Broadcom Inc. (AVGO)

Markets Rebound Nicely Ahead of Q3 Earnings Season

Even though we've seen more than a dozen companies already officially report Q3 earnings results this period, Q3 earnings season really kicks off with the release of earnings from some of the biggest banks on Wall Street.

Buy AVGO Stock After 10% Drop?

Broadcom (AVGO) stock is down 9.6% in 21 trading days. Already own the stock?

Up 500%, What's Happening With AVGO Stock?

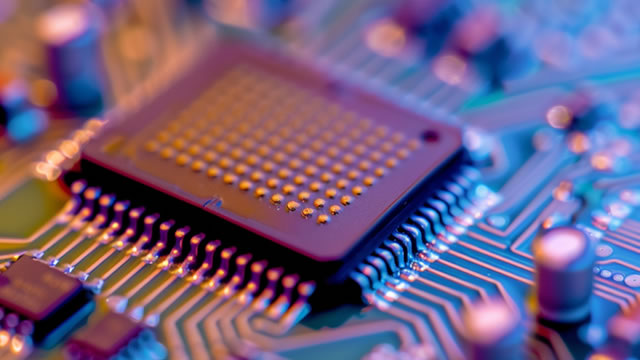

Broadcom Inc. (NASDAQ: AVGO) has significantly exceeded the broader market performance this year, with a year-to-date increase of about 46% compared to the S&P 500's 14%. This robust performance has been fueled by strong quarterly outcomes and the acquisition of a new custom AI-chip client.

These 2 AI Stocks Are Money-Printing Machines

The AI market is booming. Bain projects the total addressable market for AI hardware and software will grow 40%-55% annually, reaching $780 billion to $990 billion by 2027.

AVGO's A.I. Trade Role as Infrastructure Buildout Continues

Should Broadcom (AVGO) be added to the Mag 7, or should the Mag 7 be extended? Matt Tuttle makes the case for it, calling the stock a "must own" for investors.

Bloomberg Dividend Watchlist's 4 Ideal 'Safer' September Sizzlers

Bloomberg Intelligence highlights 50 Companies to Watch for 2025, focusing on catalysts like leadership changes, M&A, and sector trends such as AI and EVs. Dogcatcher analysis identifies 13 dividend-paying stocks as 'safer,' with free cash flow yields exceeding dividend yields, including AVGO, KLAC, FOX, TPR, and WM. Top ten dividend focus stocks, including SLB, UPS, and WM, are projected to deliver average net gains of 17.63% by September 2026, with moderate risk.

My Magnificent Seven Of Dividend Growth (2022-2025)

I screened dividend growth stocks for factors like high revenue, EPS, and free cash flow growth. Only seven companies met my strict criteria. Comfort Systems has been the top overall performer, benefiting from tech-related infrastructure spending with long project timelines and high margins. Texas Roadhouse offers the highest dividend yield among the group. It has seen positive same-store sales and higher average check sizes.

This $2 Billion Hedge Fund Led By a Former OpenAI Researcher Is Betting Against All Semiconductor Stocks Except These 2 Industry Giants

Advances in artificial intelligence (AI) have the power to create huge opportunities for some businesses, while completely disrupting others. A company that can't adapt to the changing environment stands to fall behind or see its products or services made obsolete by tech-driven alternatives.

AVGO's Semiconductor Sales Growth Picks Up: A Sign of More Upside?

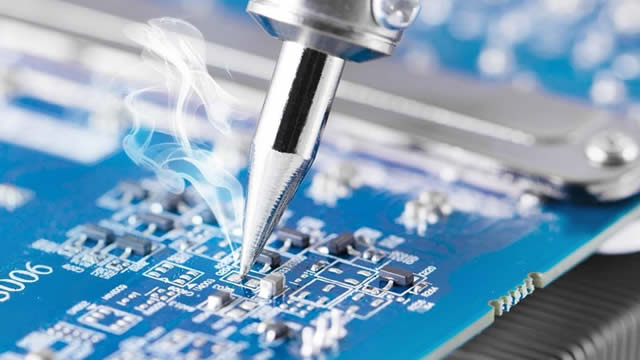

Broadcom's AI-fueled semiconductor revenues soar, with XPUs and advanced networking products powering strong growth and outlook.

5 Things to Know Before the Stock Market Opens

Stock futures are mostly inching higher in premarket trading as investors prepare for the release of a key jobs report today. The jobs report is expected to show relatively slow job growth in August.

Wall Street Breakfast Podcast: Futures Tick Up Ahead Of Jobs Data

Stock futures are slightly higher as traders await a key jobs report, with expectations for steady unemployment and modest payroll growth. The market is entering a pivotal stretch with payrolls, CPI, and FOMC decisions likely to drive volatility and rate cut expectations.