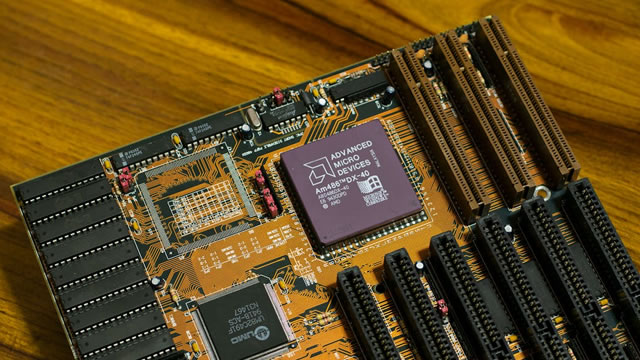

Advanced Micro Devices, Inc. (AMD)

2 Artificial Intelligence (AI) Stocks With 41% or More Upside, According to Wall Street Analysts

The potential for artificial intelligence (AI) to improve the fortunes of leading businesses has been a huge catalyst for the stock market over the last few years. IDC anticipates spending on AI, including infrastructure and business services, to reach $632 billion by 2028.

2 stocks to buy amid the tech market downturn

Tech stocks have hit a rough patch, dragging the broader market lower after leading the rally in 2023 and 2024.

AMD's Bottom May Soon Be Here: Recovery Likely In H2

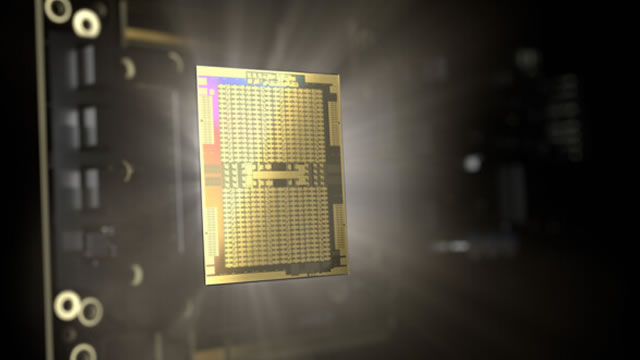

Advanced Micro Devices, Inc. has entered oversold territories, thanks to the bursting AI bubble and the uncertain recessionary risks, with it now halved from 2024 peaks. AMD's AI accelerator prospects are undeniably mixed, albeit well-balanced by the robust EPYC adoption in the cloud sector and growing x86 market share. Combined with the still rich Free Cash Flow generation and the healthy balance sheet, we believe that it remains well positioned to weather the trough H1 '25 period.

3 Stocks Near 52-Week Lows Ready for a Rebound

One of the biggest mistakes investors make when trading their portfolios and putting capital to work is staying away from discounts. It is human nature to avoid a stock chart that has been down and to the right as fears of a continuation in the same direction start to kick in.

We asked DeepSeek AI what will be AMD stock price at the end of 2025

Advanced Micro Devices (NASDAQ: AMD) stock's performance in 2024 has been a major surprise. The equity entered the year strong, rallying approximately 40% between January and March, but then entered a downtrend it hasn't escaped to date.

AMD Stock: Can the PC Refresh Cycle Spark a Rally?

Investors in Advanced Micro Devices NASDAQ: AMD have faced a year full of letdowns. As of the Mar. 12 close, shares are down 49% over the past 52 weeks.

2 Artificial Intelligence (AI) Stocks to Buy Before They Soar 82% and 124%, According to Certain Wall Street Analysts

The recent pullback in the stock market may have some investors on edge. The stocks selling off the most over the last couple of weeks are the same ones that led the stock market higher over the previous two years: artificial intelligence stocks.

AMD and Nvidia Stock Investors Just Got Amazing News From Oracle

In today's video, I discuss Nvidia (NVDA 6.43%), Advanced Micro Devices (AMD 4.17%), and why investors should be cheering after Oracle 's (ORCL 4.65%) earnings. To learn more, check out the short video, consider subscribing, and click the special offer link below.

3 Chips Stocks in Focus as Traders Buy Up Tech

The tech sector is rebounding today, pushing the Nasdaq Composite Index (IXIC) up triple digits, as investors buy the dip following an extended broad-market selloff.

AMD Stock: Why Selling Now Could Be a Big Mistake

In this video, I will cover the recent updates regarding AMD (AMD 1.80%) and why selling now could be a huge mistake. Watch the short video to learn more, consider subscribing, and click the special offer link below.

AMD Gears Up For Breakout Year In Artificial Intelligence GPUs Business: Analyst

Fresh off a series of investor meetings with Advanced Micro Devices Inc's AMD CEO Lisa Su, JPMorgan analyst Harlan Sur says the company is increasingly confident about delivering over 20% growth in 2025.

Should You Buy Advanced Micro Devices (AMD) Stock After Its 51% Drop?

The stock market is in the midst of a sell-off right now, with the Nasdaq Composite down more than 9% from its recent all-time high. However, the decline in Advanced Micro Devices (AMD 0.14%) stock started one year ago, and it's down 51% from its best-ever level.