Advanced Micro Devices, Inc. (AMD)

Chip stocks update: Nvidia, AMD, TSMC, Intel share prices fall after Trump's export license demand

Shares in Nvidia Corporation and other chip technology companies are down in premarket trading this morning after Nvidia confirmed that it would take a significant financial hit to cover costs associated with a newly required export license so it can ship some of its latest chips outside of the United States. Here's what you need to know about the new requirement and its effect on tech stocks.

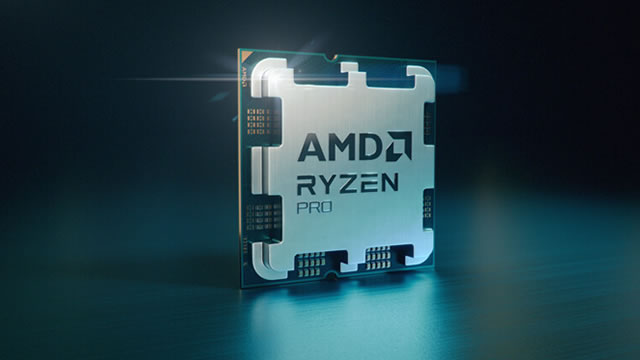

AMD Chips Face U.S. Export Control: Buy, Sell or Hold the Stock?

Advanced Micro Devices' prospects are cloudy post the new export control for its MI308 chip to China amid stiff competition from NVIDIA.

Forget The Tariffs: 3 Chip Stocks To Buy Now

The ongoing U.S.-China trade tensions, particularly around chip tariffs, are causing significant volatility and anxiety for tech investors, impacting stocks like Nvidia, AMD, and Marvell. Despite the tariff issues, AI growth remains strong, and high-quality chip companies could remain highly profitable, with the potential for a trade deal boosting their stocks. Nvidia, AMD, and Marvell have seen substantial stock price declines, making them relatively cheap with strong future profitability prospects despite temporary earnings declines.

AMD price prediction amid new China ban

Thanks to its size and the contrast between the regular session endorsement and the after-hours hit, Nvidia (NASDAQ: NVDA) has been making headlines on April 16 as President Donald Trump banned the shipping of advanced semiconductors to China.

Nvidia, AMD, and Other Chip Stocks Fall as Trump Curbs Exports to China

Semiconductor stocks sank Wednesday after Nvidia (NVDA) and Advanced Micro Devices (AMD) warned they would take a hit after the Trump administration moved to curb the chipmakers' exports to China.

AMD Expects $800M Loss, UAL Tariff Guidance Approach, JBHT Slides

Breaking news hits Morning Trade Live as AMD Inc. (AMD) reports it will lose $800 million over U.S. export restrictions. Diane King Hall makes the comparison to Nvidia (NVDA) facing similar issues, and the concern that DeepSeek's disruption still lingers over the A.I.

AMD expects $800 million hit from U.S. chip restrictions on China

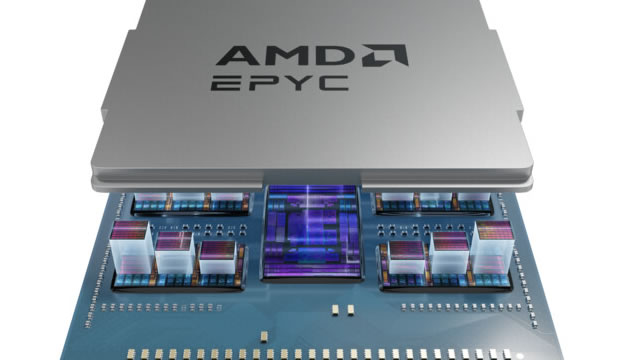

Advanced Micro Devices said it could incur charges of up to $800 million for exporting its MI308 products to China and other countries. Shares of AMD were down more than 5% on Wednesday.

Chip stocks fall as Nvidia, AMD warn of higher costs from China export controls

Technology stocks declined as the chipmaking sector warned of ongoing uncertainty and higher costs from President Donald Trump's tariff plans. Nvidia revealed in a filing Tuesday that will take a $5.5 billion charge tied to exporting its H20 graphics processing units to China.

AMD takes $800M charge on US license requirement for AI chips

AMD says that the U.S. government's license control requirement for exporting AI chips to China and certain other countries may impact its earnings significantly.

AMD, Micron, Broadcom Stocks Drop as U.S. Tightens Chip Export Rules

Chip stocks fell after new export licensing requirements were imposed on Nvidia's H20 and AMD's MI308.

Should You Buy Advanced Micro Devices (AMD) Stock Before May 6?

Advanced Micro Devices (AMD 0.85%) supplies some of the world's best semiconductors, including a growing portfolio of chips specifically designed to handle artificial intelligence (AI) workloads in data centers and personal computers.

Nvidia and AMD shares hit by new AI chip controls

Nvidia Corp (NASDAQ:NVDA, ETR:NVD) shares fell 6.3% in after-hours trading on Tuesday, while fellow chipmaker AMD dropped 7.1%, after the U.S Commerce Department unveiled new export restrictions targeting their artificial intelligence chips bound for China. The revised rules impose licensing requirements on Nvidia's H20 and AMD's MI308 processors, along with equivalent models, as part of Washington's ongoing efforts to tighten control over advanced semiconductor technology.