Arm Holdings plc American Depositary Receipt (ARM)

Arm's stock is rising as analysts say an intriguing move could be on the horizon

Arm Holdings PLC could soon emerge as a major contender in the market for custom artificial-intelligence chips, and some analysts think the company's stock is still waiting to benefit from the opportunity.

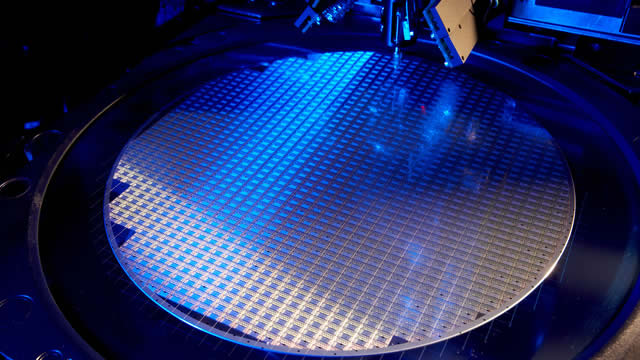

From Smartphones to AI: ARM's Expanding Global Tech Influence

Arm Holdings' energy-efficient chip designs are powering AI and IoT growth for Apple, Qualcomm and Samsung as its tech influence deepens.

Arm Holdings' Momentum Reversal Playing Out - Wait For Dips Before Adding

ARM's rally has been well supported by the durable AI-related spending trends, growing hyperscaler demand for custom silicon, and NVDA's launch of Arm-based Grace Blackwell superchip. These explain its robust FY2025 performance and promising FQ1'26 guidance, as observed in the growing monetization/ royalty opportunities thus far. Even then, ARM's rally may have occurred overly fast and furious, as observed in the premium valuations, the pulled forward upside potential, and the reversing momentum.

ARM Holdings' Valuation Running Ahead of Fundamentals Amid AI Hype

ARM's lofty 85X forward P/E and modest chip royalties raise questions about sustainability amid AI-driven investor hype.

3 International Growth Stocks To Buy Now

The U.S. stock market is dominated by companies that are headquartered in the United States, but there are also a bunch of international stocks that present enticing long-term opportunities.

Is China's RISC-V Pivot Undermining Arm's Growth Prospects?

ARM faces slowing growth in China as the country accelerates its RISC-V shift, threatening market share and future upside.

Is ARM's 22% Plummet Over a Year Offering a Fair Price for the Stock?

Arm Holdings' 22% stock decline, cooling China growth and soaring valuation raise fresh questions about its upside potential.

'Trump accounts': CEOs to unveil investments for newborns at White House

CEOs are attending President Donald Trump's roundtable event touting a program that would deposit $1,000 in investment accounts for newborn Americans. The executives are expected to announce that they will collectively invest billions of dollars into the so-called Trump accounts for the children of their employees.

Arm Holdings' Power Efficiency Poised for AI and IoT Growth

ARM's power-efficient chip design is becoming vital to Apple, Qualcomm, and Samsung's AI and IoT ambitions.

ARM vs. APP: Which AI-Exposed Tech Stock is a Better Buy Right Now?

AppLovin's AI-powered ad tech fuels surging profits, while Arm's chip royalties face tariff risks. APP may offer the smarter play right now.

Arm Holdings Plummets 22% in 3 Months: Buy, Sell or Hold the Stock?

Given ARM's price decline, we evaluate its current position to recommend to investors which is the most suitable action.

Venture Life shares jump 18% on €62m sale of manufacturing arm and non-core products

Venture Life Group shares climbed 18% in early trading on Monday after the company agreed to sell its contract manufacturing operations and certain peripheral products for €62 million in cash. The deal, with Italian firm BioDue, marks a shift in strategy for the UK-based healthcare group, which says it is moving away from capital-intensive manufacturing to focus on its higher-margin consumer brands.