Ametek Inc. (AME)

Will Ametek (AME) Beat Estimates Again in Its Next Earnings Report?

Ametek (AME) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

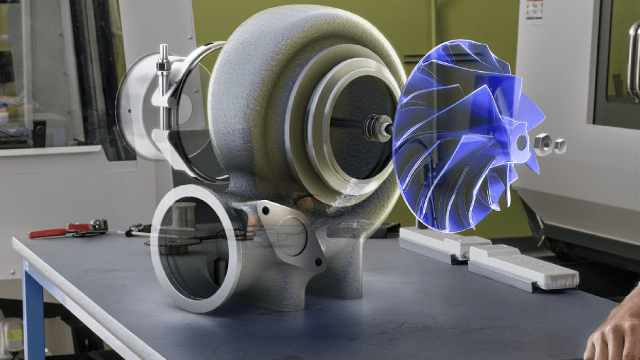

3 Electronics Testing Stocks to Watch From a Prospering Industry

The Zacks Electronics - Testing Equipment industry players, such as FTV, AME, and ITRI, are poised to benefit from the solid demand for testing instruments and 5G prospects.

Ametek (AME) Now Trades Above Golden Cross: Time to Buy?

From a technical perspective, AMETEK, Inc. (AME) is looking like an interesting pick, as it just reached a key level of support. AME's 50-day simple moving average crossed above its 200-day simple moving average, which is known as a "golden cross" in the trading world.

Don't Overlook Ametek (AME) International Revenue Trends While Assessing the Stock

Explore Ametek's (AME) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

Ametek Q3 Earnings Beat: Will Strong Guidance Lift the Stock?

AME's Q3 results reflect modest top-line performance, driven by strong growth across its segments despite macroeconomic headwinds.

AMETEK, Inc. (AME) Q3 2024 Earnings Call Transcript

AMETEK, Inc. (NYSE:AME ) Q3 2024 Earnings Conference Call October 31, 2024 8:30 AM ET Company Participants Kevin Coleman - Vice President-Investor Relations & Treasurer Dave Zapico - Chairman & Chief Executive Officer Dalip Puri - Executive Vice President & Chief Financial Officer Conference Call Participants Matt Summerville - D.A. Davidson Deane Dray - RBC Capital Markets Jeff Sprague - Vertical Research Partners Rob Wertheimer - Melius Research Scott Graham - Seaport Research Partners Brett Linzey - Mizuho Nigel Coe - Wolfe Research Christopher Glynn - Oppenheimer Andrew Obin - Bank of America Joe Giordano - TD Cowen Steve Barger - KBCM Operator Hello, and welcome to the AMETEK Third Quarter 2024 Conference Call.

Ametek (AME) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Ametek (AME) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Ametek (AME) Beats Q3 Earnings and Revenue Estimates

Ametek (AME) came out with quarterly earnings of $1.66 per share, beating the Zacks Consensus Estimate of $1.62 per share. This compares to earnings of $1.64 per share a year ago.

Insights Into Ametek (AME) Q3: Wall Street Projections for Key Metrics

Evaluate the expected performance of Ametek (AME) for the quarter ended September 2024, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Analysts Estimate Ametek (AME) to Report a Decline in Earnings: What to Look Out for

Ametek (AME) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Stock Picks From Seeking Alpha's September 2024 New Analysts

In September, thirty new analysts joined Seeking Alpha, offering diverse stock picks and insights, from Strong Buy to Strong Sell ratings. Highlighted picks include InMode Ltd., Intel Corporation, and iShares 20+ Year Treasury Bond ETF, each with unique investment theses and strong buy ratings. Analysts' backgrounds range from software engineering to finance, enhancing their stock research with diverse perspectives and methodologies.

Ametek: An Under-The-Radar Pick For Long-Term Gains

AMETEK's leadership in precision and electrical instruments, along with its diverse market segments, makes it a reliable long-term investment for my retirement portfolio. The company's strong margin performance, operational efficiency, and strategic acquisitions have driven solid financial results, including a 7% YOY increase in operating income. Despite near-term sales challenges, AMETEK's robust cash flow and operational performance position it well to manage headwinds and capitalize on growth opportunities.