ARK Innovation ETF Fund (ARKK)

1 Technology ETF to Buy Hand Over Fist and 1 to Avoid

1 Technology ETF to Buy Hand Over Fist and 1 to Avoid

Deciphering Disruption: Inside Cathie Wood's Latest Plays

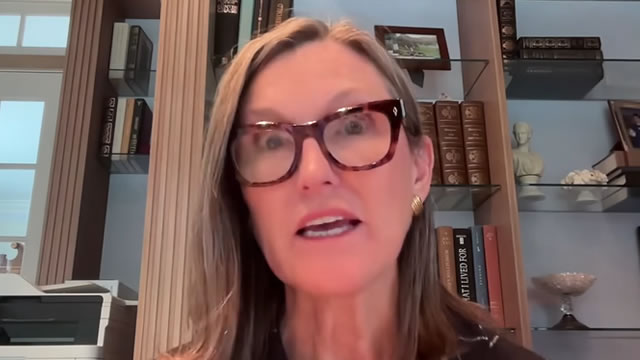

Is the future of finance already written in the DNA of today's emerging technologies? Cathie Wood, CEO and CIO of Ark Invest, believes so.

Cathie Wood says her 'volatile' ARK Innovation fund shouldn't be a 'huge slice of any portfolio'

Cathie Wood is defending her turbulent ARK Innovation ETF following a rocky stretch.

The Post-Election Flood Into ETFs

Following a tense presidential election of historic proportions, equity markets roared to record highs – with the S&P 500 putting on its best weekly showing in more than a year, up nearly 5%. Markets have historically done well heading into the end of most election years.

Technical Monday: ARKK Then and Now

On October 28th my daily article said this: Considering the bull market of 2024, Cathie Wood's ARKK fund (she has 6 ETFs) over 2 years and a lot of sideways price action, could now be a potential player. Remember, ARKK peaked in 2021 at 159.70.

Is the ARK Innovation ETF (ARKK) Ready to Perform?

Considering the bull market of 2024, Cathie Wood's ARK Innovation ETF (ARKK) – she has 6 ETFs – has seen a lot of sideways price action. But it could now be a potential player.

ARKK Should Not Be A Part Of Your Portfolio

ARK Innovation ETF has underperformed, returning only 15% over 5 years, versus 95% for the S&P 500. ARKK's concentrated holdings in companies like Tesla, Roku, and Coinbase are seen as poor investments with limited growth potential. The ETF's strategy of investing in large-cap companies is flawed; smaller companies are better suited for disruptive innovation.

ARKK: Boom, Bust And Then

ARK Innovation ETF experienced a classic boom and bust cycle from 2020-2022, similar to historical market bubbles. Post-bust, ARKK is trading within its pre-mania range, indicating a return to the mean. The ETF is unlikely to recover quickly and may struggle for an extended period.

1 Growth ETF I Would Buy Hand Over Fist, and 1 I Would Be Cautious About

I would lean on the ETF that's led by some of the world's most time-tested and financially stable companies.

Cathie Wood's ARK Invest and eToro launch tech-focused investment vehicle

eToro Group Ltd and Cathie Wood's ARK Invest have teamed up to create a new portfolio focused on technology and innovation. The ARK-FutureFirst Smart Portfolio aims to provide retail investors with access to companies at the forefront of groundbreaking technologies.

Cathie Wood's ARK: Will It Thrive Again as Rates Drop?

Investors hanging onto shares of Cathie Wood's line of ARK Exchange-Traded Funds (ETFs) may be ready to throw in the towel after mostly missing out on the impressive tech-led gains over the past two years or so.

ARKK: You Missed Yet Another Bull Market

The ETF continues to underperform the market and is down almost 11% since I first covered it, while the S&P 500 jumped nearly 20%. In addition to its selection process, the ETF's performance also seems to be suffering due to ill-timed buying and selling activity. Investors looking to buy growth stocks at a discount would likely be better off looking elsewhere.