ASML Holding N.V. New York Registry Shares (ASML)

ASML Holding N.V. (ASML) Q3 2025 Earnings Call Transcript

ASML Holding N.V. (NASDAQ:ASML ) Q3 2025 Earnings Call October 15, 2025 1:00 AM EDT Company Participants Jim Kavanagh - Vice President of Investor Relations R.J.M.

ASML Logs Strong Orders Amid AI Spending Frenzy

The Dutch group reported a rise in orders of its chip-making equipment for the third quarter, as well as net profit, and the company confirmed its guidance for 2025.

ASML looks to calm fears over 2026 growth as it warns of China sales decline

The firm said it does not expect 2026 total net sales to be below 2025 and warned that it expects customer demand and sales in China to decline significantly next year compared to 2024 and 2025. Dado Ruvic | Reuters Dutch semiconductor equipment ASML on Wednesday looked to allay concerns over 2026 growth as it warned that it expects a "significant" sales decline in China.

ASML's third quarter bookings above estimates

ASML , the world's biggest supplier of computer chip-making equipment, on Wednesday reported third quarter bookings which were above market expectations.

ASML Earnings Preview: Why I Expect A Beat And An Upbeat Outlook

ASML is an indispensable supplier to giants like TSMC, Intel, and Samsung, who cannot produce cutting-edge chips without them. There's a historically strong correlation (+0.85) showing that TSMC's capital spending predicts ASML's revenue six quarters later. Recent and planned increases in spending by TSMC and other fabs signal a significant future revenue boom for ASML.

Chipmaking supplier ASML set to ride AI megadeals wave

Multi-billion dollar deals between AI firms and computer chipmakers are expected to strengthen top semiconductor equipment maker ASML's outlook when it reports third-quarter earnings on Wednesday.

ASML Holding Before Q3 Earnings: How Should Investors Play the Stock?

ASML's Q3 performance is likely to reflect benefits from robust AI-driven demand for EUV systems, partially offset by China's trade pressures.

Is ASML Stock a Buy Before Oct. 15?

