ATS Corporation (ATS)

New Strong Sell Stocks for February 11th

ATS, CNMD and CSX have been added to the Zacks Rank #5 (Strong Sell) List on February 11, 2025.

New Strong Sell Stocks for October 4th

ATS, AZUL and BBC have been added to the Zacks Rank #5 (Strong Sell) List on October 4, 2024.

New Strong Sell Stocks for September 30th

ATS, AZUL and BW have been added to the Zacks Rank #5 (Strong Sell) List on September 30, 2024.

ATS Corporation: Diamond In The Rough

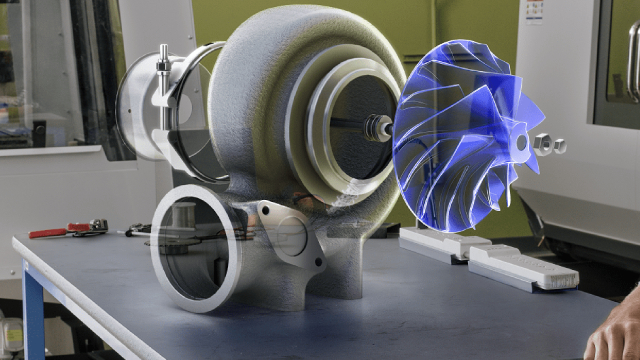

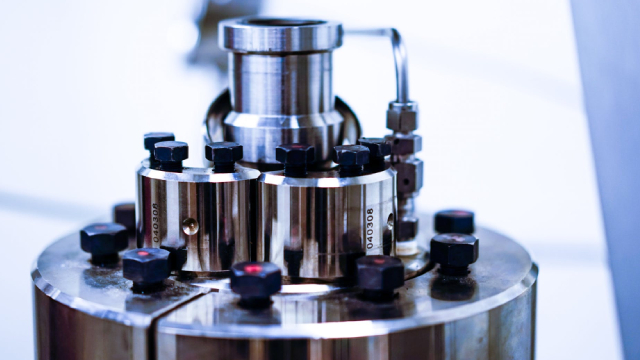

ATS provides vertically integrated automation solutions, focusing on Life Sciences and F&B sectors, with a robust backlog and strategic acquisitions enhancing growth potential. The macroeconomic environment, including lower interest rates and demographic changes, supports ATS's growth, especially in reshoring economies and increasing efficiency demands. Despite a healthy balance sheet, ATS faces risks from supply chain issues and cyclical industry exposure, with upcoming restructuring costs impacting short-term performance.

New Strong Sell Stocks for September 13th

ATS, BMTX and B have been added to the Zacks Rank #5 (Strong Sell) List on September 13, 2024.

ATS Corporation: This High-Quality Compounder Is A Bargain At 16x Earnings

ATS Corporation is a play on automation growth in manufacturing with exposure to electric vehicle battery outsourcing. The stock is down ~40% from its peak, but has potential for over 50% upside in a couple of years. Recent earnings show a slight EPS miss, but strong order bookings and backlog growth in non-transportation segments.

ATS Corporation: Near Record Bookings In Q3 (Rating Upgrade)

ATS Corporation is a developer of automation technology with global operations and $3 billion in annual sales. Recent results showed a decline in revenue but strong performance in life sciences, with a record backlog of $990 million. Despite short-term challenges, ATS's strategic investments in life sciences and attractive valuation make it a compelling investment opportunity.

ATS Corporation (ATS) Q1 2025 Earnings Call Transcript

ATS Corporation (NYSE:ATS ) Q1 2025 Results Conference Call August 8, 2024 8:30 AM ET Company Participants David Galison - Head of Investor Relations Andrew Hider - Chief Executive Officer Ryan McLeod - Chief Financial Officer Conference Call Participants Michael Glen - Raymond James Patrick Sullivan - TD Cowen Joe Ritchie - Goldman Sachs Justin Keywood - Stifel Maxim Sytchev - National Bank Financial David Ocampo - Cormark Securities Patrick Baumann - JPMorgan Operator Hello, everyone, and welcome to the ATS Corporation First Quarter Conference Call and Webcast. This call is being recorded on August 8, 2024 at 8:30 a.m.

ATS (ATS) Lags Q1 Earnings Estimates

ATS (ATS) came out with quarterly earnings of $0.37 per share, missing the Zacks Consensus Estimate of $0.38 per share. This compares to earnings of $0.51 per share a year ago.

Earnings Preview: ATS (ATS) Q1 Earnings Expected to Decline

ATS (ATS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

ATS Corporation (ATS) Q4 2024 Earnings Call Transcript

ATS Corporation (NYSE:ATS ) Q4 2024 Earnings Conference Call May 16, 2024 8:30 AM ET Company Participants David Galison - Head of Investor Relations Andrew Hider - Chief Executive Officer Ryan McLeod - Chief Financial Officer Conference Call Participants David Ocampo - Cormark Securities Michael Doumet - Scotiabank Joe Ritchie - Goldman Sachs Michael Glen - Raymond James Justin Keywood - Stifel Patrick Baumann - JPMorgan Maxim Sytchev - National Bank Financial Cherilyn Radbourne - TD Securities Operator Welcome to the ATS Corporation Fourth Quarter Conference Call and Webcast. This call is being recorded on May 16th, 2024 at 8:30 A.M.

ATS (ATS) Q4 Earnings and Revenues Top Estimates

ATS (ATS) came out with quarterly earnings of $0.48 per share, beating the Zacks Consensus Estimate of $0.41 per share. This compares to earnings of $0.54 per share a year ago.