American Homes 4 Rent (AMH)

Hurricane Helene: REIT Property Damage Report

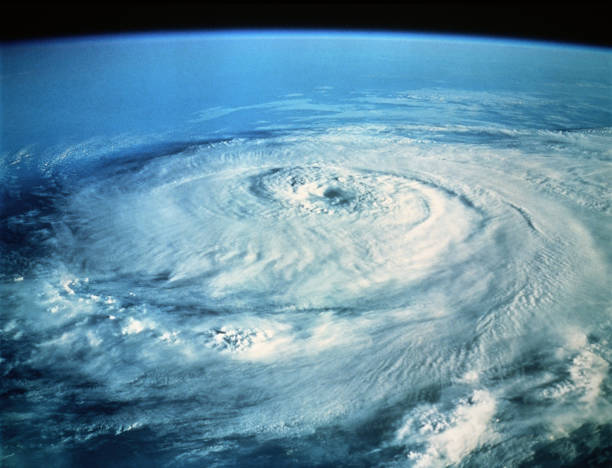

Hurricane Helene caused significant flooding in Ashville, NC, and Atlanta, GA, impacting numerous REIT-owned properties, but the financial impact on REITs is likely less severe than it appears. REITs typically experience knee-jerk selloffs after property damage announcements, but these are often over-reactions and tend to reverse over time. Most REIT-owned properties are durable and well-insured, mitigating long-term financial impacts, though insurance rates may rise, affecting future expenses.

American Homes 4 Rent (AMH) Could Be a Great Choice

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does American Homes 4 Rent (AMH) have what it takes?

The Impressive Durability Of REIT Investments

REIT bankruptcies are incredibly rare. The nature of their business is very resilient. I present 5 reasons that make most REITs quasi indestructible.

Are You Looking for a High-Growth Dividend Stock?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does American Homes 4 Rent (AMH) have what it takes?

Jerome Powell Just Launched REIT Season, Here Are 3 Top Buys

Mr. Powell and I rarely see eye to eye. I've usually been right. REITs are set for a bullish trend with the Fed expected to cut rates, offering attractive valuations and growth potential. Here are 3 top picks ranging from low to high yield.

The State Of REITs: August 2024 Edition

The REIT sector soared in July with an +8.33% average total return and is now in the black year to date with +3.83% thus far in 2024. Small cap (+9.91%) and mid-cap REITs (+9.77%) averaged the highest total returns in July. Micro-caps (+5.85%) and large-caps (+5.53%) were also in the black in July, albeit. 86.84% of REIT securities had a positive total return in July.

Why American Homes 4 Rent (AMH) is a Great Dividend Stock Right Now

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does American Homes 4 Rent (AMH) have what it takes?

10 REITs With The Best Risk Ratings

REITs have rallied strongly recently, with a 7.93% increase in the past 3 months. Recent economic data suggests rate cuts have changed sentiment towards the real estate sector rapidly. Blue chip REITs still offer upside potential, with UDR, Rexford, and Invitation Homes standing out as potential best values.

3 REITs to Sell in August Before They Crash & Burn

Those holding REITs have seen their portfolios lag behind in recent years, with the sector struggling under the weight of rising interest rates. The current economic climate has been particularly harsh on REITs, which are feeling the strain from increased borrowing costs and a shift in investor preference towards safer fixed-income assets.

Why American Homes 4 Rent (AMH) is a Top Dividend Stock for Your Portfolio

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does American Homes 4 Rent (AMH) have what it takes?

American Homes 4 Rent (AMH) Q2 2024 Earnings Call Transcript

American Homes 4 Rent (NYSE:AMH ) Q2 2024 Earnings Conference Call August 2, 2024 12:00 PM ET Company Participants Nick Fromm - Director Investor Relations David Singelyn - Chief Executive Officer Bryan Smith - Chief Operating Officer Chris Lau - Chief Financial Officer Conference Call Participants Juan Sanabria - BMO Capital Markets Eric Wolfe - Citibank Jamie Feldman - Wells Fargo Jeff Spector - Bank of America Linda Tsai - Jefferies John Pawlowski - Green Street Daniel Tricarico - Scotiabank Jesse Lederman - Zelman & Associates Adam Kramer - Morgan Stanley Brad Heffern - RBC Capital John Pawlowski - Green Street Operator Greetings, and welcome to the AMH Second Quarter 2024 Earnings Conference Call. [Operator Instructions].

American Homes 4 Rent (AMH) Reports Q2 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for American Homes 4 Rent (AMH) give a sense of how the business performed in the quarter ended June 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.