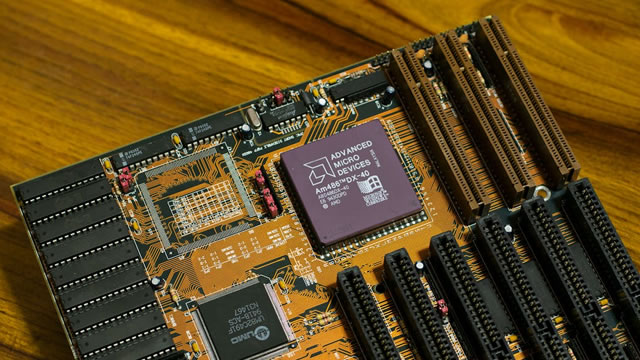

Advanced Micro Devices, Inc. (AMD)

Oracle Recently Delivered Incredible News for Advanced Micro Devices (AMD) Stock Investors

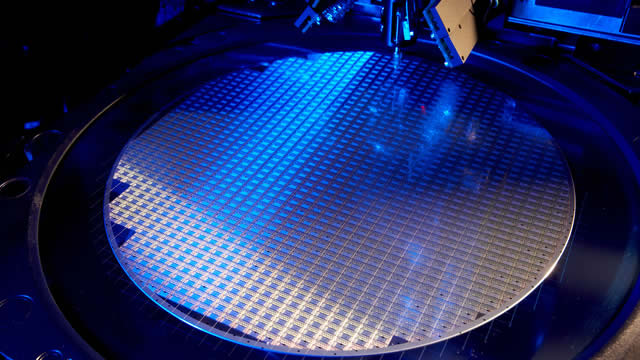

Advanced Micro Devices (AMD -0.01%) is one of the world's leading suppliers of chips for data centers, personal computers, and even cars. The data center business is the company's main focus right now, as it tries to compete with Nvidia in the market for graphics processing units (GPUs), which are used to develop artificial intelligence (AI).

Advanced Micro Devices (AMD) Stock Declines While Market Improves: Some Information for Investors

In the latest trading session, Advanced Micro Devices (AMD) closed at $102.74, marking a -0.47% move from the previous day.

AMD CEO discusses $4.9B ZT systems deal, AI future, and tariffs

Advanced Micro Devices (AMD) officially closed its $4.9 billion ZT Systems deal. It comes as the chip giant tries to further compete with rival Nvidia (NVDA) in the AI space.

Game-Changing News for Advanced Micro Devices

Advanced Micro Devices NASDAQ: AMD announced game-changing news. It will now integrate Rapt.AI into all its MI300X, MI325X, and soon-to-be-released MI350 line of GPUs.

Here's the Next AI Stock I'm Buying

I haven't added too many artificial intelligence (AI) stocks to my portfolio -- yet. To put it mildly, some of the valuations in the megacap tech stocks have been difficult to justify, especially since I consider myself a value investor at heart.

Down 50%, Should You Buy AMD Stock on the Dip?

It's been a rough 12 months for Advanced Micro Devices (AMD -3.10%) shareholders. AMD stock peaked in early 2024, and it's been tumbling ever since.

AMD: Now, A Very Cheap AI Growth Play (Upgrade)

Advanced Micro Devices, Inc. has shown tremendous resilience, outperforming its semi peers and S&P 500 recently. Is there more to come? Nvidia's market dominance doesn't mean it's game over for AMD. Remember, AMD doesn't need to be No.1. AMD's valuations are arguably dirt cheap now, suggesting the market has arguably baked in a lot of doom and gloom.

Brokers Suggest Investing in Advanced Micro (AMD): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Advanced Micro Devices, Inc. (AMD) is Attracting Investor Attention: Here is What You Should Know

Advanced Micro (AMD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Better Artificial Intelligence Stock: AMD vs. Nvidia

One of the foundational pieces of the fast-growing artificial intelligence (AI) market has been the advanced semiconductors that make AI tools possible. Nvidia (NVDA -2.01%) has garnered the most attention in this space, as its processors dominate AI data centers.

Better Artificial Intelligence (AI) Stock: Nvidia vs. AMD

Artificial intelligence (AI) chip stocks are having a torrid time on the market in 2025, and that's not surprising. The sector has been hit hard by multiple headwinds of late, such as the viability of the huge sums being spent by tech giants on beefing up AI hardware and the growing concerns about a possible economic downturn in the U.S.

Not A No. 2 To Nvidia: Initiating AMD With A Strong Buy

I'm initiating Advanced Micro Devices, Inc. with a strong buy for long-term investors, despite fierce (to say the least) competition with Nvidia. AMD's forward P/E of 23x and PEG ratio of 0.8x indicate it's undervalued compared to Nvidia and Intel, and I think it presents a compelling entry point at current levels. AMD's diverse exposure across AI, CPUs, and gaming, coupled with rising market share in PC chips, make me optimistic on the company in the long-term despite short-term pain.