Broadcom Inc. (AVGO)

Broadcom Is on Track to Edge Past Eli Lilly's Market Value. AI Is Helping It Do So.

Over its current seven-day streak in the green, Broadcom has snapped up market value that is around the equivalent to McDonald's.

Why Broadcom Stock Rallied on Monday

Robust results and a high-profile stock split caught Wall Street off guard. Analysts have been scrambling to update their price targets in the wake of Broadcom's strong performance.

Unlocking Broadcom Inc. (AVGO) International Revenues: Trends, Surprises, and Prospects

Examine Broadcom Inc.'s (AVGO) international revenue patterns and their implications on Wall Street's forecasts and the prospective trajectory of the stock.

Investors Heavily Search Broadcom Inc. (AVGO): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Broadcom Inc. (AVGO). This makes it worthwhile to examine what the stock has in store.

Broadcom Stock Analysis: There Is More Than a Stock Split That Is Causing Excitement

Broadcom stock investors have more to consider than the pending stock split.

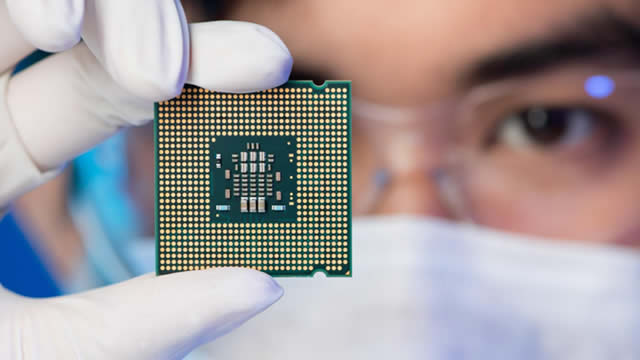

Broadcom's Cutting-Edge AI Networking Technology Leaves Nvidia, Marvell, Cisco Behind: JPMorgan

Broadcom Inc. (NASDAQ) is not only holding its position in the datacenter and AI Ethernet switching market but is also making significant strides forward. With its stock currently trading at $1,735.04, Broadcom is expected to achieve notable gains, targeting a price of $2,000 by December, according to JPMorgan.

Nvidia Jumped 27% After Its Stock Split Announcement. Can Broadcom Beat It?

After Nvidia soared on its stock split announcement, investors are reacting favorably to Broadcom's. Broadcom is gaining traction with AI demand for networking and custom chips.

Broadcom's Stock Split Isn't a Reason to Buy Shares: These 2 Reasons Are

Broadcom announced a 10-for-1 stock split in its Q2 earnings report. Stock splits don't alter a stock's intrinsic value.

Broadcom Announces a 10-for-1 Stock Split. Time to Buy?

Broadcom stock rose as the company raised its guidance and also announced a stock split. The chipmaker is now anticipating stronger revenue from sales of AI chips in the current fiscal year.

Finally, Broadcom Is Splitting Its Stock. But Does It Matter?

Stock splits do not change the size or nature of one's investments in an official sense. Investors should account for the psychological and liquidity effects involved with stock splits.

6 Artficial Intelligence (AI) Stocks Are Worth Over $1 Trillion. Here Are the 2 Most Likely to Join the Club Next.

Apple, Microsoft, Nvidia, Alphabet, Amazon, and Meta already have market caps over $1 trillion. Two semiconductor companies with tremendous AI-related growth prospects could be next in the club.

Nvidia Soared Almost 30% Ahead of Its Stock Split. Can Broadcom Do the Same?

Nvidia's stock advanced in the two-week period ahead of its 10-for-1 stock split. Investors have been particularly interested in stock split stocks in recent weeks.