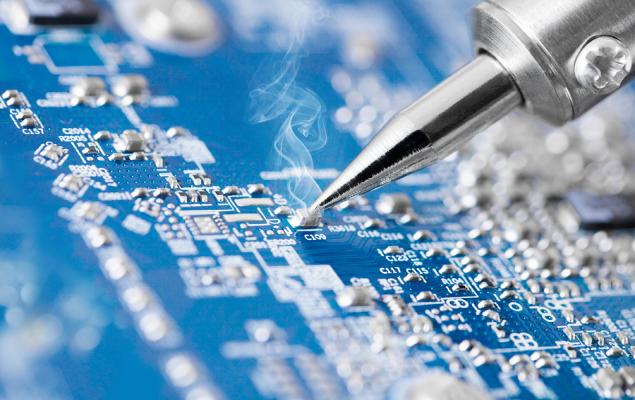

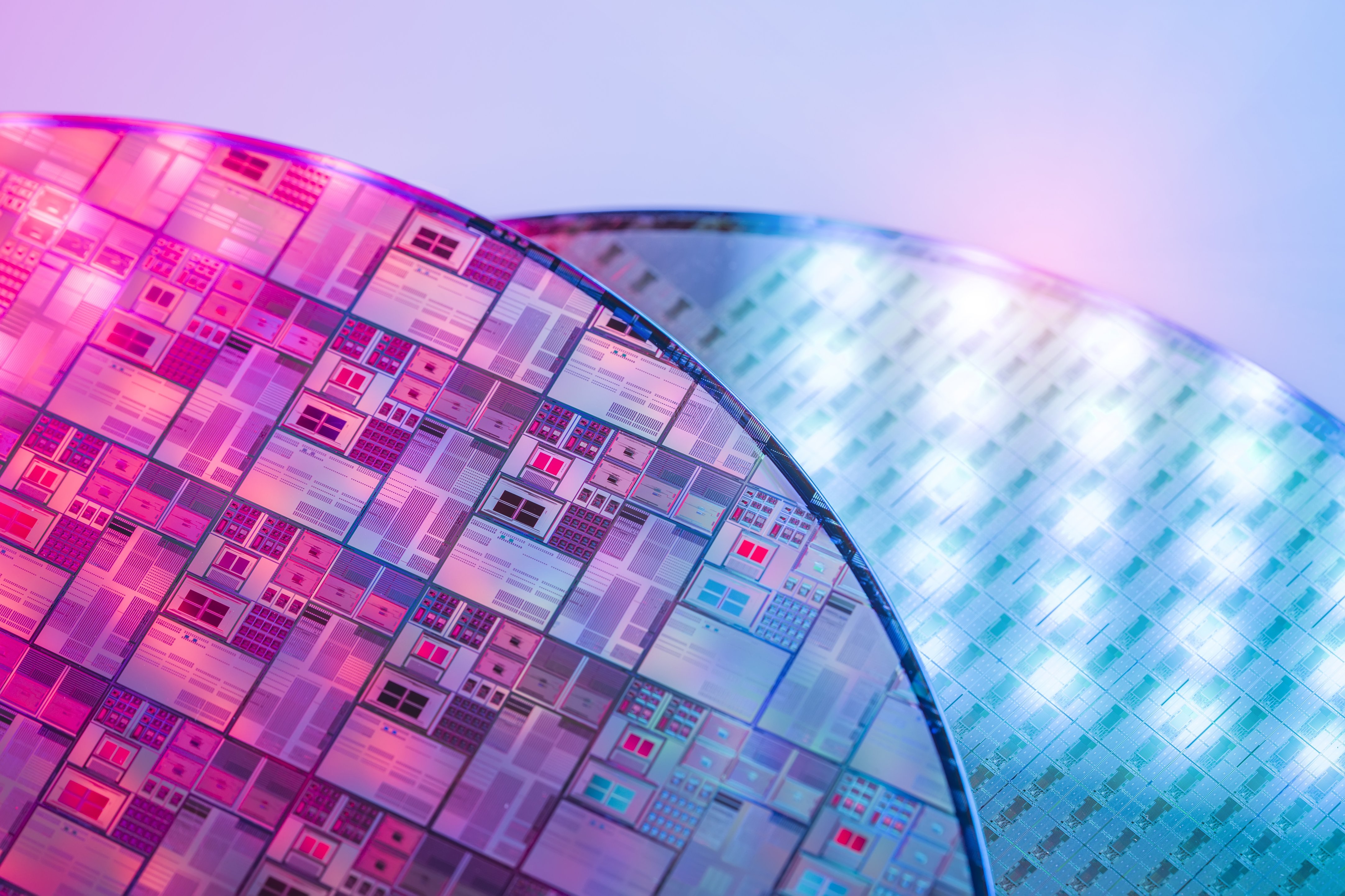

ASML (ASML -4.47%) is the world's leading producer of lithography systems, which are used to optically etch circuit patterns onto silicon wafers. Most of the world's leading chipmakers use its deep ultraviolet (DUV) lithography systems to manufacture their older and larger chips.

ASML Holding: A Risk-Focused View Of A Generational Opportunity

ASML Holding is a generational investment opportunity, offering a unique, irreplaceable position in the semiconductor supply chain essential for AI advancement. Despite trading at 10x FY 2026 sales, ASML is not expensive given its critical upstream role, strong moat, and superior revenue visibility. Key risks—revenue growth, geopolitical, long-term demand, and valuation—are mitigated by robust backlog, pricing power, and lack of viable chip technology alternatives.

ASML: Numerous Reasons To Buy Before Q3 Earnings

ASML Holding N.V. is rated Strong Buy ahead of Q3 earnings, trading at historically low multiples despite robust growth prospects. ASML's monopolistic position in EUV lithography, strong AI-driven demand, and consistent earnings surprises underscore its compelling investment case. Momentum is accelerating for ASML, supported by easing trade tensions, positive industry trends, and prudent capital allocation, fueling dividend growth.

ASML: A Mispriced Gem In The Booming Semiconductor Industry

ASML Holding N.V. stands out as the sole supplier of EUV lithography machines, granting it dominance in advanced semiconductor manufacturing equipment. AI-driven demand and global government support are fueling robust, long-term growth across the semiconductor industry, benefiting ASML's recurring revenue model. Despite cyclical risks and geopolitical tensions, ASML's dominant position and high barriers to entry provide pricing power and stability relative to peers.

ASML appoints veteran Pieters as chief technology officer

ASML , the largest maker of equipment used to manufacture computer chips, said on Thursday it had appointed Marco Pieters as chief technical officer, joining the company's management board.