needed challenger in market it dominates

AMD's big agreement this week with OpenAI gives the chipmaker a chance to cut into Nvidia's dominance in the AI market. "Right now, Nvidia almost has a monopoly," said Mandeep Singh, senior analyst at Bloomberg intelligence.